European feed production is expected to decrease by up to 5% compared to 2019 volumes.

The European Union’s (EU28) compound feed industry produced 164.4 million metric tons of animal feed in 2019, a 0.8% decrease from its 2018 tonnage. However, the European Compound Feed Manufacturers’ Federation (FEFAC) predicts the region will see a serious decrease in its 2020 tonnage due to the COVID-19 pandemic.

“Looking back at the past couple of intensive months of crisis management, we can see that the impact of the COVID-19 outbreak on European industrial compound feed production will be significant,” said Asbjørn Børsting, FEFAC’s new president.

FEFAC estimates 2020 feed production will decrease by a range of 3% to 6%.

“Dealing with uncertainty will be one of the main challenges,” Børsting said. “We’ll also have to see whether we are now at the start of a protracted recession or whether some kind of economic recovery is still feasible in the short term.”

In addition to the global pandemic, several other issues have impacted — and will continue to impact — European feed production, its manufacturers and formulations.

8 critical issues shaping 2020 EU feed production

Industry leaders have offered their insight into the eight major trends and challenges set to influence the European feed industry in 2020.

1. COVID-19 crisis

Virtually no area of the global economy has not been rocked by the COVID-19 pandemic. Despite its essential status, the EU feed industry is no exception.

“The biggest impacts we’re suffering are indirect because of severe changes in animal product consumption patterns — most importantly due to a virtual loss of the foodservice sector,” Børsting said. “Our sector can only adapt to this reality.”

Despite strains to the supply chain, compound feed and premix manufacturers have navigated the crisis well.

“The entire animal production supply chain has clearly shown strength here,” Børsting said. “In many countries, biosecurity measures proved to be useful in preventing COVID-19 from spreading at the feed manufacturing level and in contact with farmers.”

However, feed production decreases will have a ripple effect across the value chain.

Robert Alber, AlzChem’s vice president of animal nutrition, said he suspects even greater production decreases (up to 15%) depending on the species and country: “Some feed additives might be hit stronger than this, while innovative products combining performance, healthy growth and multiple benefits may even see positive trends.”

2. Threat of animal diseases

Animal disease outbreaks, such as African swine fever (ASF) and avian influenza, continue to loom as a major risk for the EU feed industry.

According to a European Food Safety Administration (EFSA) report, 1.3 million pigs have been lost to ASF in Europe in the last four years.

“The situation in Poland is a particular worry for neighbor Germany, Europe’s largest pork producer,” said Roxane Feller, AnimalhealthEurope’s secretary-general. “The main challenge lies in the fact that with vaccine research still ongoing, farmers have to rely on strict implementation of biosecurity measures to prevent the disease from reaching their herds. Due to the high environmental resistance of the virus, ASF can be spread not only by domestic pigs or wild boar, but also through pork products, and vehicles, equipment and clothing that has been in contact with the virus.”

Recently, Germany confirmed its first case ASF in a wild boar. While this fear has been on the radar for months, the country is enhancing efforts to prevent the disease from reaching the commercial herd. Meanwhile, several other EU countries impacted by ASF outbreaks — Poland, Hungary, Romania and Bulgaria — continue to struggle to contain the virus and regain trade relationships.

Sources suggest ASF-free countries may “benefit from continued export opportunities for pigs, mainly to Asian countries due to their recovery from ASF and delays in rebuilding their own pig herds.”

Despite the challenges brought on by COVID-19, Feller assures EU pig producers that ASF vaccine research has not been disrupted.

3. Investing in sustainability

Sustainability remains high on the EU political agenda. The 2020 adoption of the European Commission’s (EC) European Green Deal institutes a series of policies across many sectors, including food production, to make Europe climate neutral by 2050.

As part of the Green Deal, the EU Farm to Fork Strategy, released in May 2020, aims to make “food systems fair, healthy and environmentally-friendly.”

“The political expectation is that the economic recovery is ‘green’ also in agriculture and livestock farming,” Børsting explained.

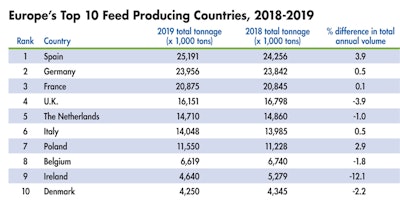

A ranking of the EU’s 2019 top 10 compound feed producing countries (FEFAC)

A ranking of the EU’s 2019 top 10 compound feed producing countries (FEFAC)In September 2020, FEFAC will release its Feed Sustainability Charter 2030, which will highlight the feed industry’s contribution to sustainable livestock farming through feed solutions, aligning with the Green Deal’s goal.

The “resource-conserving economy” will become increasingly important, said Manuel Rez, global head of marketing, BASF Animal Nutrition, expecting the focus to shift more and more toward sustainably produced animal protein.

“In the future, the ecological footprint and the production of carbon dioxide associated with the production of animal protein will play a greater role,” Rez said. “This means that aspects of sustainability will also have to be given greater consideration in feeding.”

For example, in addition to the raw material costs and the required nutrient content, nutritionists may consider sustainability as a third determinant of the feed’s composition.

4. Emission reduction regulations

There is mounting pressure for the agricultural sector to improve its environmental footprint by decreasing the emissions of food-producing animals, with evolving regulatory measures aimed at reducing nitrogen and phosphorus excretion.

Rez points to the revised German Fertilizer Ordinance, which limits the quantities of nitrogen and phosphorus used to fertilize cropland: “There are only two options available to the feed industry and livestock farmers here, either reduce the number of animals or to reduce the protein and phosphorus content of the feed and improve its utilization.”

“German companies now have to show a cradle-to-grave cycle,” explained Nick Guthier, Evonik’s vice president of global accounts and Europe. “It’s a great challenge to put tracking systems in place and document what is happening with the animals and with nitrogen and phosphorus.”

Caroline Vogelzang, director of investor relations, ForFarmers, offered this example: “In the Netherlands, the current debate on reducing nitrogen emissions affects livestock farming. Farmers need to reduce nitrogen deposition and emissions from their animals. One way could be to optimize the crude protein level in the total ration of an animal while preserving the health of the animal. There is currently enormous political pressure on farmers to ‘free up nitrogen space,’ which may impact the manner in which farmers feed their animals.”

Sources anticipated more emission regulations in the future.

5. Animal welfare

Consumers want assurance poultry and livestock are being treated properly, but that interest may extend beyond responsible farm management to the role the animal’s nutrition plays in its well-being.

Driven by the Green Deal, Rez feels animal health and welfare will gain even more importance in the public sphere and “those who recognize these challenges and adjust to them should have a better chance of gaining consumer confidence in their products in the future.”

Digital monitoring tools can play a role in meeting consumer demands for improved animal welfare “by facilitating real-time analysis of different elements, such as feed intake, growth rate and temperature, as well as fluctuations in the prevalence of diseases,” Feller said.

6. Responsible soy

The European grain and feed industries are being pressured to prove their soy supply chain is not driving deforestation, Børsting reported.

“The public and political scrutiny of our soy imports are only seeming to become more intense,” he explained. “The credibility of animal products is seriously at stake here. From our initial assessments, we know that our deforestation risk exposure is lower than usually assumed, i.e., most soy imported is free from any deforestation concerns, but we need to prove this.”

Børsting urged manufacturers to work to solve this issue with their upstream and downstream partners and move towards verified and certified deforestation-free soy sourcing.

FEFAC plans to release its Soy Sourcing Guidelines by early 2021, which it hopes will renew the industry’s interest in responsible soy sourcing.

7. Ingredient self-sufficiency

Sources suggested globalization will drive commodity volatility and pose a greater challenge for feed producers.

“The ups and downs are going to get stronger in the next five to 10 years,” said Guthier.

To combat these cost pressures, Guthier suggested producers look to the localization of raw ingredients, coupled with a firm understanding of the material’s analytics to maximize value.

Linked to the desire to reduce the EU’s reliance on imported ingredients, poultry and livestock producers are being urged to embrace a “circular economy,” which aims to eliminate waste and promote the continual use of resources.

“The European compound feed sector is generally well-positioned here, with about 40% of our raw materials consisting of co-products,” explained Børsting. “It is a priority for the compound feed sector to drive the improvement of current — and development of new — growing and processing technologies where we can better utilize the co-products that can become available.”

“A combination of new crops and new process technologies have an interesting potential for higher total crop yield and better environmental performance from both the farming and the feed sector,” but requires more research, Børsting suggested.

Alber agreed: “Always being at the edge of innovation is necessary to cope with cost, sustainability and quality expectations of customers. This — in combination with volatile raw material markets and unstable global supply chains — requires a high level of competence and flexibility. Diets will have to respond quickly to consistently changing settings.”

8. Combating microbial resistance

Quick to make moves to combat the effects of antimicrobial resistance, in 2006, the EU banned antibiotics used for growth promotion in animal feed. However, the ability to eliminate antibiotics without the loss of animal performance remains a hot topic. Poultry and livestock producers continue to explore new effective feed additive solutions to fill these production gaps.

“The aim is to keep the animals healthy by improving hygiene in the barn and the feed,” Rez said. “Here, the [feed additive] industry contributes with new feeding concepts, e.g., the use of organic acids, probiotics or feeding additives to aid in balanced digestion.”

Beyond feed additive innovations, new technologies coming online will also aid in reductions in antibiotic use.

With the increased focus on the welfare of farm animals as well as the need to reduce antibiotic use in Europe, diagnostic tests are playing an increasingly important role in animal health, said Feller.

“Some of the newer diagnostic tools make it possible for veterinarians and livestock farmers to detect disease in their animals directly on the farm within a matter of minutes,” she explained. “Such data-guided identification of pathogens enables the early detection, management and control of animal diseases, with a more targeted and responsible use of antibiotics when needed.”