Russia will experience feed shortages during 2011 due to the severe drought in the Central, Volga, and Ural districts in 2010, according to the US Department of Agriculture’s Foreign Agriculture Service. In 2010, grain production dropped by more than 30% to 60 million metric tons.

Pea-type crops, meals of oilseeds, and products of sugar refining are not available to supplement grain rations, because these crops also were affected by drought.

The Russian government has emergency measures in place to provide livestock and poultry farms with feeds this year, including distribution of grain from government stocks. However, these measures are not a cure for Russia’s inefficient feed industry.

Compound feed production

Russian compound feed production in 2009 is estimated at 14.7 million mt, however, trade sources estimate that actual feed production varies from 23-24 million mt. The reason for this discrepancy is that most poultry and pork facilities operate their own feedlots and feed production for internal use is not recorded.

The 2012 production forecast calls for an increase of feed pre-starters up to 1.2 million mt. The grain component in pre-starters is 55% barley and wheat. Currently, the production volume of pre-starters in total compound feed production is insignificant and estimated at 211,000 mt, with local demand estimated at 750,000 mt.

Total feed production

According to Russian figures, 2009 total feed production increased by 9% from 2008 levels and is estimated at 14.7 million mt. Production also increased during January to June of 2010 and is estimated at 11.4 million mt, 9% up from the same period in 2009.

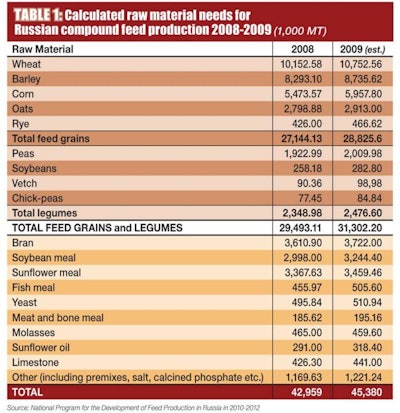

An average of 28-33 million mt of grain is used for feed production, according to the National Feed Union. The percentage of grain in total compound feed production is more than 70%.

Experts estimate that demand for concentrated feeds will increase by 30% to 35% because of intensive cattle breeding, rising imports of breeding cattle and milk production.

Russian feed mill capacity could grow to 37 million mt annually, according to the National Feed Union. The union believes that the main obstacles to efficient development of local capacities are attributed to a lack of government support and high demand for protein components, such as corn, soybean and peas.

Consumption

Poultry’s share of compound feed consumption is set to grow from 31% to 34% between 2009 and 2012. Poultry producers currently produce or manufacture 70% of their own feed demands, but some do purchase grain and other feed components.

Beef production continues to be the least-developed animal protein sector in Russia. In the short-term, economic returns will be eroded by high feed costs causing the cattle inventory to undergo further challenges. The shrinking dairy cow herd continues to be the leading long-term indicator of beef production. Therefore, inventory and production expectations for 2011 remain similar to 2010 as feed shortages will present financial challenges for producers to maintain inventory.

Trade opportunities

The Russian feed industry is heavily dependent on imports of chemical substances and vitamins for feed production. These imports increased from $250 million in 2008 to $300 million in 2009. The outlook for 2010 calls for a further increase in imports of vitamins for feeds as the result of the lack of production facilities for domestic chemical production.

Currently, 30% of all feed facilities are able to compete with foreign suppliers, others require renovation and modernization. Russia’s production of bio chemicals, amino acids and vitamins is largely insignificant, as the industry has not been operating efficiently over recent decades.

European and US suppliers have the opportunity to export amino acids and lysine to Russia because domestic production is very low. Potential shipments may include lysine, methionine, and tryptophane.

According to the National Feed Union, there is one facility in Russia that produces lysine. Approximately 70% of its shares belong to the Chinese, and as a result, high-quality natural lysine is exported to China despite demand in Russia remaining high. Russia imports almost 100% of lower quality synthetic lysine needs, according to the head of the feed union.