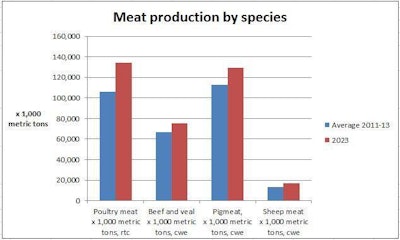

Over the coming decade, global meat production is projected to rise by 1.6 percent per year, slower than the 2.3 percent per year growth rate seen over the last 10 years. Driven largely by demand preferences, poultry will become the largest meat sector. Of the additional 57.7 million metric tons of meat production in 2023, poultry meat will account for 28.3 million metric tons, overtaking pig meat’s share of 16.7 million metric tons.

Global poultry production in 2014 is estimated to be 109.97 million metric tons, and it is forecast to reach 134.51 million metric tons by 2023. Most of the growth over the outlook period will come from the major producing countries of China, U.S., Brazil and Russia, where growth of 28 percent is forecast. China will contribute an extra 15.3 million metric tons to the world’s total poultry meat production, followed by the U.S. at 6 million metric tons and 4.5 million metric tons from Brazil. Of all other major producers, the countries experiencing the most rapid growth are Argentina (30 percent), Indonesia (47 percent) and Vietnam (39 percent), according to the Food and Agriculture Organization (FAO).

In contrast to developing regions, slower output growth can be expected for meat producers in the OECD region.

In the U.S., the value of poultry production has increased from $21.2 billion in 2000 to 44.1 billion in 2013 – an increase of 108 percent, according to a report produced by professor Hans-Wilhelm Windhorst of the International Egg Commission (IEC). A report from U.S. Department of Agriculture (USDA) shows further processed products account for nearly half of the country’s production, while the rest is comprised mainly of cut-up parts and a small share of whole birds.

The forecast for broiler meat production in the U.S. for the second half of 2014 and 2015 reveals slower growth than in previous years. On projections of lower grain prices and a decline in the volume of other meats available, USDA expected broiler integrators would expand production. However, after producing 15.6 billion pounds of broiler meat in the first half of 2014, the forecast for production in the second half of the year is less than 1 percent higher than the previous year at 19.4 billion pounds. Nonetheless, year-over-year broiler meat production in the U.S. is still projected to be higher, offset by a stronger export market and recovering economy. Year over year, U.S. turkey production has also decreased, a trend that is expected to continue on account of declines in poults placed for growout.

Latin America’s role

In 2013, Brazil and Mexico maintained their place as the third- and fifth-largest chicken producing countries in the world. The data shows an estimated 5,608 million chickens were produced in Brazil, while 1,472 million chickens were produced in Mexico.

After falling since 2011, Brazil’s chicken production volume is forecast to rise in 2014 to some 12.68 million metric tons. Here, more than half (53 percent) of production is done by three large companies: Brasil Foods, JBS and Aurora. By 2021, it is forecast there will be 22 percent more chicken in the world, and Brazil will help in achieving this growth thanks to its arable land and water availability and continued economic growth.

Mexico, where production has risen or remained stagnant since 2010, is forecast to produce some 2.98 million metric tons of chicken in 2014, up from the 2.907-million-metric-ton output in 2013. Like in Brazil, the majority (66 percent) of the country’s volume will come from three companies: Bachoco, Pilgrim’s and San Antonio. Mexico consumers generally prefer fresh chicken, killed the day before it is sold. Thus, a majority of chicken in Mexico is produced live.