While uncertainty defined global dairy production for much of 2019, stability may be on the horizon in 2020.

Though the global dairy industry has faced significant challenges in 2019, the outlook for 2020 is relatively bright, at least according to the dairy and feed industry stakeholders interviewed for Feed Strategy’s 2020 Dairy Outlook report.

The following aims to identify the macro trends and conditions impacting dairy production — and in turn, dairy cattle feed volumes over the next 12 months and beyond.

Dairy consumption trends

The consensus is that, globally, consumers are drinking less milk, but the demand for dairy products overall remains high.

“Per capita consumption of milk in all forms, like cheese, yogurt and butter, is still going up when converted back to raw milk equivalents — and that’s a good thing for producers,” reports Ben Laine, dairy analyst with Rabo AgriFinance, a U.S. subsidiary of Rabobank.

In 2018, the global dairy industry increased milk production by 2.2%, totaling 843 million tons (FAO), and saw sales over US$500 billion, according to Euromonitor International.

A growing global population will likely support the market for high-quality dietary protein, including milk and dairy products. However, to achieve sustainable growth, much of this demand will have to come from developing countries, where populations and incomes are on the rise.

Over the next five years, the global dairy market is expected to experience a 5% compounded annual growth rate (CAGR), reaching a value of US$703.5 billion, according to Mordor Intelligence.

Plant-based alternatives claim market

As plant-based dairy alternatives continue to gain popularity and market share, traditional dairy will continue to struggle to maintain its position.

According to Grand View Research, the global dairy alternative market is expected to reach US$41.06 billion by 2025, growing at a 16.7% CAGR.

Today, in the U.S.for example, plant-based dairy alternatives account for more than 13% of total retail milk sales, worth US$1.86 billion, the Good Food Institute reports. According to its 2019 study conducted by Nielsen, other dairy alternative categories such as plant-based creamer (+62%), yogurt (+54%), cheese (+41%) and ice cream (+40%) also saw significant growth from April 2018 to 2019.

Much of the popularity of plant-based alternatives is rooted in the belief that they are “healthier” and “more environmentally friendly” than traditional dairy products.

“Price, taste and convenience are now supplemented by new [consumer] concerns, such as health, sustainability and social impact,” says Constantin Sebastien, Pancosma’s bioactives product manager.

Interest in animal welfare and “foodism” also threaten to further decrease milk and dairy product consumption in the future, says Jerry McDowell, Zinpro Corporation district manager, citing popular diets requiring the elimination of dairy.

In turn, the rise of plant-based dairy alternatives have spurred innovation and the development of niche products in the dairy industry to garner higher milk prices, such as high-protein, ultra-filtered milk, the development of the “clean label” and lactose-free products, like A2 milk, notes Ben Towns, global business director, Arm & Hammer Animal and Food Production.

Impact of trade uncertainty

Trade disputes have — and will continue to — influence global dairy markets.

“Any individual tariff or dispute doesn’t occur in a vacuum, and the effects are rarely limited to its intended aim,” Laine explains. “Instead, it tends to lead to a reshuffling of trade partners, some markets closing and a search for other opportunities, other voids that need filling. The net result is higher transaction costs, more market uncertainty and greater volatility. There is also the risk of a global economic downturn, which could have an impact on the demand for dairy products.”

This has stalled the dairy industry’s long-term decision making and its ability to manage risk.

“Global trade in dairy has been growing, and the various trade disputes have had a major impact that will be felt for years,” Laine says. “There are winners and losers in many of these disputes, which put up barriers for some and open opportunities for others. But in general, they have added friction to the process of moving dairy products around the world. Ultimately, that pressure makes its way back to the producer.”

U.S.dairy exports, for example, have been greatly impacted by unsettled geopolitical issues.

“In the first half of 2019, U.S.shipments were down 14% compared to the first half of 2018,” Blaine Blackburn, commercial director – dairy, Provimi, Cargill Premix & Nutrition, reports. “This is driven, in part, by retaliatory Chinese tariffs, reductions in Asian whey exports due to African swine fever(ASF)and uncertain dairy exports to Mexico given that the USMCA agreement has not been ratified.”

As a result, he suspects 2019 global milk production to be flat.

The global dairy industry increased milk production by 2.2%, totaling 843 million tons in 2018. (dolgachov | Bigstock.com)

The global dairy industry increased milk production by 2.2%, totaling 843 million tons in 2018. (dolgachov | Bigstock.com)2019 dairy feed production trends

The outlook for global dairy feed production in 2019 will vary by region — largely due to erratic weather patterns. Regional markets have dealt with the extremes of drought and flood but, overall, feed costs and volumes are expected to remain low.

“Feed production has been flat across most of the major exporting regions, including the U.S., first because of price signals and margin pressure; and second, because of heat and other weather challenges,” Laine reports.

Forage quality, cost and supply will remain a major concern across multiple regions.

“Farmers who raise their own feedstuffs may end up purchasing more feed in 2020 if their own crop acreage was affected by poor weather in 2019,” Towns says.

Despite flooding during the planting season, the USDA Global Feed Outlook’s corn crop projections suggest yield increases, high levels of grain production in Ukraine and decreased import demand from China due to ASF. These factors should have a favorable impact on global corn prices for dairy producers.

“With the continued trade disputes and lack of market for U.S.soybeans especially, cheap concentrates and ingredients are readily available,” says Jessica Tekippe, R&D and technical services manager, Ajinomoto Animal Nutrition NA Inc.

Looking forward, feed costs are not expected to increase in 2020, but that will depend on the results at harvest.

“Although dairy prices are rebounding a bit, we’ll be watching the price of inputs closely regarding the availability and quality of forage and how that will impact margins,” says Jenny Mills, strategic marketing – dairy, Provimi, Cargill Premix & Nutrition.

2020 dairy, dairy feed production outlook

Overall, the global dairy industry should be “cautiously optimistic” going into 2020.

The global demand for dairy products is expected to increase by 2.5% to 2020, Sebastien reports. However, overproduction continues to loom as an evergreen issue.

“There will likely be a seasonal dip in price in the first half of 2020, but generally still at the upper end of the range of prices we’ve seen since 2015,” Laine predicts. “We expect any production increases in the first half of 2020 to be modest at best. If global milk production were to ramp up more rapidly than expected, we could see more downward pressure on global prices.”

Tekippe also believes milk prices will remain stable through the first half of 2020, but this may spur herd size increases, which would lead to price issues in the second half of the year.

As for feed production, Sebastien suspects volumes will continue on an upward trend, growing by 3% in 2019 and 2020.

References available upon request.

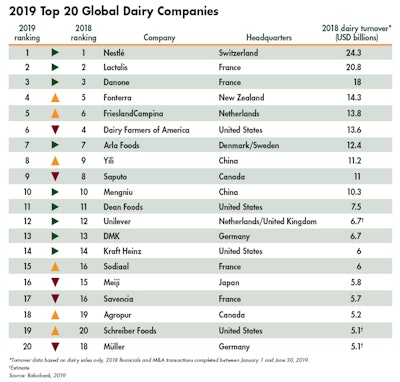

Rabobank reports a 2.5% increase in revenue across the world’s top 20 dairy companies in 2019. (Rabobank, 2019)

Rabobank reports a 2.5% increase in revenue across the world’s top 20 dairy companies in 2019. (Rabobank, 2019)US dairy industry macro trends

In addition to weather woes and trade disputes, several other trends are impacting the U.S.dairy industry.

Shortage of reliable labor

Immigration laws have hampered the ability of dairies to hire immigrant workers, which account for much of the U.S.dairy labor force.

“A reliable workforce is essential for dairies to maintain and expand production,” Towns says. “For U.S.dairy managers,the challenge of finding, training, managing and retaining a quality labor force is a major and ongoing concern. In fact, it’s a challenge we hear about every day in our conversations with customers.”

New policies proposing year-round visas to dairy workers are pending. However, the labor gap is prompting more dairy producers to turn to automation.

Industry consolidation

The dairy industry is consolidating into fewer and larger operations.

Rabobank reports 87 U.S.domestic merger and acquisition deals, 70 cross-continental deals and 39 regional deals over the last 18 months (January 2018 – June 2019).

“Europe dominated the cross-continental deals with a 60% share and also accounted for 40% of the domestic transactions,” according to the institution’s Global Top 20 report.

McDowell notes that access to capital, risk management and production efficiency will push producers to larger, more concentrated operations.

On the downside, Towns notes that processor consolidation has negatively impacted the supply chain by limiting producer’s milk market options.

Digitized dairy: Ag tech sparks big changes for feed’s future