Based in Spain, Grupo Vall Companys is a family-owned agrifood business producing pork, poultry, beef and flour products. Its vertically integrated operations make Grupo Vall Companys one of Europe’s largest feed producers.

In 2023, Grupo Vall Companys produced 3.15 million metric tons of feed at its 14 feed mills, according to Feed Strategy’s Top Feed Companies database. Of the world’s Top 50 feed producers that year, Grupo Vall Companys made the biggest leap in the rankings from the previous year, going from No. 74 to No. 42.

Feed Strategy asked Jaume Coma, director of animal nutrition at Grupo Vall Companys, about what is driving that increase in feed production, and about his outlook for the animal feed sector.

Feed Strategy: The most recent edition of Feed Strategy’s Top Feed Companies listing highlighted a significant increase in Grupo Vall Companys' 2023 feed production. What contributed to that growth, and did the company carry that momentum into 2024? Do you see it changing in 2025?

Jaume Coma: In 2024, feed production at Vall Companys Group reached 3.65 million metric tons, and we anticipate a further increase during this year 2025.

This growth is driven by two key factors. First, the Spanish meat production sector undergoes a significant consolidation, particularly in poultry and, especially, in pork. Due to business margins and market changes, the sector has rapidly consolidated over the last three years, with large vertically integrated groups absorbing small- to medium-sized companies. This is an ongoing process. Therefore, part of the increase in our feed production is the result of the integration of other companies in the sector.

Second, in 2023, we began reporting feed volumes from our international activities. Our group launched various projects in Latin America that have been gaining importance in recent years and are expected to contribute further to our growth in the coming years.

FS: What are some of the top opportunities and challenges for the animal nutrition industry, and how does your company look to address them?

Coma: The animal nutrition industry will face many challenges in the coming years, both from a technical and economic standpoint. As a vertically operated company, we view animal nutrition as a critical part of the meat production chain. The sustainability of the entire chain is essential for the future of the industry, although recent legislative changes seem to slow down the pace of implementation. Efficient animal nutrition is a requirement for this environmental and economic sustainability.

In 2020, our group launched a sustainability program called PENTA with a roadmap to 2030 and objectives validated by the Science Based Targets initiative (SBTi). Animal nutrition plays a crucial role in meeting these strategic goals. Our Sustainable Finance Framework is based on this program, and we are currently in the midpoint of the roadmap. As we look ahead, we are in the process of redefining the PENTA-40 program, which will guide our development for the following 10 years, through to 2040. Just as with the current program, the new requirements must be proactive, robust and realistic, underpinned by efficient and measurable performance parameters.

FS: Is your company seeing or utilizing changes in feed ingredients based on cost or availability? How is your company improving the sustainability of its feed sourcing?

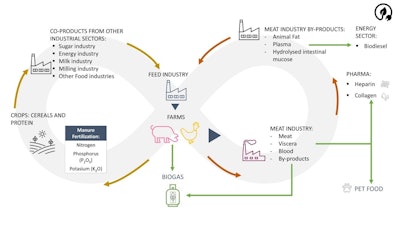

Coma: It is important to emphasize the importance of feed ingredients as part of the circular economy. Many ingredients are byproducts — or more accurately, coproducts — that come from other industries or from the human food chain. In a verticalized system like ours, there are multiple ingredients that can be reused, as summarized in the following graph, and which we try to maximize to achieve an increased efficiency and sustainability from an economic and environmental standpoint.

Courtesy Grupo Vall Companys

Courtesy Grupo Vall Companys

There is an ideal hierarchy of material for coherent human consumption from a social circularity point of view. The greatest advantage is to prevent food waste, to promote redistribution among the population, and in cases where it is not possible to divert the product to animal feed so that it can be reintroduced to human nutrition. If not, the food material becomes waste that can be used for composting, energy recovery or waste treatment, ultimately.

However, the current European legislative context in the renewable energy sector disrupts this flow. Animal fats, which could otherwise return to the food chain, are being diverted for biofuel production, an outcome that lacks societal justification. Our challenge now is to emphasize the social value of our work and advocate for a legislative framework that promotes circularity while ensuring food security and sovereignty.

In the future, as a result of the evolution of the food sector, it is foreseeable that new materials will be available for the feed industry. Their use will further contribute to the circularity of various industries, advancing sustainability across the supply chain.

FS: Are you seeing any change in demand for more sustainable products?

Coma: The demand is not so much for sustainable products themselves, but for integrating sustainability criteria into our standard processes. As mentioned earlier, the PENTA program was initiated proactively to define our Sustainable Finance Framework. Following that, we calculated the environmental footprint of our products and developed a roadmap to reduce it by 2030.

In recent years, specific customers have requested detailed information about our products and have highly valued the progress we have made. However, it is important to remain realistic. While many citizens express concern about sustainability, their actions as consumers often don’t align with these concerns — they are typically unwilling to pay a premium for more sustainable products. Therefore, at the sectoral level, maintaining continuous economic efficiency is crucial to producing foods that are both sustainable and affordable.

FS: What are some strategies your company uses to ensure feed quality and consistency?

Coma: Our sector is highly dynamic and adaptable, influenced by various factors that impact daily operations — ranging from fluctuations in the commodities market to changes in raw material flows due to geopolitical events and tariff policies. These factors are unpredictable and beyond our control. As a result, our philosophy is that our system must be flexible, both in sourcing and industrial operations.

For instance, when designing our industrial facilities, we invest in equipment with ample storage and dosing capabilities, allowing us to quickly switch between ingredients as needed. Managing the natural variability of ingredients is another challenge in ensuring consistent final product quality. To address this, we have implemented product segregation systems that rely on NIR (near-infrared) analysis upon arrival, minimizing the impact of uncontrollable variability. By prioritizing operational flexibility, implementing industrial-grade quality control, and continuously reformulating our products, we aim to ensure consistency in feed quality, which in turn supports stable and predictable farm performance.

In the medium term, we face the challenge of practically implementing new technologies (artificial intelligence and machine learning) to further enhance the flexibility and dynamics of our production system.

FS: What is your outlook for the feed industry for the next few years?

Coma: The future of animal nutrition, as an essential part of the food sector, involves ensuring the production of affordable food while proactively integrating emerging societal concepts. There is room for improvement in effectively communicating and increasing the visibility of the benefits of our activities. The role of the feed industry in supporting the circular economy across various sectors should be clearly communicated and actively lobbied, ensuring it is taken into account in future legislative developments.

It is crucial to avoid repeating past legislation that has lacked practical implementation. As previously mentioned, it is anticipated that new materials will become available to the feed industry. Their use will further enhance the circularity of multiple industries, advancing sustainability across the entire supply chain. Maintaining continuous economic efficiency is key to producing food that is both sustainable and affordable. The implementation of new technologies will significantly boost efficiency and flexibility, reaching levels that are hard to envision at this moment. The rapid diffusion of knowledge will allow for fast implementation across different regions of the world, a trend not seen in previous decades.

In summary, exciting times ahead.