Members of the poultry feed industry continue to wrestle with high grain costs while simultaneously working to increase profits and meet consumer demands for “no”—no antibiotics, no hormones, and no animal byproducts in animal feed. The results of this year’s WATT Nutrition and Feed Survey reflect those challenges.

Outlook

This year’s survey shows some good news for the industry. The number of respondents indicating they anticipate negative or deteriorating profitability for the next 12 months is at a three-year low.

In the 2011 survey, 32 percent of respondents foresaw deteriorating profitability due to economic conditions. In the 2012 survey, that number dropped to 28.2 percent. This year, only 25.4 percent expect deteriorating profits over the next 12 months.

This year 43 percent of respondents said they expect increased profitability, compared with 47 percent in 2012 survey and 38 percent in the 2011 survey.

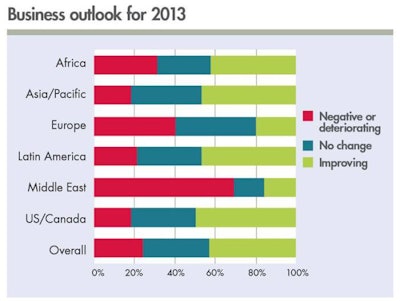

Optimism varies with the geography. While Europe stayed gloomy, dropping from a 42 percent negative outlook last year to a 40 percent negative in this year’s survey, Latin America showed the most increase in optimism, going from 22 percent in 2012 to 47 percent this year. Asian respondents also were optimistic, with 47 percent anticipating improved profitability.

Challenges

When asked about the importance of various challenges facing their business, 83 percent of respondents cited the cost of grains/volatility in grain prices as very important.

Of particular note were the challenges cited second, third and fourth, as they all tied back to issues related to grain cost: quality of grains, including mycotoxins; energy costs, including for transportation and milling; and food/feed safety and/or supply chain risk.

Feed enzyme overview

With the increased cost of grains, an overall increase in enzyme usage was both expected and reported. However, what was surprising was that 29 percent of respondents indicated they were either not using enzymes or not using any of the ones listed in the survey.

Of the enzymes listed, 46.7 percent of respondents indicated they were using xylanases in their operations. Adding in the 32 percent using a glucanase-xylanase blend, it appears that xylanase is the most commonly found enzyme in use in poultry feed operations.

Enzyme usage, current and anticipated

When asked further about how their feed enzyme usage has changed over the previous 12 months, it was interesting to note that 14 percent of respondents indicated they had adopted or increased their use of NSPs as therapeutic support. Furthermore, it was particularly noteworthy that 31.9 percent indicated they had adopted or promoted enzymes for their benefit for environmental sustainability, which appears to show an awareness of a changing market.

In addition, 40 percent of respondents said they will continue using the same level of enzymes in 2013, but nearly the same amount—36.4 percent indicated they will increase their usage of enzymes in the upcoming year.

Additives as antibiotic replacement

In general, it seems the poultry feed industry is not of one mind on the efficacy of additives as antibiotic replacements. However, of the five additives surveyed, probiotics and organic acids were perceived to be the most effective.

For those rating organic acids, 21 percent ranked it as “strong” while nearly half of that number—9 percent—ranked it as “weak.” In general, all five additives fell in a moderate range for ranking, with no one additive a decisive choice among all producers.

One surprise in the results was the relatively poor ranking that phytogenics received, particularly as compared to prebiotics. This may suggest a marketing opportunity for those in the field of phytogenics.

Use of DDGS

Overall, DDGS will continue to be a part of poultry rations for a majority of companies, with 60.3 percent reporting that DDGS usage levels will remain the same or increase somewhat or significantly in the next 12 months. Only 40 percent reported that none will be used.

This number is similar to numbers our survey found in 2011 and 2012. In 2011, 57.5 percent of respondents indicated they would be using DDGS in the upcoming year. In 2012, the anticipated usage percentage was 61.3 percent. It would appear that overall DDGS usage has stabilized in the poultry feed industry.

In the United States, the percentage of respondents that said they did not use DDGS in feed went from 40 percent in 2012 to 33 percent in this year’s survey. Conversely in Europe, where 48 percent of last year’s respondents said they didn’t use DDGS, that number climbed to 52 percent.

Antibiotics, other inclusions

A trend noted in the 2012 survey was a general reduction in the use of antibiotics and anticoccidial drugs, and this trend appears to be continuing. In this year’s survey, 26 percent of respondents noted they had reduced their use of sub-therapeutic antibiotics, and 24 percent indicated they had reduced their use of therapeutic antibiotics.

Also notable were the items reported by respondents to have been increased in their poultry rations. Use of prebiotic organisms was noted by 42 percent of respondents. Increased use of mycotoxin binders/inhibitors was noted by 39 percent of respondents, and 31 percent said they had increased their use of yeast cell wall products. In a separate question, 52 percent said they include prebiotics in their feed formulation, and 62 percent said they include probiotics.

Labeling claims

Most likely in response to growing consumer demand, labeling claims have clearly become an important aspect of poultry product feed marketing, with a substantial number of respondents indicating that they now include some kind of labeling claim, with the most prevalent being “no hormones.” Other claims that are being offered include (in order): no antibiotics/drugs; no animal byproducts fed or “all vegetable diet”; all natural organic; and all corn diet. As consumer demand appears to be growing in this area, it would not be at all surprising to see this number increase in 2014.