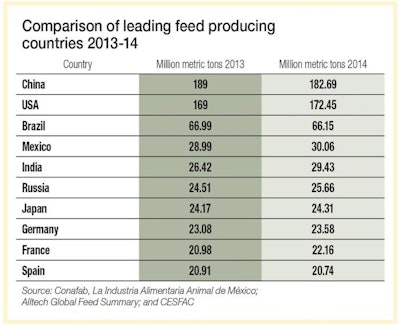

In 2014, global feed production was 980 million metric tons, representing an increase of 1.8 percent compared to 2013. Of the five largest feed-producing countries around the world, only the United States and Mexico recorded growth, while China and Brazil showed slight decreases in production.

With 30 million metric tons of feed produced in Mexico during 2014, the country is the fourth-largest producer (Table 1).

Mexico continues to rank as the fourth largest feed producing country in in the world.

Feed production in Mexico

Antonio Pedroza, president of Conafab (the National Feed Manufacturers Council of Mexico), says, "It is difficult for any analysis to find the factors explaining how in a few months we went from very high expectations of development in Mexico, to another situation where there is insufficient economic growth."

During 2014, the decline in growth expectations were gradually undermining the morale and certainty in many economic sectors. However, various sectors performed favorably, getting out of the weak growth environment — one of these is feed manufacturing.

During the 2015 Feed Industry Analysis Forum held by Conafab in Cancun, QR, Mexico, Pedroza said that "since 2011 there has been a constant growth, and in 2014, this production growth was of 3.3 percent, an increase not seen for 10 years." He even predicted growth in 2015 of 3.5 percent, with a total volume greater than 31.1 million metric tons, supported mainly due to performance in poultry, swine and a marginal contribution of aquaculture.

Growth factors

It is noteworthy that the growth of production in Mexico is primarily due to organic growth, as there are no exports.

According to Pedroza, there are three vectors that can explain this growth:

1. Population growth, although it is growing at a much lower pace;

2. The higher disposable income of the population, impacting and changing eating habits; and

3. The effect of remittances from Mexican workers in the United States, as it is estimated that 50 percent of them are used for food and mainly to increase consumption of animal protein.

The Mexican feed industry is efficient; Mexico has high technology and with enough room to grow with more than 400 feed mills in the country.

There is another aspect that cannot be measured, but it seems that it is also growing: that is, backyard production. Producers of commercial feed (local and regional) have seen an increase in production above average and as well as sales in this sector.

Poultry feed

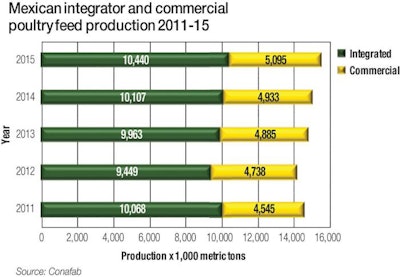

By species, 49.9 percent of Mexican feed was intended for poultry in 2014. Of total feed production, integrated poultry represents 54.3 percent, while in commercial feed production, there is always a greater dispersion of animal species for which feed is intended.

Figure 1 shows production of feed for poultry (both broilers and layers) and what corresponds to integrated producers and commercial feed mills.

In 2015, 67.2 percent of Mexican poultry feed will be produced by the integrated companies and 32.8 percent by commercial feed plants.

Poultry is the most developed livestock subsector – and it looks like integration will strengthen in the medium term. It is expected that 15.53 million metric tons of poultry feed will be produced in 2015; of which 6.45 million (41.5 percent) is feed for laying hens and 9.08 million (58.5 percent) for broilers. Furthermore, of this total amount, 67.2 percent will be produced by the integrated companies and 32.8 percent by commercial feed plants.

Animal health problems in poultry production have not completely disappeared, so that poultry productivity has been affected. However, the increase in the national flock will offset that situation. Thus, higher egg production in 2015 over the previous year is expected. Chicken meat production of 2.1 million metric tons is expected in 2015, representing a growth of approximately 2.5 percent over the previous year.

Raw materials

Domestic production of soybean meal was at 2.95 million metric tons and was obtained from crushing 3.86 million metric tons of soybeans. Domestic consumption of this feedstuff grew by 7.8 percent, to reach 4.4 million metric tons.

Outlook positive

Overall, 2014 was a successful year for livestock production. Conafab estimates that the trend will continue in all subsectors in 2015.

"The industry will continue to grow in Mexico, even against the devaluation of the peso,” Pedroza explains. “The conditions are here: capacity, market, experience and technology. In addition, there are efforts and objectives of exporting and to meet the requirements of potential customers. With a highly dollarized industry like ours, the effects of exchange rate in feed formulation costs are felt immediately. An adverse and permanent exchange rate, even with a well-managed risk, force us to shift the cost to our customers, who in turn will shift it to the final consumer. This will have an undesirable effect on inflation.”

Production in Latin America

Despite the decrease in Brazilian production, the Americas produced 337 million metric tons of feed in 2014, representing an increase of nearly 2 percent over the previous year. Brazil and the United States — which combined produce 70 percent of feeds in the Americas — produced 172.5 and 66.2 million metric tons, respectively, in 2014.

Mexico produces 9 percent of the feeds manufactured in the Americas. It is the third-largest producer of the continent and the second largest in Latin America. Argentina and Colombia produced 11.8 and 6.3 million metric tons, respectively, which set them in the third and fourth positions in Latin America.