With the demand for soybeans and related byproducts growing, Argentina is poised to become a leader in global production and export. Today, Argentina produces 50 million metric tons of soybeans annually, a figure which accounts for 60 percent of the country’s cultivated land area. According to data from the Fundación Producir Conservando and the United States Department of Agriculture (USDA), Argentina will produce around 67 million metric tons of soybeans by 2020-21.

Agritrend’s Gustavo Lopez, interviewed by Industria Avícola, says: “We believe that the projections for the end of this decade will show a significant growth in production. This is very promising, but must be given within a framework of more integration and additional crop rotation — not only for soy, but also for grains [corn or wheat] — for a more sustainable production scheme in Argentina.”

In terms of acreage and production, Argentina and Brazil have the highest growth rates in the global grain sector and are two of the largest providers of soy, both the grain and its byproducts. The Mercosur, a trade bloc agreement between Argentina, Brazil, Paraguay, and Uruguay and associated countries, produces 11.3 percent of the planted acreage, 13.4 percent of production and 33.2 percent of world exports of grains and oilseeds, the USDA reports. However, it is very likely that by the end of the decade, the region will be consolidated as the leading global provider of grains and oilseeds with about 41 percent market share.

Investments, value added and exports

Argentine soybean production and the export of value-added products maintains its market all year round, lending dynamism to the agro-industrial chain and the national economy.

For the past 10 years, Argentina has invested more than $2.5 billion in soybean crushing plants.

“The high level of technology that these plants have and the highest scale structures, together with the lower processing costs, make them highly efficient and competitive,” says Deputy Minister Lorenzo Basso.

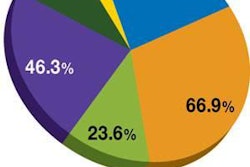

According to ForoPaís, Argentina is the world leader in value-added soy products accounting for 43 percent of the world’s soybean meal exports; followed by Brazil with 23 percent; and the United States with 16 percent. Its value-added oilseed byproducts (oil, flour and biodiesel) account for the vast majority of its exports (see Table 1). The country exports to 100 countries, but the Netherlands, Italy, Spain and Indonesia are its main markets.

Competitiveness

“Argentina’s great competitive advantage is in the value chain from raw materials,” Basso says. But their global competitiveness is also based on several factors, such as:

- Suitable soil and climate conditions

- Short distances between arable land and crushing plants

- High daily processing capacity guaranteed by the advanced technological level

- High-level professional training

- Soybean production complex located along the banks of the Paraná River

- Plants have their own export ports

The soy industry is also highly efficient and competitive because it has lower logistic costs and transportation. Argentina only has to move its soybeans a short distance, ranging from 400 to 600 km, between production areas and crushing plants. In contrast, neighboring Brazil triples the average with distances of 1,500 km between the two sectors, which directly impacts the final export prices.

Lopez states: “We have an industry that has grown in terms of output growth, which has become one of the most efficient in the world because of its level and scale. We are talking about plants ranging from 10,000 to 20,000 [metric] tons per day of processing.”

Each year, more than 165,000 box cars and 1.1 million trucks unload soybeans in the soybean crushing plants.

According to ForoPaís, Argentina has a high level of technology in their plants which leads to greater productivity with fewer plants. The average size is larger than the rest of the top producers in the world: 21 percent larger than European plants, 53 percent more than the Brazilian plants and 133 percent more than American plants (see Table 2).

In biodiesel, although it is the third largest producer, it accounts for 60 percent of the world’s exports of fuel. Argentina also provides 43 percent soybean oil.

The Paraná River and its advantages

Agritrend’s Lopez says: “We have several advantages, some from the natural point of view, since roughly 80 percent of soybean production are very close [300 to 400 km] to the crushing centers and ports.”

One such example near Rosario, is T6, a company formed by AGD and Bunge, which operates in 220 hectares in Puerto General San Martin, Santa Fe, on the banks of the Paraná River. It is part of the industrial area of major agribusiness companies.

The Paraná River is a deep-draft navigable river, capable of handling large export vessels. The system upstream of the city of Rosario extends 80 km with terminals all along the west bank. According to 2012 data, at least 77 percent of Argentine grains are exported from here – specifically 48 percent of soybeans, 97 percent of soybean meal and 98 percent soybean oil.

Via the waterways formed by the Paraguay, Uruguay and Paraná rivers, Argentina is connected with Paraguay’s soybean production (8 million metric tons); Bolivia, which is 2 million metric tons; and Brazil (80 million metric tons).

However, logistical problems remain an issue throughout the Mercosur. According to experts, they are transportation; limited grain storage; production capacity; and port logistics that cause delays.

In the future, it is likely the Mercosur will be consolidated as the leading global provider of grains and oilseeds; however, it calls our attention to the need for changes in the basic structure of mobilization, storage and logistics of bulk cargo ports adapted to the expected increase in supply.