Content

The adjusting entry to record this $250 shrinkage is a debit to Cost of Goods Sold and a credit to Merchandise Inventory for $250. Sales Discounts is a contra revenue account, meaning the Sales Discounts account is deducted from the Sales account when computing net sales. Management monitors Sales Discounts to assess the effectiveness and cost of its discount policy. Z-Mart completes a credit sale for $1,000 on November 12 with terms of 2/10, n/45. The entry to record the revenue part of this sale is to debit Accounts Receivable and credit Cash for $1,000.

Merchandise return controls require that there be a separation of duties between the employee approving the return and the person recording the return of merchandise in the accounting records. Basically, the person performing the return should not be the person recording the event in the accounting records. This is called separation of duties and is just one example of an internal control that should be used when merchandise is returned. It is possible to show these entries as one, since they affect the same accounts and were requested at the same time. From a manager’s standpoint, though, it may be better to record these as separate transactions to better understand the specific reasons for the reduction to inventory and restocking needs.

Types of Financial Statements

Ideally, the cycle should be kept as short as possible, so that the cash requirements of the business are reduced. Describe merchandising activities and identify income components for a merchandising company. Name the accounts debited and credited for each of the following transactions. Reports the following balance sheet accounts as of December 31. 16 Merchandise is returned to the Dollar Store from the November 13 transaction.

- An instructor can choose to cover either one or both inventory systems.

- If a company is a reseller, then the operating cycle does not include any time for production – it is simply the date from the initial cash outlay to the date of cash receipt from the customer.

- As previously mentioned, a sale is usually considered a transaction between a merchandiser or retailer and a customer.

- If cash is received on November 12 within the discount period, company will record the third entries shown.

- The use of internal controls is a protective action the company undertakes, with the assistance of professional accountants, to ensure that fictitious returns do not occur.

- 8 Macy discovers that 150 units are scuffed but are still of use and, therefore, keeps the units.

Nike’s current ratio suggests it has more than enough current assets to cover current liabilities. Analysts might argue that Nike could invest some current assets in more productive assets. This slide shows the current asset section of Z-Mart’s classified balance sheet.

Service Company Operations

It differs from the current ratio by excluding less liquid current assets such as inventory and prepaid expenses that take longer to be converted to cash. The acid-test ratio, also called quick ratio, is defined as quick assets (cash, short-term investments, and current receivables) divided by current liabilities. Many sales discounts the operating cycle of a merchandiser is are favorable to the buyer, and many buyers will take advantage of them. New revenue recognition rules require that sellers report sales net of expected sales discounts. If Z-Mart pays the amount due on November 12, the entry is a debit for the entire Accounts Payable of $500 which is paid off with a cash payment of $490.

VM is the art of implementing effective design ideas to increase store traffic and volume of sales. Creating an attractive product display can draw customer in, promote a slow moving item, announce a sale, or welcome a season. Merchandisers make sure that the product you like price is within your budget, colour of your choice and the store has a stock of the particular product. At Tesco’s merchandisers are really important people.

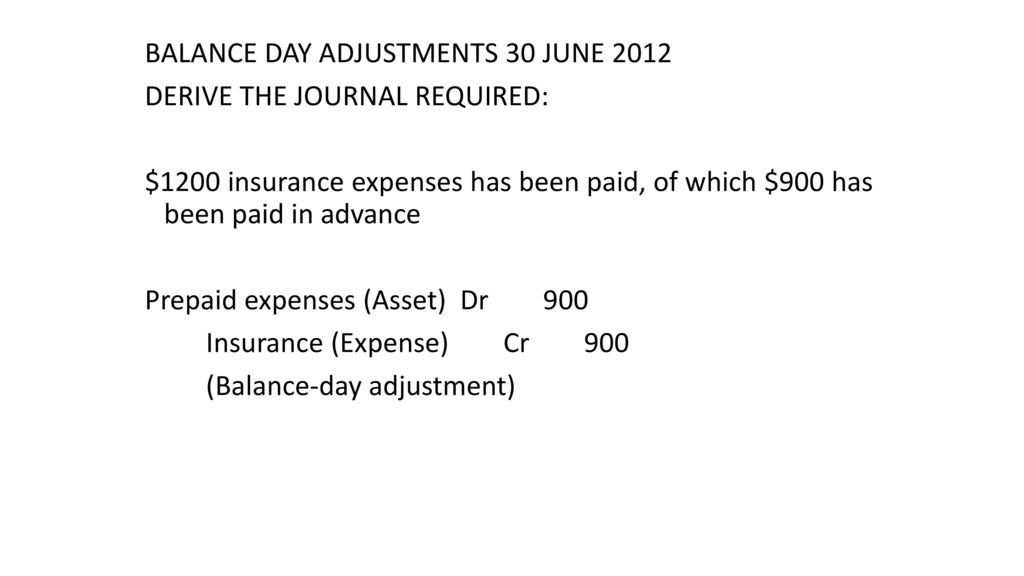

Purpose of Adjusting Entries in a General Ledger

The operating cycle is also known as the cash-to-cash cycle, the net operating cycle, and the cash conversion cycle. The order fulfillment policy, since a higher assumed initial fulfillment rate increases the amount of inventory on hand, which increases the operating cycle. The following list includes temporary accounts from the December 31 adjusted trial balance of Emiko Co.

By contrast, service businesses’ assets tend to be weighted toward accounts receivable. For a service business, the absence of inventory means receivables are a greater proportion of total assets. Exhibit 5.3 illustrates an operating cycle for a merchandiser with credit sales.

Horngren’S Financial And Managerial Accounting

A visual merchandiser sets the store and its merchandise in such way as to reflect the image a store wants to reflect. VM is the way in which to display goods for sale in the most attractive manner with the end purpose of making a sale. It is important to understand that visual merchandiser is not there to impose ideas but to help clients articulate their own personal style.

Is the operating cycle of a merchandiser longer than a service company?

The operating cycle of a merchandising company ordinarily is longer than that of a service company. The purchase of merchandise inventory and its eventual sale lengthen the cycle.

If cash is received on November 12 within the discount period, company will record the third entries shown. A company sells merchandise on November 2 at a $500 invoice price ($490 net) with terms of 2∕10, n∕30. Its November 2 entries under the gross and net methods are shown in the first two entries. A company purchases merchandise on November 2 at a $500 invoice price ($490 net) with terms of 2∕10, n∕30.

They can also choose to bill the customer by the service provided, by the hour or by a billing scheme of their own. The second entries shown illustrate if the invoice is paid on November 12 within the discount period. Allowance for Sales Discounts is a contra asset account and is reported on the balance sheet as a reduction to the Accounts Receivable asset account.

- 9 Purchased merchandise inventory on account from Tucker Wholesalers, $6,000.

- The seller records this allowance as shown in entry f.

- This entry records the receivable and the revenue as if the customer will pay the full amount.

- A customer received an allowance in transaction f of $10 cash; only the revenue side is impacted as no inventory was returned and cost stays the same.

- However, service companies can often expect to wait several weeks or months between the time they invoice the customer and the time they receive payment.