Animal feed producers in Japan enjoy a stable market, but there are few players

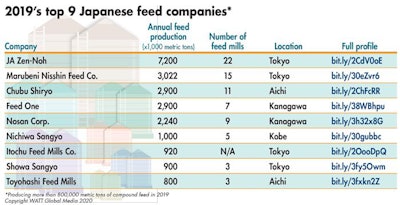

There are nine animal feed producers in Japan that produced more than 800,000 metric tons of compound feed in 2019, accounting for 83% of Japanese complete feed production, according to Feed Strategy’s Top Feed Companies data.

Most of Japan’s animal feed production is for poultry, hogs and cattle, and corn makes up about half of the country’s compound feed production, followed by soybean and rapeseed meals, at 12.5% and 4.5% respectively, according to Zeke Spears, agricultural attaché for the U.S. Department of Agriculture Foreign Agricultural Service/Office of Agricultural Affairs in Tokyo.

“The animal feed market in Japan is stable, reflecting the stability of domestic livestock and poultry production,” he said. “The animal feed import market in Japan is a multibillion-dollar-a-year industry and the United States is the leading supplier.”

Spears said there are relatively few companies involved in animal feed production in Japan, and they “generally have longstanding relationships with their input suppliers and distributors. Exporters looking to break into the feed market in Japan need to be patient and work to build relationships over time.”

There are nine animal feed producers in Japan that manufactured more than 800,000 metric tons of compound feed in 2019.

There are nine animal feed producers in Japan that manufactured more than 800,000 metric tons of compound feed in 2019.According to the Alltech 2020 Global Feed Survey, feed production in the country reached 25.3 million metric tons in 2019.

While Japan has steered clear of African swine fever (ASF), which has ravaged the pork industry in several other Asian countries, the challenge for Japan’s feed producers is in its need to import ingredients.

“A challenge for Japanese feed manufacturers is the limited domestic production and their reliance on imports for key inputs,” Spears said. “However, low tariffs, minimal market access restrictions, and longstanding business relationships with exporters ease many of these concerns. Animal feed manufacturers in Japan have the advantage of a limited competition and an insulated market somewhat protected by geographic, cultural and language barriers.”

The coronavirus (COVID-19) pandemic is expected to give Japan’s overall feed production a slight boost short term, as cattle producers delay bringing their animals to slaughter due to low prices and a projected increase in poultry production to meet household demand, Spears added.