SD Guthrie International Ltd. (SDGI), formerly known as Sime Darby Oils International Ltd., has acquired a 48% equity interest in Netherlands-based Marvesa Supply Chain Services B.V. (Marvesa). The EUR54 million (US$55.7 million) acquisition enhances SDGI’s capabilities in supplying oils and fats to the strategic European animal feed and biofuel industries.

The 48% stake was purchased from Parcom, a Dutch private equity firm. The remaining 52% stake is held by BGR Beheer B.V., which is owned by the executive management of Marvesa.

SDGI is a wholly owned subsidiary and the downstream arm of SD Guthrie Berhad (SD Guthrie), formerly known as Sime Darby Plantation Berhad. SD Guthrie is one of the world’s largest producers of certified sustainable palm oil (CSPO), producing about 12% of all CSPO in the world. It is a fully integrated player in the global palm oil value chain with business presence in 12 countries.

Marvesa is a well-established name in the European market, specializing in the sourcing, blending and distribution of oils and fats to the animal feed and biofuel industries. Its diverse customer base, comprising traders, distributors and multinational feed producers, make it a key partner in the region.

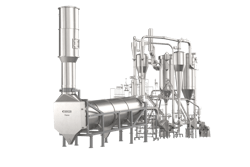

The Marvesa acquisition strengthens SDGI’s presence in Europe, where it serves customers in 11 countries from its Zwijndrecht refinery in the Netherlands, which has a capacity of 450,000 metric tons annually. The refinery produces a variety of oils and fats that are essential for applications such as industrial frying, emulsifiers, bakery and confectionery ingredients, margarines, dairy products, candles and milk substitutes, catering to evolving market needs.

“This acquisition positions us for long-term success across emerging markets,” said Dr. Shariman Alwani, SDGI’s CEO. “To stay ahead of market demands and regulatory changes, it is crucial that we work together with strong, like-minded partners. Our position in Europe is now stronger and we will be able to build more robust relationships.”

Marvesa’s established trading volumes in lecithin, soy and other soft oils align with SDGI’s diversification strategy into non-palm sectors. This allows both companies to penetrate high-growth opportunities, including in North and Central Asia Pacific, the Middle East and Africa, and the Americas. Marvesa already has a presence in Indonesia and is well positioned for growth in the Southeast Asia region that is experiencing high demand for animal feed ingredients.

“As shareholders in Marvesa, we are deeply invested in its growth and long-term success. This partnership with SDGI is a testament to the strength of our business and our shared vision for sustainable value creation. Together, we are well positioned to drive growth and deliver exceptional value to our customers across Europe and beyond.” said Bart de Bruycker, CEO of Marvesa.

The acquisition aligns with SDGI’s long-term strategy to integrate its value chain and expanding its footprint in key markets.