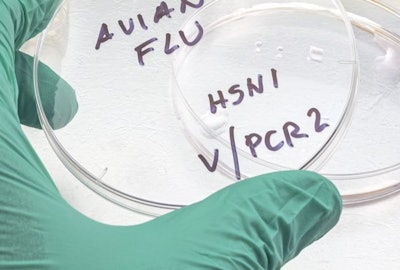

As highly pathogenic avian influenza (HPAI) continues to disrupt poultry markets and consumer confidence, industry experts at the 2025 Chicken Marketing Summit earlier this year identified five urgent priorities that demand immediate attention.

1. Combat food safety misconceptions

A shocking 41% of consumers believe they can contract bird flu from properly cooked chicken, with nearly half of millennials sharing this dangerous misconception. This fundamental misunderstanding is already changing buying behaviors, with 37% of consumers modifying their purchasing habits due to HPAI fears, said Rob Levine, partner and president of Mariner Marketing Communications.

To combat these misconceptions, the industry must deploy targeted messaging by generation: 15-second social media content for Gen Z, expert testimonials for millennials, and email communications for Baby Boomers. Simple, directive messages like "Cooking kills bird flu" must become industry standard across all channels.

2. Resolve questions about airborne transmission

The industry faces a $2 million per barn decision problem without clear answers on airborne transmission. While some outbreak patterns suggest viral spread over multiple kilometers, experimental evidence shows viable virus only travels 80 meters from barn walls.

This uncertainty is driving potentially wasteful investments in HEPA filtration, UVC lighting and electrostatic precipitators, Dr. Brian McCluskey, director of Lonestar Epidemiology Consulting and former U.S. Department of Agriculture (USDA) veterinarian, cautioned.

Systematic monitoring during outbreak events is essential to determine whether expensive airborne mitigation technologies represent sound investments or misdirected resources.

3. Implement data-driven biosecurity strategies

Current biosecurity approaches lack systematic evaluation of which practices deliver the greatest return on investment. Producers need specific guidance based on geographic location and seasonal risk factors rather than impossible "DEF CON 1" security levels, explained McCluskey.

The industry must prioritize rigorous data collection to identify which biosecurity measures actually prevent viral entry, while improving monitoring systems to catch daily lapses that create vulnerabilities.

4. Address economic impacts across all sectors

The current outbreak has created unprecedented market disruptions across the entire poultry complex, said Brian Earnest, lead economist for animal protein at CoBank.

The egg industry has lost 70% of affected birds, driving retail prices above $5 per dozen during peak holiday demand earlier this year. California alone lost virtually all production capacity for 40 million residents in a single outbreak. The turkey industry faces dual pressures from production losses and export restrictions, with Mexico — which receives 70% of U.S. turkey exports — implementing import bans.

Even the broiler industry, with fewer production impacts, continues facing trade consequences that eliminate premium export values, forcing high-value products into rendering markets.

5. Consider vaccination as a strategic tool

Vaccination safety and efficacy for poultry HPAI are scientifically proven, with successful programs already operating internationally, including France's duck production. Vaccination reduces viral shedding and can significantly decrease outbreak size and scope, but requires intensive surveillance programs monitoring both antibody levels and viral mutations, said McCluskey.

The convergence of these five challenges creates both unprecedented risk and opportunity for the poultry industry. Success requires immediate, coordinated action combining scientific advancement with strategic communication to rebuild consumer confidence and protect long-term market stability.

Attend the 2026 Chicken Marketing Summit

The 2026 Chicken Marketing Summit will be held at the Innisbrook Resort in Palm Harbor, Florida, on July 27-29, 2026. Serving a unique cross-section of the chicken supply chain, the Chicken Marketing Summit explores issues and trends in food marketing and consumer chicken consumption patterns and purchasing behavior.

Registration will open in Spring 2026.