The week of the 2016 Biomin Nutrition Forum, Tyson Foods announced its investment in a 5 percent stake in plant-based protein startup, Beyond Meat, the manufacturer of the Beyond Burger meatless patty. Coincidentally, the event’s presentation, “Driving the Protein Economy: Unprecedented Challenges and Opportunity,” by Dr. David Hughes, professor at the Imperial College London, addressed the very real threat plant-based protein alternatives pose to animal agriculture.

Beef, for example, has long been “the bullseye of the target for many campaigners” and the effort has successfully resulted in the decline of beef consumption due to negative PR surrounding food safety, environmental concerns and health risks (cancer, cholesterol, etc.). This sentiment created a significant opportunity for Beyond Meat to raise $180 million to develop the Beyond Burger, with backers such as General Mills, the Humane Society of America and Bill Gates.

Additional examples of animal product companies dipping in to meatless territory in 2016:

- Unilever: After originally planning to sue “Just Mayo” purveyor Hampton Creek, the parent company of Hellmann’s mayonnaise decided to get into the eggless mayo game instead.

- Danone: The French dairy giant purchased non-dairy dairy business WhiteWave.

Why are investors clamoring to get on the protein-alternative bandwagon? Is it a bellwether of things to come? The answer is yes, with hopes to profit from evolving consumer behavior and an aim to stay in touch with upcoming innovations in food science.

Hughes identified the trends that will allow plant-based foods to gain market share:

- Most consumers purchase food based the cuisine they are in the mood for rather than the protein (“Let’s have Chinese” vs. “Beef, it’s what’s for dinner”).

- Millennials don’t eat three meals a day, choose convenience and are willing to pay a premium for specialty products.

- In general, older consumers eat less meat.

- The “green bar” is rising: Health and sustainability attributes are as important as taste.

- Meat-free products, such as “fishless tuna,” are already merchandised next to animal proteins.

- “Flexitarian diets” are based on taste and options.

Hughes urges the animal ag industry not to underestimate the major forces with a vested interest in reducing animal protein consumption.

“Plant-based proteins are going to have a big day and be a big competitor for [animal proteins],” Hughes says. “They’re targeting our competitive space.”

However, it’s not all doom and gloom. Hughes agrees with Rabobank’s prediction that meat and egg consumption will grow 45 percent by 2030, but earnestly asserts that alternative proteins will prove an obstacle to this trajectory.

The plant-based and beef burger patties have very similar nutritional attributes, such as fat and protein. | Jackie Roembke

Beyond Burger vs. a beef patty: A taste test

Trade publishing offers few opportunities for investigative journalism so, upon hearing of the Beyond Burger, I jumped at the chance weigh in.

Full disclosure, I was already familiar with the Beyond Meat brand because I rather enjoy its faux chorizo; however, the Beyond Burger was not available in Wisconsin. Patties are only being sold at Whole Foods in select states. So I got creative and reached out to Beyond Meat’s public relations team to request a special delivery to the upper Midwest; they graciously obliged.

The Beyond Burger patty (left) clearly differs in size, color, texture and smell from its meaty opponent. | Jackie Roembke

At first glance, the patties resemble hamburger meat, but once you get a whiff, you know you’re not dealing with beef. The faux burgers have a distinct leguminous fragrance, much like kidney or refried beans; the texture is lumpy and fibrous.

For the experiment, I used a 4 oz. 80/20 ground beef patty — the closest beef product in terms of total fat (beef, 23 grams vs. Beyond Burger, 22 grams) and protein (beef, 19 grams vs. Beyond Burger, 20 grams).

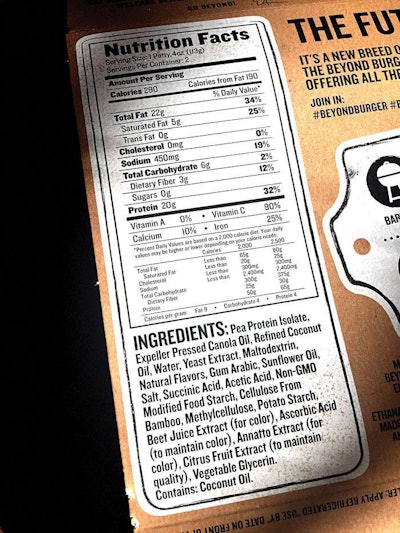

Many of the nutrition facts are comparable to 80/20 beef patties with the exception of the vitamin, carbohydrate and saturated fat content. | Jackie Roembke

The Beyond Burger patty is comprised of pea protein, oils and various natural binders and preservatives. One patty is 290 calories, 22 grams of total fat, 20 grams of protein and six grams of carbohydrates.

When cooked, the Beyond Burger sizzled and “bleeds” (no worries, it's beet juice) much like beef. However, much less fat is expelled, there is little shrink and, of course, the smell is unique. Beyond Burgers are to be cooked to medium (overcook it and you kill it); 3 minutes of heat on each side. The patty forms a crispy outer crust which I find quite appealing.

Health- and environmentally conscious “flexitarian” millenials may be quick on the Beyond Burger uptake. | Jackie Roembke

Having dabbled in faux meats before, I’d say the Beyond Meat patties taste a lot like its competitor, the Boca Burger, but it's more like a crunchy, chewy, fattier cousin.

Once cooked, they look very similar. | Jackie Roembke

So, what did I think?

The Beyond Burger is not a substitute for beef, but a firm alternative to animal-based products. In my millennial opinion, the real strength of the Beyond Burger is its comparable nutrition value and its impressive shelf life (upwards of three months). They may also appeal to folks on low-carb diets that may be looking for a little variety in their protein consumption.

Meanwhile, I think the “easy-on-the-environment” spin will resonate with its target audience as well as the other characteristics it’s touting: GMO free, soy free and gluten free (also known as the holy trinity of “clean eating”).

Because I did not pay for my faux patties, I had to do a little research to find out the retail price. According to an Indian School Plaza Whole Foods clerk in Albuquerque, New Mexico, the two-patty pack retails for $5.99. So, at the moment, ground beef is cheaper.

Tyson is wise to get in on the faux meat business because there certainly is a growing market for it among a certain type of consumer — one who is happy to pay a premium for their protein.

In conclusion, I would eat a Beyond Burger again but, for now, where’s the beef?

Biomin's 2016 World Nutrition Forum was held in Vancouver, BC, October 12-14.