Producers faced several challenges in 2020, but were able to apply innovation and flexibility to succeed

Among the many challenges Latin America’s feed producers faced in 2020 were increased demand from China and elsewhere in Asia, high raw materials prices and changing consumer protein consumption, but with innovation and flexibility, the industry was still able to grow.

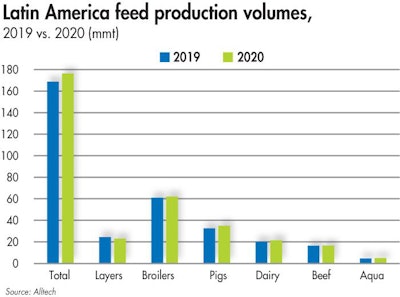

Animal feed production in Latin America was up 4% in 2020 compared with the previous year, according to Alltech. Brazil, Mexico and Argentina were among the top 10 producing countries, and they saw growth of 10%, 4% and 7%, respectively.

Of all species in the region, aquaculture feed saw the biggest growth at 8%, while dairy and pig feed were each up 7%, broiler feed was up 2%, and beef was up 1%, Alltech reported in its 2021 Global Feed Survey. Layer feed production, meanwhile, was down 5%.

Pandemic changes production, consumption habits

Despite the challenges created by the COVID-19 pandemic, sources said the Latin American feed industry adapted well.

“Although the economy of the region has experienced a drop of about 7% on average, the animal feed industry has proven to be resilient,” said Jorge Martinez, president, Latin America, at ADM Animal Nutrition. “As a strategic industry, many countries were able to maintain production levels during the pandemic. It is worth recognizing the flexibility and quick response of the feed industry in the region, including the creativity to maintain the supply chain, the last-minute investments in technology and the commitment of many companies in Latin America to protect their employees and families from COVID-19.”

Demand for feed and protein imports from China has risen as the country rebuilds its hog herd and consumer habits change in the post-COVID era.

“During the last months of 2020, prices suffered an increase due to the high demands of China. China is rebuilding its pork meat production, demanding more imported beef from south Latin America, as well as recovering its corn inventories,” Martinez said.

Citing data from the Organization for Economic Co-operation Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO), he added: “International demand of animal protein of markets such as China and southeast Asia increased their imports of pork and beef, reaching 7.8% of the pork meat production at the global level in 2020.”

Price increases lead to more alternative ingredients

Brian Spencer, executive account manager at BRI Worldwide, said alternative ingredients were gaining popularity even before feed prices started to rise, but higher prices accelerated demand for products such as rice hulls and wheat as well as higher-quality corn and soy.

“Producers and integrators began by cutting additives because (they add) cost to diets,” he said. “However, there has been an additional analysis to look at which additives are necessary. These producers prioritized essential additives and ingredients. There has been an increase in some additives, like enzyme feed additives, because producers have to maximize diets.”

Spencer added that producers used to be more focused on quality of ingredients than availability. But, “now, because of price and availability, producers are, at times, more focused on availability instead of quality. Especially large integrators need to have consistent ingredients so they can formulate correctly. They may sacrifice quality for consistent supply,” he said.

ADM’s Martinez said precision nutrition is another tool producers are using to cope with high feed costs.

“Price volatility of raw materials, particularly commodities, has put an additional pressure on the margins of animal feed and protein producers,” he said. “Uncertainty on harvest quality and quantities in North and South America has created further volatility as well as the long positions of funds in commodities, creating huge pressure on prices and feed production costs.”

He also said high prices and limited availability means some changes to feed formulation are necessary to keep costs reasonable.

“Our animal nutrition team sometimes must replace an ingredient in order not to raise the total cost of formulation, and we always take care to preserve nutritional quality of the formulas,” he said.

Spencer also said alternative sourcing has become important for producers.

“Alternative ingredients have become vital to producer success, especially as corn and soy prices have increased,” he said. “The inclusion rate has increased as prices have. This is important as producers and nutritionists formulate/reformulate with cost and quality in mind, so animals perform at a similar rate to prior conditions.”

Poultry prospers during pandemic

The COVID-19 pandemic has had an effect on production and consumption patterns in Latin America, similar to other regions, but Spencer said its effects were delayed.

“The global COVID-19 pandemic caused a lag in production. So, we did not see an effect immediately,” he said. “The production gap was realized three-four months after the initial shutdown in March 2020. As economies shut down and people isolated, it caused production and consumption to shift. However, producers and pre-mixers already had feed purchased. The whole system had a stagnation, but it took months to realize that feed wasn’t being purchased in certain areas.”

In the second half of 2020, he added, consumption slowed, supply was down, and poultry prices were high while live bird costs were down.

“Consumption slowed because people could not work and did not have disposable income,” he said. “Wet markets, which is where a large portion of the LATAM population get their protein, were closed so supply was significantly down. The processed poultry prices were higher than historically, however the actual live bird cost was driven down. Producers lost profitability because they could not find processors for their chickens. Producers sometimes held onto birds and had to feed them increasing feed. … Carcass prices went way down, because there was a surplus of live birds. At the same time, processors were making profits, because their outputs were down due to regulations and shutdowns.”

Sources said cheaper proteins, such as chicken and eggs, grew in popularity during the pandemic.

“The purchasing power and consumption behavior during the pandemic has been imposing the growth of cheaper protein sources such as chicken, eggs and pork at the expense of beef,” Martinez said. “Therefore, our industry reacted rapidly to this change in consumer behavior. While the internal demand of animal protein shifted in our region to cheaper products, our industry experienced the largest growth in 2020, most notably in Brazil.”

Additionally, said Pablo Azpiroz Esteves, president of FeedLatina, the Brazil-based association of the Latin American and Caribbean animal nutrition sector, there has been a “great demand” for poultry meat and beef from Latin America to Asian countries.

“Poultry has seen an upside,” during the pandemic, Spencer said, “because it is an affordable protein.”

Technology, innovation for future success

Martinez and Esteves agree technology and improved logistics will help the Latin American feed sector prosper in the future.

“Innovating and expanding technologies for feed production, improving infrastructure and new trade opportunities will help increase profitability for Latin America,” Martinez said. “The trend toward advanced technology for more efficient logistics and feed production is increasing. There’s also interest in better efficiency indices in average daily gain/feed conversion ratio and yield.”

He added that implementing more technological innovations will improve resiliency in the primary production sector.

Esteves said innovation can also improve food quality and efficiency and fulfill certain regulatory requirements and expand exports.

“Within the animal nutrition industry, adaptation to new trends and transformations is no exception,” he said. “That is why, today, new equipment, ingredients, new raw materials, and other natural components are being investigated and used to obtain a better food product, but especially aiming to become more and more efficient. Countries that meet quality and health requirements and have an optimal and efficient food production process can obviously have greater commercial opportunities.”