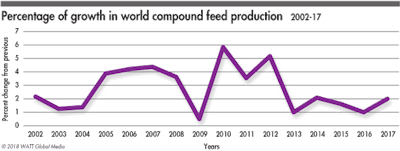

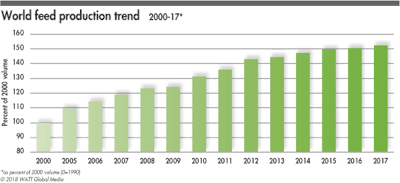

World compound animal and aquaculture feed production increased nearly two percent in 2017, to 910,000 million metric tons compared with 2016, outbreaks of avian influenza and swine diseases notwithstanding.

While poultry and pig production suffered some setbacks, particularly in the first half of the year, there were surprising increases in ruminant and aquafeed in many countries.

There was no clear pattern to the ups and downs of compound feed production around the world, as some nations saw record highs, while others faced big downturns.

Global compound feed manufacturing increased almost 2 percent in 2017, better than expected, as there were animal disease issues around the world.

Poultry, swine diseases result in losses

Due to poultry and pig diseases, which were mostly a continuation of outbreaks that began in 2016, global poultry feed production fell by 1 percent and swine feed fell by half a percent in 2017 from the year prior.

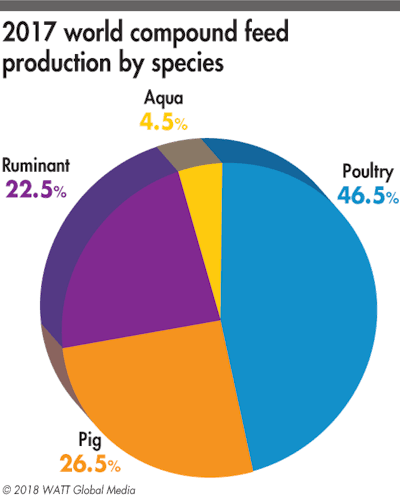

Despite those issues, poultry remains the primary compound feed produced, representing 46.5 percent of the world market. Pig feed now represents 26.5 percent of global feed production.

World compound feed production grew again in 2017, despite poultry and pig diseases around the globe.

Highly pathogenic avian Influenza (HPAI) outbreaks affected some poultry-producing regions of Europe, resulting in feed production stabilizing or even slightly decreasing. The biggest effect was a nearly 9 percent fall in poultry exports, the largest drop in 16 years, according to the U.S. Department of Agriculture (USDA).

South Korea’s chicken production fell more than 5 percent in 2017 due to the depopulation of more than 34 million birds affected by an HPAI outbreak that began in 2016.

China saw consumer demand for poultry drop significantly due to an HPAI outbreak from late 2016 into mid-2017.

On the pig feed side, African swine fever in Eastern Europe, Russia and Ukraine resulted in lower production. Meanwhile, porcine epidemic diarrhea (PED) virus resulted in heavy losses to the swine herd in parts of Canada through the first half of 2017.

In 2017, the ruminant feed sector grew by one percent and the aqua sector grew by half a percent, as the poultry and pig feed sectors declined slightly.

Ruminant feed bounces back

With both the dairy and beef cattle industries resurging in many countries, global ruminant feed production gained 1 percent in 2017 over 2016, now representing 22.5 percent of world compound feed production.

In Europe, where the dairy industry faced a downturn in 2016, a recovery took place, with a 1 percent increase in cattle feed production in 2017.

The Turkish feed industry reports it grew by 10 percent from 2016, due primarily to ruminant feeds, as beef cattle breeders use more compound feed.

In the United States, beef production rose more than 5 percent in 2017. Colombia also experienced a 5 percent rise in cattle feed production.

In India, the demand for commercial dairy feed rose by about 15 percent as dairy genetics move to higher yielding breeds, while in Australia, cattle on feed rose by 9.5 percent.

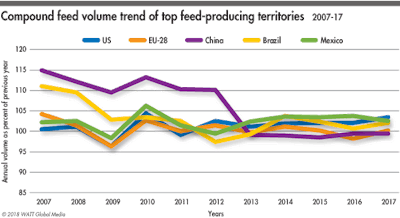

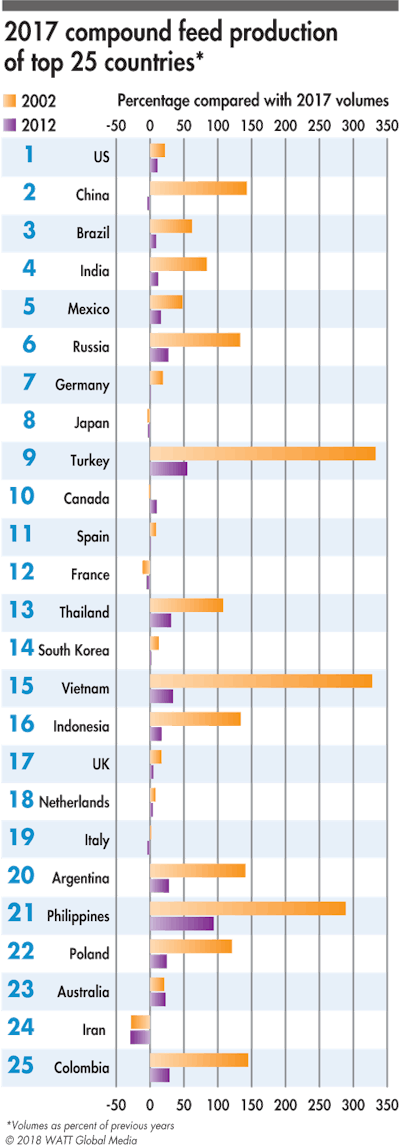

China's compound feed production fell slightly in 2017, while production increased in the U.S., Brazil, Mexico and the EU-28.

Aquaculture continues to grow

Aquaculture continued its steady growth in 2017, advancing globally by one-half of a percent to represent 4.5 percent of global compound feed production.

According to the USDA, China remains the world’s largest aquaculture producer, accounting for more than 60 percent of global production. China’s aquaculture sector grew 4.5 percent in 2017, compared with the previous year.

Chilean salmon feed production grew by 3 percent, a pace it’s been maintaining annually.

The Vietnamese aquaculture sector grew by 10 percent in 2017 and continues to grow. Meanwhile, Thailand’s shrimp feed production grew 25 percent in 2017.

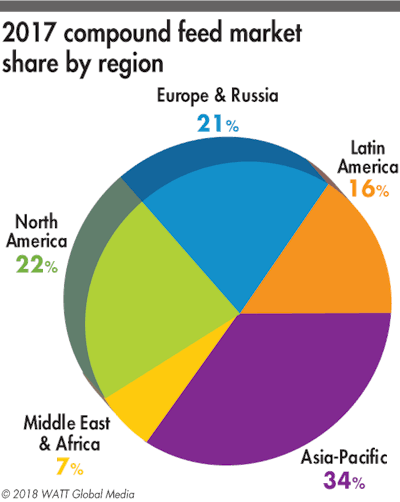

As Asia-Pacific continued to dominate world compound feed production in 2017, North American production surpassed that of Europe and Russia combined.

Asia-Pacific sees variability

Continuing to represent 34 percent of the world’s compound feed production, the Asia-Pacific region is home to 9 of the top 25 feed-producing countries in the world.

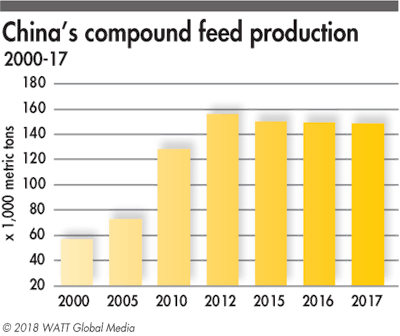

China is the world’s second largest compound feed producer as well as the largest pork producer and consumer. The pork sector grew almost 9 percent. China is also the world’s largest aquaculture producer, growing 4.5 percent in 2017. However, due to HPAI, chicken meat production decreased by 6 percent. Added all up, China experienced a 0.5 percent drop in compound feed production compared with 2016.

While China remains the second largest compound feed producer in the world, its production has continued to slightly decline since 2012.

India has continued to grow in feed production, up 5 percent from 2016, rising to the fourth spot of world compound feed production. According to the USDA, commercial dairy demand for feed rose 15 percent, with poultry feed increasing more than 4.5 percent.

Despite USDA reports that feed demand in Vietnam fell by 15 percent in 2017, the decline was in homemade animal feed, not in manufactured compound feed, a sector which grew 4.5 percent in 2017. Poultry and pig feed grew by 3.5 percent, while aquaculture feed increased an impressive 10 percent.

Due primarily to the previously mentioned HPAI outbreak in South Korea and a decline in cattle feed, national compound feed production fell by 4.5 percent in 2017. The one bright spot for Korea was the demand for swine feed, which rose more than 3.5 percent in 2017.

Japan’s compound feed production rose 1 percent from 2016, retaining its spot as the world’s eighth top producer. There was a decline in dairy cattle feed, but small increases in the rest of the nation’s livestock and poultry sectors.

Thailand’s compound feed production rose nearly 5.5 percent in 2017. Thai chicken meat production grew nearly 3 percent, as swine production slightly declined. Although small, the Thai aquaculture sector grew dramatically on the strength of a 25 percent increase in shrimp feed production.

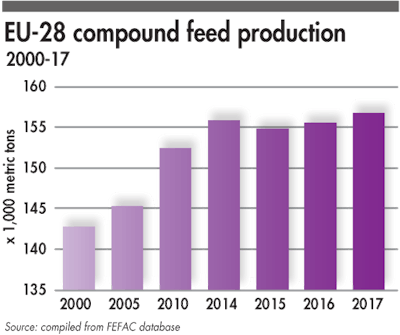

EU-28 compound feed production reached a high point in 2014, lost steam in 2015, regained in 2016 and achieved a new record in 2017.

Growth in Europe

Europe and Russia together accounted for 21 percent of global compound feed production, 1 percent less than its market share in 2016.

The EU-28 in 2017 reached an estimated level of 156.7 mmt, 0.2 percent more than in 2016, according to the European feed federation, FEFAC. EU poultry feed remains the leading sector, well ahead of pig feed.

FEFAC reports that, for the fourth year in a row, Poland was the best performing country, with annual growth of total compound feed production over 7.5 percent, thanks mostly to the demand for poultry feed.

The United Kingdom’s feed production rose by almost 2 percent. In Germany, the Netherlands and Italy, feed production remained at the same level as 2016. However, France saw a 1 percent drop and Spain experienced a 3 percent drop in compound feed production.

Russian feed production grew almost 3.5 percent in 2017, due to the recovery of pork consumption and to chicken meat expansion in eastern regions of the country.

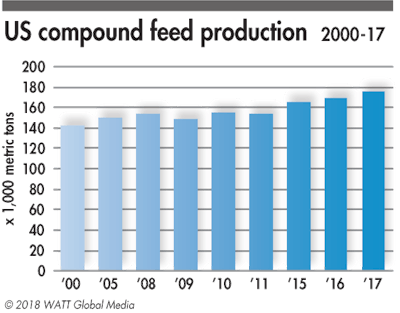

U.S. compound feed production faced some ups and downs from 2008 to 2011, but since then has climbed strongly and steadily.

Volumes in the Americas increase

North America, represented primarily by the U.S. and Canada, increased its global share of the market by 1 percent, up to 22 percent, surpassing Europe and Russia.

U.S. compound feed production rose 3.5 percent from 2016 on the strength of a 5 percent increase in beef production, thus maintaining its position as the world’s largest feed producer. Pork production also rose 3.5 percent, while chicken meat production increased close to 2 percent.

Canadian compound feed production gained 3 percent from 2016. Despite its PED virus issues in Manitoba, the overall losses to the pork sector were not major. It was on the poultry side that Canada saw the biggest growth — almost 4.5 percent. According to the USDA, 2001 was the last time the Canadian poultry sector grew at a rate above 4 percent. '

2017 growth rates compared with World Feed Panorama’s 2002 and 2012 historical data. India and Turkey moved up in 2017 and are now the world's fourth and ninth largest compound feed producers, respectively.

Latin America maintained its 16 percent share of the world’s compound feed production market in 2017.

Brazil, the world’s third largest feed producer, saw a 2 percent rise compared with 2016, as the world’s largest exporter of chicken meat continued its growth.

In 2017, Mexico grew 2.5 percent and has dropped down to the fifth spot in world compound feed production. In 2017, chicken production increased by 3 percent, while swine production rose more than 1.5 percent.

Compared with 2016, in 2017 Colombia’s feed production rose almost 6.5 percent in poultry, more than 1.5 percent in swine and an astounding 20 percent in aquaculture.

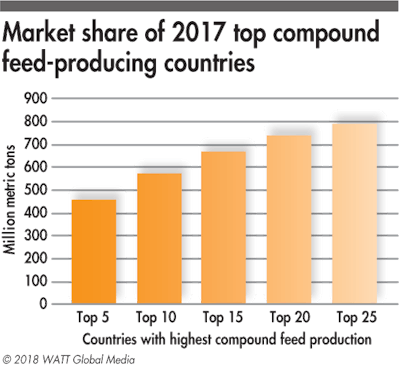

The top 5 countries represent 50 percent of total world compound feed production, the top 10 cover 63 percent, the top 20 represent 81 percent and the top 25 countries produce 87 percent of the world's compound feed.

Middle East, Africa experience gains

In 2017, the Middle East and Africa region accounted for 7 percent of global compound feed production, with no change from the previous year.

Turkey moved up in the list of top producers to the ninth spot with a 10 percent growth from 2016. Aside from Turkey’s big expansion in ruminant feed, poultry meat production in that country increased by 13 percent in 2017, due to a large increase in exports.

Saudi Arabia’s chicken meat production grew by 9 percent in 2017 thanks to expansion projects by the largest poultry companies.

South Africa’s feed production increased 2 percent from 2016 to 2017, as the poultry industry continued to grow, despite avian influenza issues.