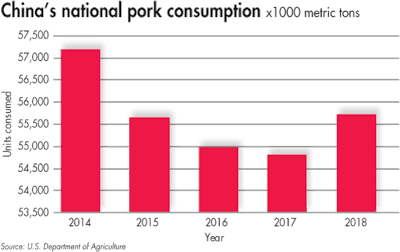

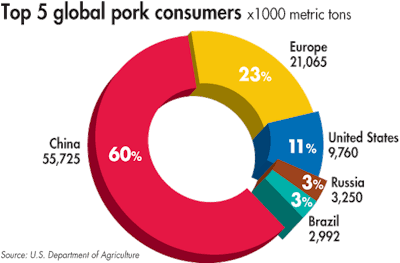

China consumed 55.7 million metric tons (mmt) of pork last year — way ahead of Europe's 21 mmt and the United States' 9.7 mmt – but a notable decrease from its record level of 57.1 mmt in 2014.

While 2018 marks the first slight uptick after three years of consumption declines, the world's largest pork consumer and producer is now suffering the impact of a deadly virus outbreak of African swine fever (ASF), which some estimates suggest could plummet domestic pork production by more than 20 percent this year.

China's domestic pork production is extremely important — imported pork only represented 2 to 3 percent of the total market in 2018 — but the country’s producers are facing a variety of other challenges.

Chinese pork consumption saw a slight increase in 2018, after three years of consumption declines.

A 'negative' for feed

“Domestic sow and live pig inventories are declining sharply,” says Angela Zhang, head of the business intelligence division at IQC Insights.

“Due to the negative influence of ASF, most of the domestic major pig breeding companies have lowered their prospective revenues in 2018, compared with their earlier estimation made in the first half of 2018,” she says. “It indicates they could suffer financial strain for production capacity expanding into 2019, which is a negative factor for the feed industry.”

Public company Chying Agro-Pastoral Group, for example, recently announced it is unable to afford enough feed for its pigs, which has also led to higher-than-expected death rates.

“ASF is now the biggest issue in China and it will significantly reduce the supply this year, maybe next year as well,” notes Chenjun Pan, senior analyst at Rabobank. “If pork production drops significantly, the demand for feed will also drop. But feed demand for other sectors like poultry and beef cattle will increase. So, there's a little bit of an offset on that but, overall, the impact on the feed industry is negative.”

However, Pan says ASF will only impact the market in the short term, e.g. over the next two to three years. Longer term, there are other factors to consider as China's pork consumption continues to slide.

“Even if we didn't have ASF, the consumption will drop slowly,” she says. “There is no very solid reason for pork consumption to increase.”

Per capita pork consumption declined in recent years, shrinking almost 6 percent from historical highs of 43.5 kg in 2014 to 41 kg in 2017, reports Pan.

So, what's behind this downturn?

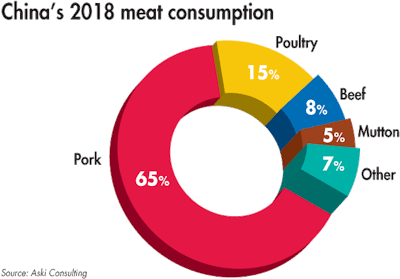

Pork remains China's most popular meat, but consumption is on the decline. | Aski Consulting

Consumption habits are changing in China, fueled by a rising health literacy. (e_rasmus | iStock.com)

Health literacy 'on the rise'

Given pork is a staple, mass-market product in China, there is desire for variety, Pan says, with many consumers switching to beef, poultry, fish or seafood on occasion. A niche but growing number of Chinese consumers are also opting for vegetarian options. These consumption changes are either driven by a desire to eat more premium meats — imported beef is one good example — or a rising health awareness, she says.

Kerstin Brolsma, business analyst at China Market Research (CMR), agrees: “Health consciousness and health literacy is on the rise here. So, in tandem with that, you're getting people who don't want to eat as much meat.”

Much of this is being fueled by increased online activity and travel among Chinese consumers, as well as a rise in purchasing power, enabling consumers to be more selective, Brolsma says.

Chicken is proving a popular switch as it is easy to prepare, she says, and beef is gaining strong ground, particularly among white collar workers who enjoy eating imported steaks in food courts.

Anne Peng, editor of ChemLinked, agrees beef is an “increasingly important alternative,” along with mutton.

Peng says beef, a comparatively premium meat, will benefit hugely from China's surge in “new retail,” which sees online and offline shopping converge, offering fresh produce fast.

Alibaba's Freshema chain, for example, can deliver orders within 30 minutes of an online purchase. Customers can also shop in-store and schedule home deliveries. Peng says this retail trend will undoubtedly drive sales of high-end and premium beef and pork varieties.

Consumers 'really care how the pigs are fed'

For the large swath of consumers still favoring pork — it remains China's most-consumed meat by far at 63 percent of the market — food safety and the environment are key purchase influencers.

On top of ASF concerns, tougher environmental protection laws introduced in 2015 by the Chinese government mean issues like air, water and land pollution are now front of mind for industries and consumers alike. With this, consumers are paying closer attention to the story behind meat, its origin and how animals are raised.

Pan says many consumers are increasingly drawn to high-quality attributes like certified organic, free range or natural grown that align with these concerns. The type of feed given to animals is also of interest.

“Actually, Chinese people are quite similar to European consumers in this aspect — they really care how the pigs are fed and how they are treated,” she says. “It's a little bit different from the animal welfare concept in Western countries, but in China people are concerned about what kind of feed is used and whether medicines have been added to the feed. They have a very high awareness.”

While providing information on how animals are raised and what they are fed has potential, and some companies are trying to take note, Pan says such storytelling is “not very common” in China.

What's fueling China's shift away from its favorite meat? (zeynepogan | iStock.com)

Marketing pork to the Chinese consumer

Product marketing isn't always straightforward, given the majority of consumers have “limited trust” concerning label claims and what producers say, and gaining trust takes time.

Brolsma says, for many pork shoppers, branding can sway purchase decisions.

“In a grocery store … the consumer will say 'I know brand x, y or z from when I was a kid; I trust their chicken meat, so I'm going to purchase their pork' or if they know it's a national brand, that will bring about a higher level of trust,” she says.

Along with this, a rising middle class is giving consumers the means to pose ethical questions, and such concerns about their health and the environment “will only increase” in the next three to five years.

The industry must be “cognizant” of changes in the pork market, she says, and focus on how best to present and sell to Chinese consumers. This pivots around providing a product that consumers believe helps achieve a healthy lifestyle, at a decent price and with a story behind it.

“Those are tangible things that Chinese consumers can grab onto and be positively attracted to when purchasing meat,” she says.

On top of this, the Chinese government is remaining vigilant in its efforts to keep pork demand afloat, Brolsma says. After all, it's “kind of the national meat of China.”

Pork remains China's most popular meat, but consumption is on the decline. China consumed 55.7 mmt of pork last year, but a notable decrease from its record 2014 level of 57.1 mmt.