In 2025, the outlook for global dairy and dairy feed production is faced with a complex landscape of genetic breakthroughs, modest production growth and evolving nutritional demands that will influence how feed producers and nutritionists approach dairy cattle nutrition.

RaboResearch expects milk production in the Big 7 export regions to expand by 0.8% year-over-year, with similar gains projected for the first half of 2026. This modest growth is driven largely by a return to production growth in the EU and U.S., where typical annual gains have stagnated in recent years. However, this expansion remains below 1%, indicating the industry's shift toward efficiency rather than volume-based growth.

The global feed production landscape reflects this measured approach. According to the 2025 Alltech Agri-Food Outlook, world feed production increased by 1.2% in 2024 to 1.396 billion metric tons.

Notably, dairy feed tonnage surged by 3.2% to 165.5 million metric tons, driven by robust consumer demand, favorable milk prices and a shift toward more intensive farming practices across Asia-Pacific, Europe, Africa and Latin America.

Here is a snapshot of four trends that will impact dairy cow feed production moving forward:

1.Genetics increasingly influence feed formulations

Advances in dairy cow genetics have increasingly affected nutrition strategies. According to the Council on Dairy Cattle Breeding (CDCB), today more than 70% of production improvements come from genetic advances versus management factors. This marks a 180-degree shift from the past when production management, including nutrition and feeding programs, were the main drivers of performance improvements.

The CDCB maintains a comprehensive genetic database containing 100 million dairy cattle records and more than 10 million genomic tests. This genetic precision, for example, will likely push butterfat content to exceed 5% in the next decade, assuming herd management and nutrition keep pace with the dairy cattle's genetic potential.

For feed producers, this creates opportunity and challenge. With heritability estimates for butterfat and protein ranging from 20% to 25%, genetic potential is relatively fixed, making optimal nutrition crucial for trait expression. This means feeding strategies must now prioritize butterfat and protein production over milk volume, with $8 billion in new dairy processing capacity coming online through 2027, where 80% of milk supply goes to manufactured products dependent on component levels.

2.Disease, policy could cost producers

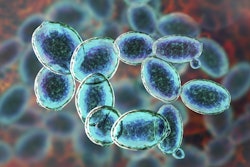

When highly pathogenic avian influenza (HPAI) was detected in dairy cattle herds in 2024, and then spread to farm workers exposed to infected animals, the dairy industry quickly dispelled public concerns by confirming that pasteurization effectively kills H5N1 virus in milk. While the dairy industry avoided a backlash in consumer demand and consumption, it still faces headwinds cause by the virus.

HPAI infections affect 10% to 15% of cows on infected farms with 1% to 2% mortality, but the economic impact extends beyond immediate losses as some cows never return to full productivity. According to Cornell University research, HPAI costs dairy farmers up to $1,000 per cow.

Meanwhile, policy uncertainties add another layer of complexity. For example, in the U.S., tariffs and reductions in food assistance programs could reduce all-milk prices by as much as $1.90/cwt and decrease U.S. dairy export values by up to $22 billion over four years.

3.Feed demand varies by region

Beyond the erractic global geopolitical environment adding uncertainty to the forecasts of all sectors, regional trends already set in motion will determine the amount of dairy feed production throughout the remainder of the year.

In Europe, for example, the European Feed Manufacturers' Federation (FEFAC) forecasts EU compound feed production to reach 146.1 million metric tons in 2025, marking a slight decrease of 0.34% compared to 2024. EU cattle feed production is forecast to exceed 41 million metric tons, down 1.4% from 2024, reflecting environmental policies and animal disease pressures including foot-and-mouth disease outbreaks.

Meanwhile, growth within the U.S. dairy cow herd — up 101,000 head so far compared with 2024 to 9.425 million — is the result of reduced culling due to high replacement costs rather than expanded operations.

4.Low feed costs improve margins

Feed producers have benefited from stable input costs in 2025. U.S. Department of Agriculture (USDA) analysis indicates that U.S. dairy producers face lower feed costs compared with 2024, "with soybean meal prices falling and corn prices remaining well below 2022-23 highs." Alfalfa prices have also decreased after drought relief in major growing areas, with on-farm stocks increasing 6%.

Implications for feed producers

The convergence of these four trends create a strategic roadmap for dairy feed producers and nutritionists. For example, evolving genetics demand precision nutrition solutions that maximize component yield rather than milk volume.

Success in 2025 will depend on developing feeds that unlock genetic potential while maintaining cost efficiency in an environment where every cow must perform at peak efficiency. The industry's shift from expansion to optimization changes the value proposition for dairy nutrition, creating opportunities for producers who can deliver measurable improvements in milk components and, overall, herd efficiency.

References available upon request.