Given the maturity of the market, feed manufacturers of the 28 member states of the European Union do not anticipate much short- or long-term growth in their production volumes. Though these countries produced 156 million metric tons of livestock feed in 2014, according to the European Feed Manufacturers Federation (FEFAC), compound feed volumes decreased by 0.5 percent last year.

While this figure was influenced by geopolitical issues, feed companies cannot expect to passively remain profitable – especially where independent feed manufactures are concerned.

From consolidation to commodity volatility, many variables will dictate how Europe’s feed industry will evolve in the coming years. This article examines strategies for independent small- to mid-sized EU feed manufacturers to implement now to prepare for the competition they will face over the next decade.

Consolidation narrows the scope

For quite some time now, consolidation has been shaping the agribusiness landscape. On the production side, as European farms grow in size and scope, so will the number of vertically integrated operations.

Nutreco’s global marketing director of animal nutrition, Richard Maatman, notes that with this trend, producers will continue to become more sophisticated and will increasingly bring their feed production in-house or develop a “co-milling operation where they may not own the feed plant, but they control the feed plant.”

While contract feed production may offer some regional opportunities, it will limit the market share for other independent feed manufacturers. Consequently, these losses will further drive consolidation.

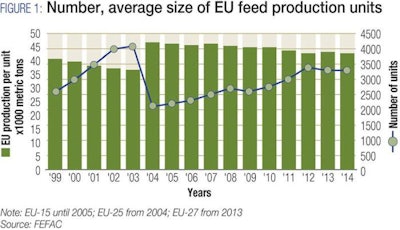

FEFAC’s deputy secretary general Arnaud Bouxin reports a 20 percent decrease in the number of feed plants between 2004 and 2014 (Figure 1). Moving forward, “a 10 to 15 percent reduction in the number of plants within the next 10 years looks realistic,” he says.

“Currently, consolidation is happening faster on the customer side than on the feed industry side – it is happening, but for several reasons it’s not happening as quickly as one would anticipate,” adds Stijn Steendijk, director of strategy, ForFarmers, Europe’s largest compound feed manufacturer. “Looking at the economics – the available capacity and the number of active players – [consolidation] is not happening as quickly as one would expect, but it is still happening and will continue to accelerate.”

Despite the stability of EU animal agriculture, the actual amount of European livestock to be fed is not increasing, Maatman reports.

“With the increase in home mixing and vertical integration – and knowing the capacity of the feed industry will be somewhat fixed – we foresee a surplus capacity at independent feed mills,” Maatman says. “With the feed volumes going down it will increasingly put pressure on their margins. For these reasons, I’m not too optimistic about the future of the independent feed industry.”

Rethinking the business to survive

Given the projectile of the European feed market and animal agriculture, it begs the question: How can independent feed manufacturers best position themselves between now and 2025 in order to survive? Nutreco’s Maatman and ForFarmers’ Steendijk offer their perspectives:

Specialization: Many independent feed companies will hone in on smaller market areas where they can establish themselves and profit. Whether they focus on a specific species, sub-species product group or niche market, these small- to mid-sized operations will have a better chance of evolving with the market.

Diversification: While the farmers mixing onsite may have compound feed covered, offering premixes, concentrates or other specialty products the producer may need. The introduction of higher margin specialty products that complement their existing portfolio will prolong and secure the producer relationship.

“[Independent feed mills] need to make sure they will adapt to the different needs of the more professional farmers and integrators,” Maatman says. “Don’t solely offer compound products, even the farmers who produce their own feed will still need concentrates, premixes and specialty products that complement the mainstream products they produce themselves.”

Knowledge is power: Though the availability of any and all types of information has grown easier for customers to access, feed millers should try to “leverage the application of the know-how rather than the know-how itself,” Maatman says, specifically, enhancing customer service by taking on more of a consultative role.

While a producer may become more sophisticated in many aspects of their business, they still require the insight of an expert nutritionist – one who brings new ideas and technologies to the relationship.

For instance, when the demand for antibiotic reductions became important in the UK, ForFarmers already had several years of experience dealing with the challenges: “We knew how to effectively change our feed formulations without losing too much nutritional value and were able to deliver that to our [new UK] customers,” Steendijk explains.

Hedge against volatility: Companies that have established stronger buying positions with commodity suppliers have better odds of weathering market ebbs and flows. Though it has a bit more clout than most manufacturers, ForFarmers, for example, leverages strategic partnerships to add value on both sides.

Opportunities outside of Europe?

For feed manufacturers who seek to expand their businesses, the answer may not lie within Europe. For some companies, it may be wise to consider expanding their operations offshore to capitalize on growth markets, such as Asia and South America – and further into the future, Africa.

“[Companies] need to be where the market is going,” Maatman explains, emphasizing how European manufacturers can bring their technologies and best practices to enhance animal production in these regions. “The growth will be outside of Europe.”

However, ForFarmers, which operates exclusively in Germany, Belgium, Netherlands and the UK, will remain exclusive to Europe and does not have plans to expand beyond it at this point in time, Steendijk reports.