2022 Alltech Agri-Food Outlook reveals 2021 tonnage in the Asia-Pacific region and how consumer preferences are changing

The COVID-19 pandemic has significantly impacted the agrifood sector, contributing to supply chain challenges and accelerating the adoption of new technology and environmental sustainability practices. Drawing data from more than 140 countries and more than 28,000 feed mills, the 11th edition of Alltech’s annual feed production survey estimates that 2021’s global feed tonnage increased by 2.3%, reaching 1.235 billion metric tons.

Feed production in the Asia-Pacific region exceeded expectations in several areas, primarily due to recovery from COVID-19 restrictions, hitting 458.121 million metric tons or 5.7% growth.

Top performing Asia-Pacific countries

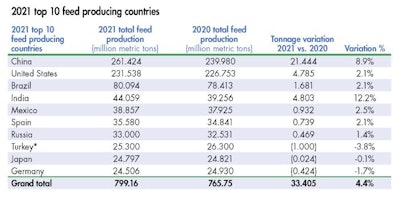

China remains the largest feed producing country in the world, with 261.424 million metric tons, while also reporting the largest annual growth of 8.9%. A key trend resulting in this growth was the continuation of the consolidation and modernization of the country’s feed industry.

Swine farms and feed production have moved from utilizing food waste to contracting with professional feed mills. At the end of the third quarter, China’s pig stock increased by 18.2% year on year, as per the National Statistical Bureau. The output of pork increased by 38%, and the number of sows was 44.59 million, an increase of 16.7%. At present, the pig stock continues to grow.

Globally, the pig feed production sector experienced a significant comeback, with a feed tonnage increase of 6.6%, which was primarily boosted by Asia-Pacific’s recovery from African swine fever (ASF). Japan, South Korea, Malaysia and China demonstrated recovery from ASF, but Indonesia, Myanmar, the Philippines, Thailand and Vietnam continued to feel the impact of the disease.

Dairy feed tonnage increased slightly by 1.9% globally. Asia-Pacific saw the largest increase of 8.6% to 25.619 million metric tons, which is primarily attributed to growth in India, as it experienced an upsurge in milk price. There has also been a significant growth in co-ops conducting business expansion in India.

Ranked fourth among the top 10 feed producing countries, India experienced a dynamic recovery from COVID-19, with a robust increase of 12.2% to 44.0594 million metric tons due to people returning to work, business expansion and the re-opening of restaurants and food courts.

China and India accounted for the most significant increases in Asia-Pacific’s broiler feed production. Affected by the pandemic, Indian consumers now prefer a protein-rich diet to support their immunity. Chicken and egg consumption are the major protein sources for Indian consumers. Eggs are an especially popular source of protein because they are affordable.

India also saw a significant increase in its aquaculture feed tonnage — up by 9%. A rise in shrimp feed production by a leading feed manufacturer has partially attributed to the expansion of the shrimp cultivation area. Additionally, Indonesia accounted for 10% of Asia-Pacific’s aquaculture growth.

Japan ranked ninth in the top 10 feed producing countries, although its feed tonnage decreased slightly by 0.1%, from 24.821 million metric tons in 2020 to 24.797 million metric tons in 2021. Japan is still facing a labor shortage, as the COVID-19 pandemic has affected the foodservice sector, with business hours only recently being extended. The aquaculture sector shows momentum, with increasing prices due to the low stock during the pandemic and gradually increased consumption.

The global pet food sector experienced the largest growth of all species, at 8.2%, and Asia-Pacific led the regions in growth with a 17.9% increase in pet food production. This significant increase is largely due to the rise in pet ownership amid the COVID-19 pandemic.

Production challenges

Supply chain issues and inflated prices were cited in the survey as creating the biggest issues, with 33% of countries in Asia-Pacific reporting that high raw material prices were the biggest challenge facing agriculture.

In India, between April and August 2021, soybean meal rates had jumped to historic highs, rising by 60%. By request of industry stakeholders, the central government allowed, for the first time, the importation of 1.2 million metric tons of genetically modified soybean meal to India.

Meanwhile, in Bangladesh, grain production and the supply chain were disrupted due to COVID-19 and, as China imported a significant quantity of grain from the U.S., this ultimately created a scarcity of U.S. grains in Bangladesh. Also, due to the unavailability of containers and vessels, exporters could not deliver the raw materials on time. This led to a decline in raw material supply and a rise in price, resulting in a significant reduction in income and profitability for feed millers and farmers, thereby contributing to a decline in feed production.

As many countries face the rising cost of raw materials, feed efficiency improvements and raw material replacement innovations are sought after to help reduce costs. More integration and automation is being witnessed in the agrifood sector throughout the Asia-Pacific region. Mega-farms are emerging, and labor shortage remains a challenge, so more automation is being applied on-farm to provide data-driven management with fewer feet on the ground.

For example, Chinese corporate pig producers are building bigger and faster, employing fewer people and using more technology, such as intelligent feeding systems, manure-cleaning robots and infrared cameras that detect when pigs have a fever. With this pig factory, the companies say they can keep disease out while increasing efficiency to satisfy the country’s huge appetite for pork.

Consumer tendencies

In Asia-Pacific countries, many consumers recognize the importance of the safety and traceability of food. They prefer functional and protein-rich food of a premium quality that is good for immunity and health.

In Thailand, functional and personalized food is designed for people of different ages, lifestyles and health issues, which seems to be an important trend in offering more sustainable, healthy options to consumers. However, given the challenges in the economy and pandemic, there is still a struggle by the vast population in Thailand to afford healthy food that is sustainably sourced and produced. Chicken meat and eggs are still the preferred protein sources, largely due to the low price and high protein level.

Chinese consumer preferences have shifted, especially among the younger generation, who are already positioned to respond well to new alternative-protein products. The key metrics for successful alternative-protein products are quality, taste and nutritional profile, and price. Researchers say that China’s under-40 population of 700 million is going to be the major driver behind the demand for alternative proteins. While still in its early stages, China’s alternative protein market has grown over recent years. So far, much of it has been driven by foreign players, such as Beyond Meat and Oatly, but may soon change with the arrival of domestic food technologies.

Online grocery shopping

Social restrictions during the COVID-19 pandemic changed many people’s lifestyles, and more consumers turned to online grocery shopping. Egrocery, fresh produce and fast-moving consumer goods rates are increasing due to the short shelf life of fresh food. Convenience and quality are driving the digital-savvy younger consumers to purchase groceries online. As people were staying at home for long periods of time during the pandemic, they would choose to purchase online necessities and stock frozen food and convenience food items with a longer shelf life.

Fresh food ecommerce options also became popular since people could not go to the market to buy fresh food, such as vegetables, fruits and meat. For example, during the Spring Festival in China, the daily online orders of vegetables and fruits in SuFresh — a new retail fresh food ecommerce owned by Suning — increased by more than 200%, and the Suning Food Market saw a 245% increase in online orders.

In Indonesia, consumption of instant, raw and frozen foods also increased due to COVID-19 restrictions and/or lockdown, and ecommerce usage increased as many purchased those foods online. In Malaysia, consumers tended to cook from home or ordered food delivery, and online purchases of food surged during the pandemic. In Myanmar, there have been some changes in the industry supply chain since the pandemic, and people have started to buy food online to reduce physical contact as much as they can, instead of buying at the wet market or supermarket.

Environmental concern and sustainability

Over the past year, there has been a strong focus on the environment, as governments worldwide have made renewed commitments to reducing their environmental impact and focusing on sustainability practices. In some Asia-Pacific countries, governments have implemented regulations on sustainable development to reduce emissions to the environment, including carbon and heavy metals.

China has set the goal of reaching peak carbon emissions before 2030 and becoming carbon neutral before 2060. Strong nationwide actions have been implemented to help achieve these targets. For example, in the agriculture sector, the government is focusing its attention on building a monitoring system for agricultural carbon emissions, developing a “big data platform” to establish collaborative innovation for different stakeholders, and focusing on water control, efficiency enhancement, straw recycling, resource utilization of livestock manure, and agricultural film pollution prevention and control.

Retailers are cooperating with logistics companies to make the supply chains in China greener as they transform operations from production lines and warehousing to distribution and recycling, with an emphasis on the reuse of packaging. Some retailers are trying to strengthen their role in dairy farming for more sustainable sources of milk, but that is still in the early stages because increasing the production of milk is still their priority.

In South Korea, manure control will continue to be the top priority for livestock farms. In the future, certificates of sustainability, such as those noting carbon reduction, eco-friendliness and record sharing through mobile devices, will be the most important benchmark for consumers. In Japan, feed producers are more interested in an environmentally friendly, nutritional solution for animal farming, and retailers are also selling that concept to consumers through products.

Many sectors continue to focus on innovation and partnerships, which proved essential to sustaining business over the past year. As we look ahead to the future of agriculture, there are many reasons to be optimistic. The resilience of the agrifood sector against the challenges of COVID-19, as well as disease and supply chain disruptions, along with its continued growth, modernization and increased sustainability during those challenges, are positive proof of an industry on the right track.