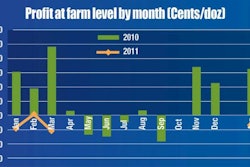

High grain prices resulted in losses for the average U.S. egg producer in the first three months of 2011, according to Maro Ibarburu, business analyst, Egg Industry Center, Iowa State University. Ibarburu’s calculations show the egg industry returned to profitability in April due to demand increase associated with Easter, but the industry had negative returns again in May.

“What concerns me is that winter months are usually profitable and the industry was not profitable this winter,” said Ibarburu. The industry heads into summer, the season when demand for eggs is at its lowest, with costs exceeding egg prices and with no sign of lower grain costs on the horizon.

Grain prices

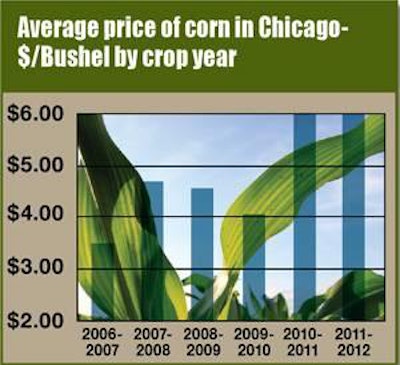

Economists do not think that this fall’s harvest will be large enough to significantly lower corn prices. “We need a record corn crop to build any kind of inventory at all,” said Dr. Thomas Elam, economist, FarmEcon LLC. Unfortunately, Elam and Dr. Paul Aho, international consulting poultry economist, both said that the 92 million acres expected to be planted in corn in the U.S. this year would require an average yield of 166 bushels per acre, which is above the trend line for yield, to give a corn crop large enough to provide increased carryover inventory.

With no increase in the carryover corn inventory expected from this year’s harvest, egg producers will likely see high corn prices through the fall of 2012. “It is possible that corn could average $6 for the entire crop year of 2010-2011 and even for the crop year 2011-2012, a total of 104 weeks,” Aho said. “The likelihood of corn ever again falling to $3 per bushel is only slightly short of impossible.”

Over time, the increased price for corn has drawn acreage away from other crops, but there aren’t many more acres that can be shifted. “We have cut wheat by 20 million acres and sorghum, barley and oats acreage has been halved since 1990,” Elam said. “We have reached the limit on acres that can be shifted to corn. We are not going to get back to $3 or $4 a bushel corn anytime soon.”

“Egg producers should plan on these higher feed costs through at least the summer of 2012. I don’t see any significant relief in sight,” Elam said. “For gosh sake don’t build your business plans on $3 or $4 per bushel corn. We might see $5 corn, but don’t plan on anything lower than that, unless we have another recession and crude oil drops to $50 a barrel. With the Federal Reserve devaluing the dollar around the world I don’t see that as a very strong possibility. So, plan on $5 to $7 per bushel for corn.”

Aho also expects today’s high corn prices to hang around into the future. He said, “I am penciling in $5.50 per bushel as the new normal.”

Both Aho and Elam said that the way of avoiding the “new normal” of around $6 per bushel corn is for Congress to make a major change in the country’s ethanol policies. “The wild card would be a change in the ethanol policy,” Aho said. “There are some rumblings in the senate that the universal support for ethanol is starting to crack.” A coalition of groups opposed to the ethanol subsidies is lobbying Congress to let the subsidy expire at the end of 2011 and there appears to be more support for this effort now than there was when a similar effort failed late in 2010.

Short-term profitability outlook

Given the current grain costs and egg supply, the prospects for profitable egg prices this summer are not good. Based on Egg Industry Center calculations, the average egg producer was unprofitable in four of the first five months this year. Ibarburu said, “We see some signs that there may be a decrease in flock size. The hatch decreased in February and March when compared to last year, I am still concerned that the flock size is going to increase a little bit.”

Egg prices are very inelastic, so small changes in supply have a big impact on price. Ibarburu said that a relatively small reduction in supply could bring the industry back to profitability, even with the high grain prices. He said that any cutbacks in production would likely result from producers culling some flocks a few weeks earlier than originally planned.

Long-term impact of high grain prices

“When the recession started I thought we would see a decline in beef and pork consumption and an increase in chicken and egg consumption, but I was wrong, we saw a decline in all of them,” Aho said. Now with a slowly recovering economy we have high grain prices. Aho thinks that chicken and eggs will fare well through this time frame, because beef and pork supplies are expected to be relatively low. “I would guess that eggs will not be hurt as much as beef and pork by high grain prices,” he said. “This is an optimistic situation for the egg industry,” Aho said. “After there is an adjustment of supply to the higher grain prices, there may be an opportunity to increase egg consumption.”

In this video, Dr. Paul Aho explains why he thinks high corn prices will be with us at least until the fall of 2012.