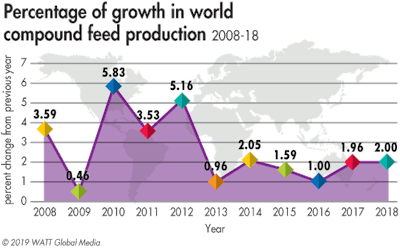

World compound feed production rose 2% in 2018, repeating the 2017 rise. While pig and poultry production suffered downturns due to disease outbreaks in some parts of the world, the overall output of feed for animal consumption continued to rise, but not at the rates seen early in the century.

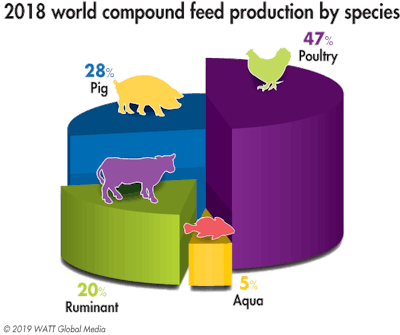

The poultry market – feed for broilers and layers – consumed nearly 47% of world feed production, followed by pig production at 28% and ruminant at 20%.

Poultry production continues to grow

Worldwide poultry production also increased approximately 2%, with the EU and U.S. showing the healthy growth fueled by exports. Brazil was the only major poultry producer to not show growth. In 2019, Brazil is expected to rebound with record growth fueled by stronger exports and economic recovery. The EU is also expected to reach records in poultry output in 2019 fueled by exports and domestic demand.

Beef production worldwide is growing at a slightly slower rate than pork or chicken. The U.S. leads growth in beef production, but most of the growth is seen in export markets such as Japan, South Korea and Mexico.

World pig production up

In 2018, the Asia pig market saw gains, increasing in Vietnam and Philippines for export into China. While China is the world’s largest pork consumer, Chinese pig production has been slowed the past couple of years by disease outbreaks, such as the 2018 outbreak of African swine fever (ASF). Despite China’s losses due to ASF, its 2018 pork production grew 1.4% with more consolidation of pork production in large commercial facilities.

Here, it is important to note that 2019 Chinese pig feed production is projected to experience historic decreases due ASF, the full scope of which remains to be seen.

The European Union and United States saw increased pork production with increased exports. While U.S exports to China were limited by tariffs, increased exports to Mexico picked up the slack. Other major pork producers all saw modest growth in 2018, with the exception of Canada, which was hit with a disease outbreak.

European feed production

According to European Feed Manufacturers’ Federation (FEFAC) members, European feed production grew less than 1% in 2018 to 159.1 million metric tons. Overall poultry feed production increased by 1% in 2018, mostly driven by the development of poultry production in Poland.

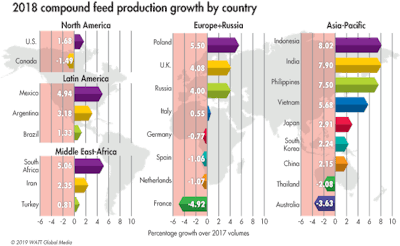

Poland’s compound feed production was up 5.5% in 2018. The United Kingdom increased its production by about 4%, while Spain, the Netherlands and Germany all had drops in production from 1% to 1.5%.

On the pig side, the EU countries reported a 1% decrease in feed production, despite an overall increase in pork production.

FEFAC reports that 34% of 2018 EU compound feed production was for poultry, 31.5% for pig, and 28.5% for cattle feed.

North American output

The United States and Canada showed modest growth in compound feed production in the 2% range.

In the U.S., poultry production is the major consumer of compound feed with broilers accounting for 32% of production and layers 8%. Pork production consumes 27%, followed by dairy at 15% and beef at 15%.

Poultry and pork production rose slightly in 2018 and are projected to rise slightly again in 2019.

Latin America slows

Latin America remained fairly steady as a group, with gains in Argentina and Mexico offset by steep declines in Venezuela, El Salvador and Chile. Brazil, the third largest compound feed producer in the world, showed an increase of only a little over 1%. Brazil’s poultry production saw a drop in exports for the first time in decades.

Restrictions on Brazilian exports to China, the European Union and Saudi Arabia have limited chicken production, hence feed consumption in Brazil. A modest rebound with nearly 2% growth in poultry production is forecast for Brazil in 2019.

Colombia is seeing development of its poultry and pork markets. According to the Colombian Chamber of Animal Feed, in 2019 the poultry industry is expected to grow 5% and the pig sector by 7%. Compound feed production in Colombia grew 8% in 2018.

Asian sources of growth

China showed modest growth of compound feed production of about 2% in 2018. The problems with decreased pork production and demand due to the ASF outbreak have driven demand for poultry up and poultry producers have responded with increased output. Average per capita demand for poultry is expected to grow by nearly 10% in 2019.

India has shown strong growth of more than 8% in feed production, largely driven by growth in dairy, layer and broiler feeds. India’s consumer demand for eggs, meat and milk is rising rapidly with the growing middle class and continued population growth.

Indonesia’s feed industry continues to grow, with the poultry industry consuming 87% of its output. According to the Indonesia Feed Producers Association, there are now 97 feed mills in Indonesia with a capacity of 24.68 million metric tons per year. Feed mills have been running at 80% capacity.

Philippine feed production continues to climb with increased consumer demand for protein. Roughly 60% of the feed production is for pig feed, with poultry at 25% and aquaculture and other feeds 15%.

Thailand has seen slower growth in its poultry industry, and farmers are expected to continue to scale down swine and layer production in 2019 in response to falling domestic prices for pork and eggs caused by shrinking exports to neighboring countries. According to the Thai Feed Mill Association, swine and layer feed demand is expected to respectively decline by 2% and 13% in 2019.

Mideast and Africa face challenges

Increased broiler production in Iran and Saudi Arabia contributed to 2% growth of compound feed production in the region. Turkey increased production by less than 1%, after several years of growth of more than 10%.

In Africa, South Africa remains the leading compound feed producer and increased production by 4% in 2018. South Africa produced 22% of the compound feed in Africa. Egypt, Algeria and Nigeria are the other major feed producers in Africa. Africa and the Mideast account for 7% of the world’s compound feed production. This area also has the fastest growing population in the world and remains an opportunity for protein and feed production in the future.

References available upon request.

Of the top 25 compound feed producing countries, India and Indonesia showed the highest year-to-year growth.

In 2018, the pig and poultry sectors grew in share of world feed production while the ruminant share declined by 2%. Aquafeed production remained steady.

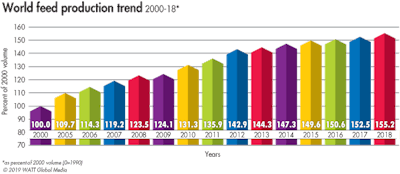

Although the rate of growth has slowed, world compound feed production continues on an upward path.

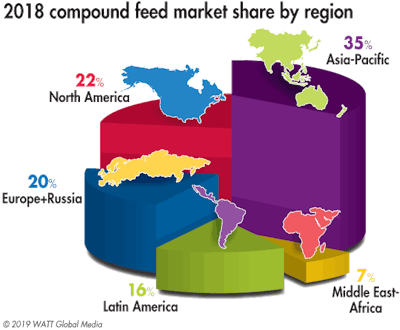

The major Asia-Pacific region produced 35% of world’s compound feed. North America – the U.S. and Canada – produced 22% of the world supply. Europe and Russia produced 20% and Latin America 16%.

Global compound feed manufacturing increased 2% in 2018, driven by continued growth in Asia, but remained flat compared with 2017’s growth percentage.