The European Union grew larger in 2013 when Croatia became its 28th member. On preliminary estimates from the European Feed Manufacturers’ Federation (FEFAC), the newly enlarged EU-28 produced a total of 153.8 million metric tons of compound feeds in 2013, fractionally less than the 154.2 million metric tons from the same 28 member states in 2012.

The accompanying table shows quantities produced in 2012 and 2013 by each of the five largest feed-producing EU countries. Several of the bigger players suffered an annual loss, among them Germany, France, Spain and the Netherlands, along with Belgium, Denmark, Portugal, Bulgaria and Hungary.

The UK was the only one of the Big Five to produce more in 2013. Weather played a part in this, as a particularly cold winter from late 2012 until April 2013 brought a higher-than-expected demand for ruminant feeds.

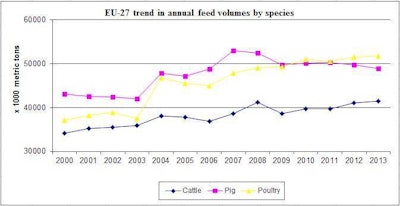

Tonnage trends

Our chart shows the tonnage by species in the EU-27 (without Croatia) since 2000. It illustrates the developing contrast between trends by sector, with pig feeds losing market share progressively since 2008 while there has been some growth for both cattle and poultry feed segments.

Russia is the other big contributor to the all-Europe total tonnage and Russian mills achieved an increase from 20 million metric tons in 2012 to almost 21.9 million metric tons in 2013, on estimates that do not include undocumented or hidden production sometimes said to reach 5 million metric tons annually. Both compounds and premixes have increased in volume for Russia in 2013.

Another country included in our European category is Ukraine, where 6 million metric tons of visible compound feed production is reputedly joined by another 4 million metric tons not currently recorded. Ukrainian feed volumes are forecast to grow quickly as the country’s abundant domestic grain crop supports investments in producing pork and poultry meat.