Future feed production will be shaped by the growing population demands for more animal protein and new foreign players enter the market.

With a current population of 1.2 billion inhabitants — a level expected to reach 2 billion by 2050 — Africa faces a major challenge to supply animal protein to its people. With a consumption of two to five kilograms of animal protein/year and fast-growing demand, sub-Saharan Africa appears in the strategic business plans of numerous agri-food corporations over the next five years.

However, depending on each country, solutions and expectations diverge and most people looking at these markets ask the same questions: Where to set up a business; how can we enter the market; and what result can we expect?

These are not easy questions to answer.

Africa accounts for 54 countries, ranging from 30,000 inhabitants in Seychelles to more than 200 million in Nigeria, with having each one its own political, economic, religious and, of course, agricultural context.

For sure major players have already taken a position in key countries, such as South Africa, Egypt, Kenya or Nigeria and, if they succeed, they will continue to invest. Feed millers and premixers, such as Cargill, Seaboard Corporation, Olam, ADM, Koudijs and Royal DSM, have become local or regional stakeholders, but so many other corporations look for pathways to enter these markets, either as local players or with commercial partners, e.g., distributors.

African feed industry trends

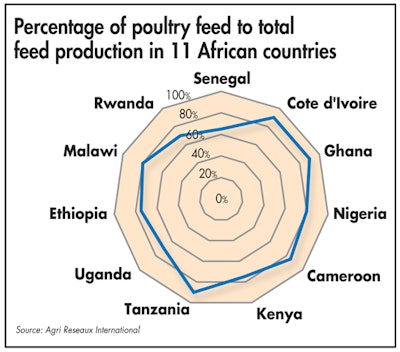

The African feed industry is predominantly driven by the poultry market. In most countries, poultry is the main source of animal protein, accounting for 80% of the commercial feed locally produced. This means feed mills and hatcheries are linked. If a company wants to sell feed, one needs to procure day-old chicks (DOC); if you want to sell DOC, you need to get feed.

Coming from the sea and increasingly from freshwater aquaculture, fish protein is another main protein source. Have an eye on Nigeria, Ghana, Zambia and new players, such as Cote d’Ivoire and Cameroon? Clarias, tilapia and catfish production are booming in these countries.

Though international companies, such as Aller Aqua, Skretting and Raanan Fish Feed, have already set up businesses in these areas, most of the main feed millers investing in aquafeed are local players, who were first involved in poultry feed production, e.g., Olam, Obasanjo and Chi Farm in Nigeria. These major companies entered the market using state-of-the-art extruders, but most of the local aquafeed producers invest in small standard extruders and supply small- and medium-sized farmers.

Western Africa is seeing huge development and investment in aquaculture.

In sub-Saharan Africa, feedmills are poultry feed oriented. (Agri Reseaux International)

In sub-Saharan Africa, feedmills are poultry feed oriented. (Agri Reseaux International)Influence of the retailer

International retailers, such as Carrefour or ShopRite, have recently opened supermarkets in major African cities, e.g., Abidjan, Dakar, Nairobi and Douala, which also have their big malls with major international brands. These retailers sell 95% imported products — apart from fruits and vegetables — not an easy position when access to the foreign exchange (Forex) market is an issue. Therefore, they face government pressure and are being asked to also deliver local products, such as table eggs, chicken meat, beef, lamb or pork cuts.

Retailers sign contracts with the best local producers and help them increase volumes and quality (i.e., antibiotic usage reductions, animal welfare, etc.) and for sure cold chain or the temperature-controlled supply chain.

Fast-food chains, such as KFC, have made deals with the main broiler producers to secure local meat. In Senegal, KFC franchises belong to Sedima Group, the country’s biggest broiler producer.

These new deals give huge opportunities to international suppliers, such as feed additive, premixes and equipment suppliers.

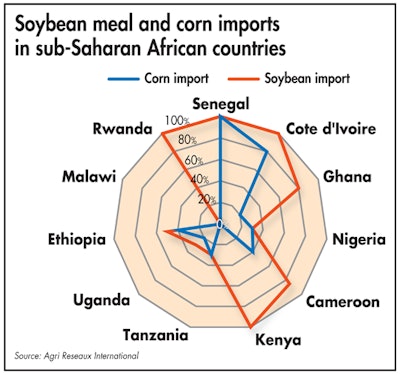

East African countries are less dependent on imports compare to West Africa and particularly Sahelian countries. (Agri Reseaux International)

East African countries are less dependent on imports compare to West Africa and particularly Sahelian countries. (Agri Reseaux International)African feed industry challenges

Another point to consider is the access to raw materials and if local sources of protein and energy are available. Sahelian countries, such as Senegal, Mali and Mauritania, are raw material dependent. Other countries, such as Uganda, Malawi, Zambia or South Africa, depending on the year and local weather conditions, produce their own corn and/or soybeans to supply their market and even export to neighboring countries.

Most African countries entered programs to produce cereals. Some, such as Cote d’Ivoire (corn) and Zambia, are successful; others continue to import corn and soybean meal massively. These programs are supported and financed by local government, international institutions, nongovernmental organizations (NGOs) and feed millers.

In some countries, some commercial feed mills even refuse to use local sources of corn, citing mycotoxin problems. We met some of them in Senegal, Cameroon and Kenya.

In Nigeria, big companies, such as Olam, invest in crop farming on their own land but also help and training farmers to grow corn and soybeans to supply the feed mill. It is the same situation in Cameroon, where we met feed millers investing in irrigation systems to grow corn.

Entering the market

Unfortunately, 2020 did not see regional trade shows specializing in African livestock and poultry farming. Each country runs its own, rather small fair. Aviana is an international event organized by an Indian company and touring in most East and West African countries, i.e., Nigeria, Kenya, Uganda, Ethiopia and even Madagascar. VIV created its first event in Rwanda in 2019 and planned to organize the next one in Kenya this year, but it was canceled due to the COVID-19 pandemic. Even into 2021, no exhibitions are slated for the first half of the year.

Despite the challenges to connect, premix, concentrate, feed additive and animal health product distribution are still experiencing a lot of opportunities in Africa. Major distributors are leaders in animal health, selling international brands from Europe, the U.S., China and India. Those companies have started to diversify their businesses and are open to learning more about feed additives and biocontrol practices, i.e., antibiotic-free production, improved hygiene, etc.

The effects of the pandemic are a medium-term trend and, even now, the priority is to feed people, which no doubt resonates with distributors.