New regulations and increasing consumer pressure have motivated animal protein producers, integrators, feed mills and premix companies to explore new ways to eliminate or reduce antibiotic growth promoters (AGPs). As a result, the interest in phytogenic feed additives (PFAs), or natural plant-based products shown to produce multiple positive physiological effects in livestock, has exponentially increased.

To date, the size of the market has surpassed $500 million in sales, and animal nutrition companies selling PFAs report 20 percent year-over-year growth. PFAs are applied to 5 percent of global livestock feed tonnage, but PFA suppliers are preparing to see this number surge.

Animal nutrition company BIOMIN predicts PFA sales will double every five to seven years moving forward.

“Looking at numerous scenarios based on feed production trends, evolving consumer demands, changes in livestock production including antibiotic-free and antibiotic-reduction strategies, and the growing demand for animal protein products, by 2030 we can expect the PFA market to total between $1.7 billion and $2 billion in annual turnover,” said Michael Noonan, BIOMIN’s global product manager of phytogenics.

As the market nears the brink of a major boom, a few speculative questions must be asked: Who uses PFAs? Are there regional disparities? Why wouldn’t a producer explore the use of PFAs? And what do livestock producers ultimately hope PFAs will achieve?

Survey respondent breakout

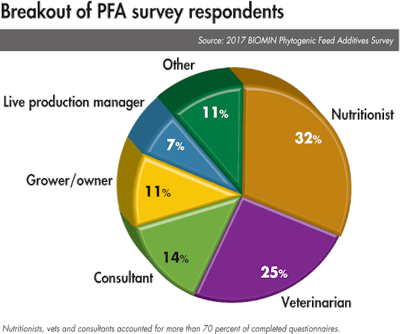

In late 2016, the 2017 BIOMIN Phytogenic Feed Additives Survey set out to gauge the perceptions and experiences of stakeholder groups feeding, formulating and manufacturing livestock feed. Nearly 1,200 nutritionists, growers, veterinarians and consultants spanning multiple species in more than 100 countries offered their feedback.

Fifty-one percent of survey respondents use PFAs in their animal feed formulations; 33 percent have never used PFAs; and 16 percent report having used PFAs in the past, but are not currently using them. Nutritionists accounted for one-third of respondents with past PFA experience, followed by veterinarians (27 percent) and consultants (20 percent).

European respondents were the most likely (57 percent) to utilize PFAs, while respondents in Latin America proved the least likely to utilize PFAs.

Perceived benefits of phytogenic feed additives

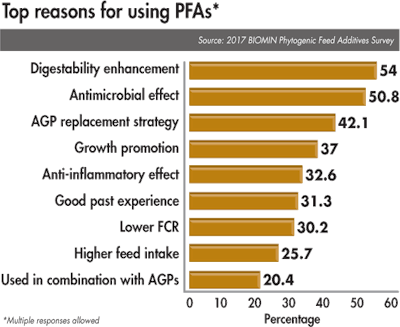

Enhanced digestibility was the primary benefit of phytogenic feed additives. Perceived antimicrobial effects and the replacement of AGPs ranked in the No. 2 and No. 3 slots, respectively.

These results told a much more interesting story when dissected by geography and job title:

- Though improved digestibility ranked highest (15 to 20 percent) with livestock producers and nutritionists, feed manufacturers were least likely to rank it as a crucial benefit.

- In North and South America, antimicrobial effects were a key motivator for utilizing PFAs.

- Twenty percent of respondents use PFAs to replace AGPs.

- High feed intake was most important to piglet and broiler producers in Asia and Europe.

- Broiler and grower-finisher producers were the main group using PFAs for growth promotion.

- Feed manufacturers, breeders and egg/meat producers were most likely to use PFAs for anti-inflammatory effects; integrators and grower-finishers were the least likely.

- A lower feed conversion ratio was cited as a major reason to use PFAs in the Middle East and South America.

In Noonan’s opinion, many factors contribute to the local differences surrounding the advantages of PFA use.

“Consumer awareness of antibiotics can vary from one country to another over time. In some markets it’s been discussed for 20 years or more, while elsewhere it’s a fairly recent topic,” he said. “Likewise, relevant regulations – including AGP bans – have been adopted over several decades and appear to be gaining momentum. There is now a much more scientific focus on phytogenics in Europe most likely tied to the 2006 AGP ban and ongoing search for natural alternatives to antibiotic growth promoters.”

Gauging industry views, applications

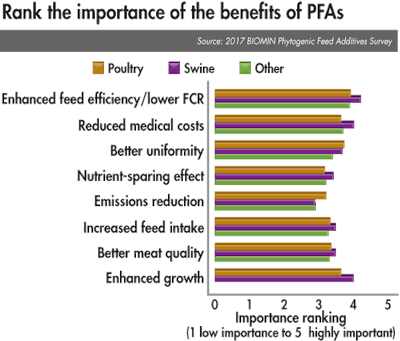

Respondents were also asked to rank the importance of PFA benefits on animal production. For poultry, swine and feed professionals, a lower feed conversion ratio and enhanced feed efficiency were identified as the most important benefits of PFAs. Reduced medical costs came in second for the swine and feed groups, while uniformity ranked highest among poultry producers.

The remaining of the PFA benefits (meat quality, growth enhancement, nutrient-sparing effects) were perceived to have equal importance with the exception of emission reduction, which was the least important to swine and feed respondents.

Enhanced feed efficiency and lower FCR was identified as the most important PFA benefit to all groups of respondents. Emission reduction ranked the lowest.

Of the respondents using PFAs, 65 percent report using more than two different products; 30 percent use one; and 5 percent utilize more than five.

Taking a closer look by region, 70 percent of European, American and Canadian respondents integrate two to five PFA products into their animal feed formulations; 20 percent of American and Canadian respondents incorporate more than five phytogenic products into their feeding programs. In contrast, Asian participants tend to stick with one product.

Objections to PFA use

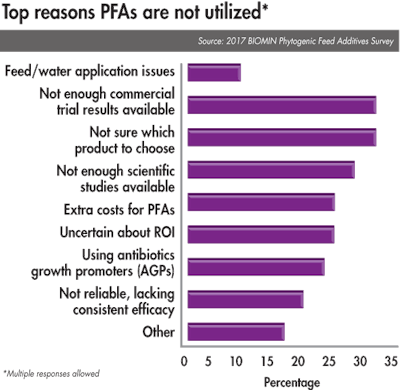

According to survey respondents, the top two reasons for not using phytogenic feed additives is the uncertainty of which product to choose and a perceived lack of sufficient commercial trial data.

Twenty percent of respondents report that a lack of commercial trial data and uncertainty regarding which product to choose prevent them from integrating PFAs into their livestock feed.

More so than in any other region, European PFA adoption was hindered by their inability to choose between the PFA products on the market. The difficulty of product selection was the most frequent choice among growers, owners and live production managers.

Fourteen percent of respondents do not utilize PFAs because they feel there is a lack of scientific research; these respondents tended to be from Asia, Europe, United States and Canada. The lack of commercial trial results was a prevalent objection among Asian, African and Middle Eastern respondents.

“Our understanding of phytogenics has progressed a great deal over the past three decades,” Noonan said, citing the company’s more than 300 commercial trials and 20 co-authored scientific papers in 2016. “The vast array of different plant-based compounds and substances means that there is plenty left to discover. I would highlight the experience of early adopters — livestock producers who have used PFAs successfully for many years.”

U.S. and Canada respondents cited questions about the return on investment of PFAs as their primary objection.

Noonan feels these customers should be open minded to the effectiveness of phytogenics and the value they can add to a business.

Meanwhile, respondents who have chosen to stick with AGPs rather than explore the benefits of PFAs were located in Asia and South America.

“Communication and education are the backbone of our effort to engage the industry,” Noonan said. “We see this PFA survey as an effective tool to gauge the clients’ perceptions and address their specific situations. We will repeat the exercise in order to track changes in market sentiment and continue the dialogue going forward.”