Despite the challenges of the COVID-19 pandemic, Asian feed production experienced gains driven by China’s ASF recovery and the region’s demand for animal protein.

COVID-19 was a major disruptor across the world in 2020. In Asia, the industrial channel shifted from foodservice to retail and online, due to the closing of wet markets as well as trade volatility. The supply chain, worker absences, logistics and distribution issues, and the supply and pricing of inputs like feed additives, animal health and genetics are critical challenges for everyone. However, there were opportunities that allowed Asia to thrive and grow last year.

Asian 2020 feed production trends

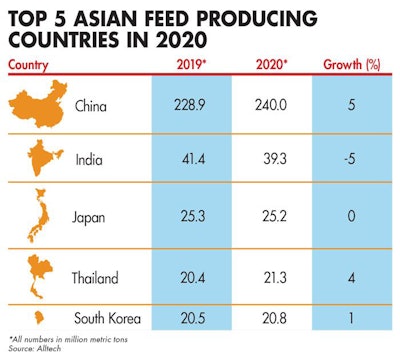

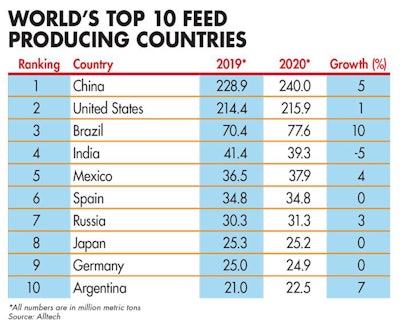

Based on an analysis of the 2021 Alltech Global Feed Survey, feed production recovery increased gradually in China in 2020, with 5% growth, allowing China to reclaim its position as the top feed-producing country, with 240 million metric tons (MMT). After a series of disease, food safety and environmental challenges, feed production in China has emerged as one of the most high-tech industries in the world, utilizing new technology and new investments at a faster pace than anywhere else. This resurgence is related to African swine fever (ASF) controlling the swine restocking program in China and producers exploring the production of other species to find a protein replacement for pork.

The rest of Asia — Southeast Asia in particular — has seen a recovery from ASF. Vietnam ended 2020 at 80% of its pre-ASF production rate and has seemed to come through COVID-19 relatively strong and less affected than the rest of the region. Vietnam’s population is still largely under 35 years old and consumes more protein and dairy. Disease challenges have remained while the country is recovering from ASF; we have seen an outbreak of avian influenza in the northern region.

Even though Asia experienced a lower domestic meat consumption during the COVID-19 lockdown for a few months in 2020, which resulted in a slight decrease in livestock and feed production, overall, feed production in Thailand increased by approximately 4% by the end of the year. The export of chicken to Japan, England and the EU was a main factor in the 1% increase of broiler feed production. The growth of aqua and pet feed production was also another factor in the increase of feed production in Thailand. While pig and pig feed production decreased by around 4.5% due to the ASF situation in neighboring countries, Thailand’s COVID-19 measures forced swine farms to slow down their pig production, and consumers consumed less pork.

COVID-19 impacted the animal feed industry in India, which saw its feed production decrease by 5%, to 39.3 MMT. Noticeable declines were seen in aquaculture (by 5.65%), dairy (by 5.89%) and broiler feed production (by 8.73%). The lockdown across the Indian states resulted in the disruption of the supply chain, and the movement of animal products halted, with chicken and milk products becoming scarce for many weeks. Later, in the second half of the year, India witnessed the revival of its animal industry, as well as a rise in consumer demand.

Globally, pork production is set to grow faster than any other species in 2021, largely because of the recovery from ASF in China and Vietnam. Poultry is also expected to grow — after COVID-19 restricted the sector’s growth in 2020 — based on improvements in foodservice. After disruptions due to COVID-19 in 2020, aquaculture is forecast to return to steady growth in 2021. Beef should also return to modest growth in 2021, led by increases in North America, Brazil and even a new significant growth sector in China. Wild-catch seafood is expected to move in the opposite direction, however, with a small decline, due to climatic conditions and reduced quotas.

The recovery from COVID-19 presents both opportunities and risks for the global animal protein industry. Major issues include the recovery of foodservice, labor availability and costs, supply chain transformations and food safety. The global animal protein trade continues to create areas of opportunity and risk as we head into 2021.

China’s ASF rebound,

China is the largest of many areas facing uncertainty in terms of global trade. Restocking will continue, pressuring prices onto a downward track in the country. Improved biosecurity has proven to be effective, particularly on large-scale farms. Aggressive restocking and new farm expansions in 2020 will lead to a strong rebound in pork production in 2021 — with at least 10% year-over-year growth in output. The hog herd will likely recover to around 80% of its pre-ASF level in 2021.

According to the data from November 2020, production capacity has recovered to 90% of its 2017 statistics, and the number of live pigs has reached 396 million.

The industry is in recovery mode, with faster-growing production and a movement toward larger-scale pig farming. The largest integrators in China are expected to reach 120 million pigs in 2021. Investments will continue to flow into pig farming, driven by lucrative profits in 2020 and strong government support.

The swine market in China rebounded faster in 2020 than anyone could have expected. The third-quarter sow numbers totaled more than 38 million sows — almost a 30% increase year-over-year, and in line with the pre-ASF 2018 numbers. This is a result of the restructuring of the industry. Backyard contract farms have widely been replaced with modern facilities. Large pig producers have taken an intensive, multi-story, high-density approach, whereas others have taken more traditional approaches that still, for China, are very technologically advanced.

The reduction in backyard farms has increased the need for modern compound feeds. Waste that was previously fed to pigs is no longer an acceptable feedstock. The price of pork is CNY34 (US$5.28) per kilogram, and this has attracted major investment. The government has approved a record number of production licenses. However, the profit spread at the moment is narrowing due to the increased prices of raw materials — namely, corn and soy. The per-capita pork demand has also declined to around 30 kilograms per person, which is down 11 kilograms from the peak in 2016. Will these factors affect China as an attractive export destination for overseas pork?

Efficiencies in the sector are low by international standards, with the number of pigs per sow per year averaging 19. How will this change in light of the fact that breeding sows have largely come from commercial three-way crosses, rather than from pure genetics? This has implications for the feed conversion ratio (FCR) and pigs per sow per year (PSY), as well as overall efficiencies.

Pork imports are expected to decline in 2021, after reaching a record high in 2020. The demand for imports in 2021 will be weaker than in 2020. While still a deficit relative to historic consumption, the market expects this to result in a 20%–30% drop in pork imports, or about 1 MMT, in 2021. Given the slower projected import demand in the coming years, as most economies are facing less robust growth in the interim, this may leave more sizable volumes on the domestic market. This is likely to translate into weaker product pricing and lower hog values.

In the poultry sector, China’s prices improved slightly in the second half of 2020 as the world market demand for poultry steadily recovered, but the growth rate was still lower than expected. Supply will continue to increase in 2021, and the market will continue to adjust. The production of China’s high-yield layers reached around 22 million tons in 2020 and increased by around 15% compared with the same period in 2019.

Changing Asia consumers

A digital business transformation in agricultural integration is underway in Asia. Digitalization and investment in storage and logistics are creating a paradigm shift in the food supply chain. Large e-commerce platforms will drive industry consolidation to create super platforms. As many of us have personally experienced, COVID-19 has changed many people’s working styles and lifestyles, with more people working from home. Connecting with clients virtually has been widely adopted, and events, conferences and networking have moved to online platforms.

A major trend in Asia has been the influence and power of the consumer, especially online consumers. COVID-19 caused a huge shift, as Asian consumers began to spend more money and time on their health and cooking at home. Seventy percent of online shoppers in China bought fresh groceries online more than two times per week in 2020. This is a massive change from the wet market. Online grocery shopping is expected to grow at a compounded annual growth rate of 29% over the next five years and will represent a US$298 billion market by 2025. What implications does this have for traceability, production and the cold chain in the new online segment?

The values of Asian consumers have also been positively shifting to focus more on sustainability, health and the joy of life. Consumers are not only choosing good-quality products, but they are also looking at the value of the brand. Multi-livestream selling — such as Pinduoduo, linking food producers direct to consumers — has allowed them to access food more widely and rapidly at a good price.

COVID-19 has led to many changes and disruptions globally over the past year. The drive for efficiencies in production and diseases remains a concern, but demographic trends and the new consumer power in online retailing represent a wealth of opportunities.