In recent years, the poultry industry faced its share of ups and downs. WATT Global Media’s 2014 Nutrition and Feed Survey reveals the poultry industry’s ability to adapt when faced with feeding challenges and market volatility.

Overall, however, all regions remain optimistic.

According to the survey’s participants, the 2014 business outlook is on the upswing with 42 percent expecting profitability to improve. Latin America, the U.S./Canada and Asia/Pacific have the most positive attitude about the year ahead. Twenty-two percent reported a negative or deteriorating outlook for the year ahead – a figure down 11 percentage points from those polled in 2011.

This year’s survey reveals how the world poultry industry managed in 2013 and gives an idea of how it will navigate the year ahead.

Staying profitable in the face of volatility

With feed as their greatest expense, producers are working to mitigate the risks of market uncertainty by efficiently feeding their birds and hedging against swings in grain prices by investing in their facilities, using new ingredients and experimenting with nutrition-based technologies.

Grain quality and volatility in commodity markets continue to sit at the top of the list of the poultry industry’s primary concerns. Nearly all respondents cited the cost of grains and additives as the primary challenge to their business. Grain quality, in terms of mycotoxins and other anti-nutritional factors, came in at a close second.

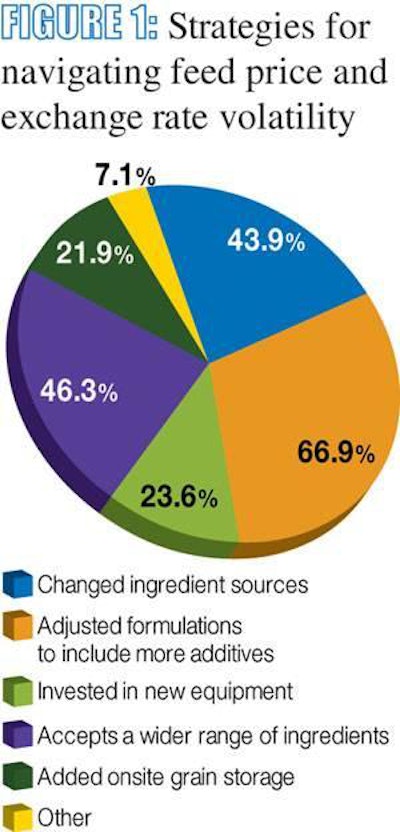

Feed formulation adjustments – specifically including more additives – is the most popular strategy for dealing with high feeding costs. Many respondents also changed or altered their ingredient sources and have begun accepting a wider range of ingredients to soften the blow of high prices. This volatility has not, however, altered feed conversion ratios. Half of respondents claim to have experienced no change. In fact, 30 percent reported one-half to one point improvement.

What’s in the formula? Given the rising costs of poultry feed staples like soy and corn, 27 percent of respondents report integrating alternative ingredients into their poultry rations. Nearly 40 percent state that no dried distillers grains with solubles (DDGS) will be used during the next 12 months. Most participants who use DDGS report no change in their inclusion, while 27 percent expect it to increase over the next year.

Overcoming operational burdens

Milling and transportation energy costs remain one of the top concerns, taking the slot as the number three most challenging issue to poultry feed operations.

More than any other region, Latin Americans seem to have increased their capital investments – such as additional onsite grain storage – to help better hedge against grain market volatility. Conversely, Latin Americans also cited the access to capital for facility improvement as a major obstacle.

Africa and the Middle East tackled this issue by looking toward the added efficiency of new equipment investments to combat these challenges.

Further down the supply chain, the United States/Canada, Europe and the Middle East report that food safety and supply chain risks remain one of their primary concerns. It’s not clear if this is from an ingredient supply standpoint or if they are referring to foodborne illnesses during meat processing and its potential to affect their companies.

In contrast to other regions, Asia/Pacific noted access the world markets and navigating exchange rate fluctuations as being troublesome to their businesses.

Additives to replace antibiotics

Overwhelmingly, yet unsurprisingly, participants indicate that their use of subtherapeutic and therapeutic antibiotics have fallen off; however, anticoccidial drugs remain in the rotation, but at a reduced amount over previous years.

With the exception of Europe, many report increasing their use of antibiotic and probiotic combinations in the last year. (Note: Europe ranked regulation and the elimination of antibiotics as its number one nutrition challenge.)

Organic acids were especially popular in Asia/Pacific and Latin America. In Latin America, frankly, all of the additives listed on the survey fared well.

Eighty percent of respondents report using probiotics in their formulation, with regions reporting high to moderate efficacy as an antibiotic replacement. Fifty percent use prebiotics. Overall, probiotic and prebiotic efficacy ranked highest in the United States.

Phytogenics received the lowest ranking among all respondents, which may be in part because they are used more commonly for their sensory properties and ability to increase feed intake than their presumed antimicrobial and antiviral benefits. Of those polled, 40 percent report using essential oils in their feed formulations – and an additional 22 percent cite that their company is exploring the inclusion.

Enzymes on the rise

From lower feed costs to improved nutrient availability, nutritionists and producers are well aware of the benefits of feed enzymes. Enzymes ranked well across the board as effective additives in replacing antibiotics in poultry feed. As a result, 36 percent of participants report increased their enzyme use in 2014; 44 percent suspect it will stay the same as 2013.

Overwhelmingly, global respondents adopted – or increased – a mixture of phytase and non-starch polysaccharide enzymes (NSPs) during the last 12 months. Phytase’s popularity is growing. With anti-nutritional factors a constant challenge in all corners of the world, 28 percent of companies predict their use of phytase will increase in 2014; 50 percent of respondents predict it will over the course of the next three years. Forty-four percent suggest their usage has and will remain the same in the years ahead.

Only 5 percent of participants claim they do not use phytase.

Geography may determine profits

Overall, the feedback from WATT’s Nutrition and Feeding Survey suggests a positive outlook; however, profitability in the global poultry industry may still prove to be a mixed bag of winners and losers in 2014. For example, in the United States, poultry has surpassed beef as the most popular meat, while Asia struggles with avian influenza and its effect on both production and consumer confidence.

On the feed side, Rabobank’s Poultry Outlook recently reported its prediction that feed costs will rise by 10 to 15 percent in the second quarter of 2014. Regardless of the uncertainty of the year ahead, the good news is that poultry companies have weathered years of volatility before and such experience has given their nutritionists and formulators the tools to find strategies to deal with whatever feeding challenges come their way.

What does sustainability mean to you?

Sustainability has become a bit of a buzzword in recent years – and geography plays a big role in how it is defined. North America, Latin America and Europe define it as the conservation of the earth’s resources. Asia/Pacific and Middle East more strongly looked toward strategies for increasing profitability as sustainable agriculture’s goal. Regardless of region, development of methodology for strengthening efficient production ranked high. Overall, “recycling animal by-products and waste” also proved a common theme. From the feeding side of the fence, 25 percent of participants (the majority found in Latin America) cite the use of enzymes for their benefit to environmental sustainability.