I’ve been out of the office an awful lot over the recent months. Not only due to the Christmas break but also to visit trade shows, lectures, conferences and product launches. In the closing weeks of 2012, all seemed to be rosy with the poultry industry. And let us hope that it is.

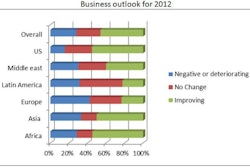

But look a little deeper and things may not be quite as good as they seem. The industry may have become used to living with high feed prices, and certain sectors believe that grain prices will fall, so there is at least some good news, but this is not the end of the story. You can see from watching our EuroTier Tout reporting that opinions on how the industry will develop this year really are mixed.

Light at the end of the tunnel?

To return to the question of high input costs, it must be asked: How long can any company ride out high costs without passing those costs on? This is what is happening for many companies and is not sustainable, but even when costs can be passed on, there is a downside.

Chicken meat is seen as the most affordable animal protein option, so passing costs on to the consumer will almost certainly press some consumers out of the market, thus reducing volumes.

Lower income consumers exist in all markets, but demand is particularly sensitive in developing markets, which are repeatedly pointed to not only as the savior of the poultry industry but of the global economy as a whole.

For example, Brazil’s total poultry output is thought to have declined last year—the first contraction for 20 years. Producers have been selling at less-than-cost prices, due to a combination of high feed prices and weak consumer demand, a situation that cannot continue for long. The Brazilian economy as a whole, like those of its Russian, Indian and Chinese counterparts, is slowing. Of course, this is bad news for consumers, whose diets are being hit. For the poultry industry, companies are reducing capacity or closing down all together.

Profitability and efficiency

Of course for producers in those markets, where demand has been fully satisfied or is weak or tailing off, export markets become even more attractive, but growing competition in this arena can only force prices downward. Some markets that have been strong importers are now trying to foster their home industries.

Cutting back production may well restore profitability, but this is far from efficient from an investment point of view as facilities and plant are made idle, because the investment made comes to nothing. In the end, so we are told, markets correct themselves, but there can only be more casualties as this process takes place. There is always a big difference between practice and theory—markets are less than perfect.

So let’s hope that more are lucky in 2013 than are unlucky and there are not too many casualties along the way as equilibrium is found. For those who do survive, profitability should be restored even if volumes are not. There is some light at the end of the tunnel, as at least the U.S. economy ended the year in positive territory. However, the same cannot really be said for Europe.

Of course, in the long term, it is worth remembering that demand will continue to rise. The percentage increases of the future may not be as impressive as those of the past, but overall volumes will go up.