German feed sector should experience minor gains in 2021 amid the ongoing economic COVID recovery and despite decreased local demand.

The German feed sector shows stable results in 2021, encouraging optimism to local producers and reviving investment activities in the industry. Still the lack of state support and low rates of German economic development may bring the industry into deep stagnation in second half of the year.

The German feed sector is steadily developing amid the ongoing pandemic recovery of the German economy and its agricultural sector, which has stimulated the local demand for feed, according to recent statements made by representatives of some leading local feed producers and analysts.

In contrast to other European states, the pandemic has not had a major negative impact on the German feed industry and its situation remains stable, explained Dr. Hermann-Josef Baaken, managing director of German feed association Deutsche Verband Tiernahrung e. V. (DVT), a public association uniting the leading German feed producers.

“Currently the level of feed production in Germany is generally equal to the level of demand,” Baaken said.

According to DVT’s preliminary 2020 data, the total consumption of raw materials to produce compound feed in the country increased by 0.8% compared with 2019. This means the German feed industry used approximately 21 million tons of raw materials for the production of compound feed in 2020.

“The total amount of produced feed last year also increased by 0.76% compared to 2019,” he said. “The total output in 2020 reached 24 million tons. The production of mineral feed in 2020 increased by 3% compared to the previous year. Thus, the total amount produced reached 653,400 tons.”

Bakken noted that African swine fever (ASF) and the global demand of meat has impacted the German feed sector more than other factors, including the COVID-19 pandemic.

Analysts of DVT expect this year the volume of feed production in Germany will remain stable, being comparable to 2020 and some previous years.

Total German 2020 feed output reached 24 million tons, a .76% increase from 2019. (Courtesy DVT)

Total German 2020 feed output reached 24 million tons, a .76% increase from 2019. (Courtesy DVT)Declining livestock numbers

One of the reasons for the current stagnation is the ongoing decline of livestock population trend in recent years in Germany and other EU countries.

According to analysts, the ever-tightening requirements in livestock farming caused by social, political, environmental and other factors in Germany has lead to the reduction in livestock numbers in the country and resulted in the drop of the consumption of feed in the local market.

Analysts of DVT expect further stagnation of the industry, which may take place throughout the entire year, although “they have been expecting such negative developments for several years which, however, has not happened so far.”

Feed manufacturers have felt additional pressure due to the ever-growing state demands to ensure sustainable sourcing of important feed additives/raw materials for their production processes, which also leads to the growth of their costs and the overall decline of production.

Companies continue to invest

Despite the challenges, many local producers have resumed the implementation of some major investment projects, which had been suspended by the 2020 pandemic.

Alltech, for example, plans to further strengthen its positions in the German feed market this year. According to Ralf Stuerznickel, an Alltech senior country manager for Germany and Austria, the company will continue to focus on the delivering components for the needs of German feed mills, with particular attention paid to the rise in sustainability of its local business.

Stuerznickel expects the development of Germany’s feed industry will be flat in years to come, with only a slight growth, attributed to the pandemic. He also believes the German feed sector managed to overcome the peak of the pandemic with minimum losses.

“In January and February of the current year the local feed market demonstrated negative dynamics,” Stuerznickel said. “In addition to a tough situation with COVID-19 in Germany, which resulted in the introduction of numerous quarantines and lockdowns, the problem of ASF also had a negative effect on the industry. March and April, however went back to a normal development, meaning it’s on former years’ level.”

In the meantime, representatives of Dutch ForFarmers Group also feel optimistic about the future of their feed business in Germany, considering its further expansion in years to come.

Caroline Vogelzang, an official spokeswoman of ForFarmers Group, said the company will continue its development in the German feed market this year, paying a particular attention for cooperation of large farms.

According to Vogelzang, a priority will be also given for a further development in the segment of concentrates and specialties.

The company expects the pressures put on the agricultural sector by the German state to reduce its impact on the environment throughout the current year and will lead to a further reduction in animal numbers in Germany and cause a drop of local demand for feed.

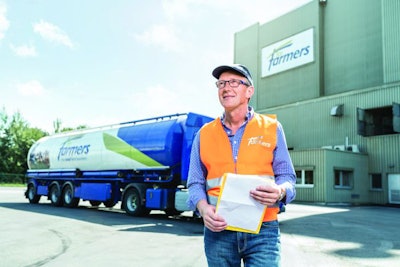

ForFarmers’s Langförden, Germany, feed mill (Courtesy ForFarmers)

ForFarmers’s Langförden, Germany, feed mill (Courtesy ForFarmers)COVID’s lingering impact

German feed industry stakeholders continue to monitor the COVID-19 situation in the country and its related quarantine measures.

According to the local producers interviewed, if the COVID measures can be lifted around the summer — and hospitality and out-of-home venues are able to reopen — they would expect the production of animal protein to increase again.

The biggest hopes of producers at this time are placed on the country’s poultry sector, where the consumption of feed has significantly increased in recent years. At the same time, the demand for feed from the German beef and pork sectors is expected to be a subject of a slight decline for at least this year.

Sources noted the volume of state support of the industry was small even during the peak of the pandemic in the country last year, so funding of their investment projects this year will primarily be carried out from their own reserves.