Brazil, Mexico and Argentina are at the top the list of the largest feed producers in Latin America, where poultry feed plays a dominant role.

According to data published in Alltech‘s 2022 Agri-food Outlook, Latin America accounts for 14.4% of the world’s feed production. Compared with Asia-Pacific (458.1 million metric tons, or mmt) or even North America (252.9 mmt), the Latin American region is well below production with 178.5 mmt. However, in the world’s top 10 ranking, there are two Latin American nations – Brazil and Mexico.

The data provided by FEEDLATINA, the Latin America feed industry association, are very similar to Alltech’s figures.

Getting to know feed production in Latin America can be complicated, due to differences in the way production is accounted for. Some countries include the production of mineral salts and others include the production of premixes. Even forages, which are not compound feeds, are sometimes included.

Despite this, feed producers in this region of the world not only carry good production statistics, but are well organized within most countries, and regionally with FEEDLATINA. This association, which is part of the International Feed Industry Federation (IFIF), also collaborates closely with many international agencies such as the Food and Agriculture Organization of the United Nations (FAO) or World Organisation for Animal Health (WOAH).

Even though countless unfavorable circumstances, such as uncertainty in raw materials availability, logistics instability, a strong currency devaluation, rising fuel costs and inflation, the region is showing good strength.

Therefore, let’s take a look at the production of the top 3 Latin American feed producers, their evolution and prospects.

1) Brazil

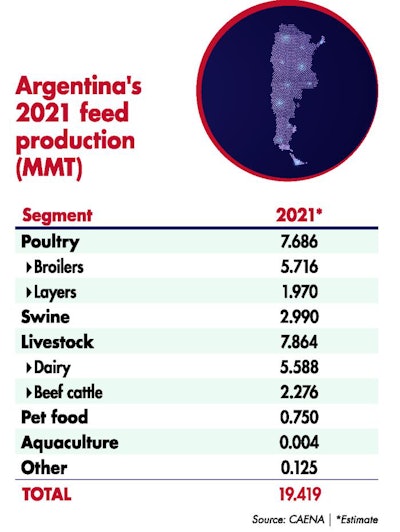

Brazil accounts for 45.28% of the region’s feed production. The National Association of the Animal Feed Industry (Sindirações), the entity representing Brazilian feed producers, reported that at the end of 2021 production was of 80.8 mmt and a 3.5% growth rate compared with 2020.

However, poultry, particularly broiler feed, accounts for more than half of national production. The pet food and aqua feed (fish and shrimp feed) segments, although still much lower than poultry, stand out for their expected growth rates of more than 5%.

Sindirações estimates a 3.5% growth in 2022, although the sector would like a more favorable production and business environment.

Brazil has a prominent position in the world for its international trade characterized by a robust export performance of grains and other agricultural products, such as animal protein. This privileged status of Brazil is due to its great agricultural potential, which may allow it to further expand its share of global supply.

2) Mexico

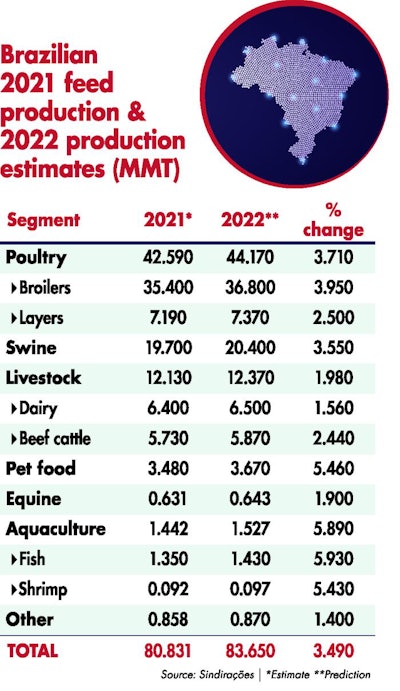

With a 21.7% share of the Latin American feed market, the Mexican industry ranks second at the regional level. The National Feed Manufacturers Council (CONAFAB), the entity that represents Mexican feed producers, reported that at the end of 2021 there was production of 38.7 mmt, between integrated and commercial producers, with a growth rate of 2.9% compared with 2020, a percentage similar to that of Brazil.

By 2022, the Mexican feed manufacturing industry expects to produce just over 40 mmt, which would represent a 3.65% growth rate over 2021 and a total of 14.5% – including the COVID-19 pandemic – over the past 5 years.

There are growth expectations in all segments. However, pet food production stands out with a 7.02% growth rate by 2022, while poultry is expected to increase by 4.16%, in particular that of laying hens, at 4.81%.

The aquafeed segment (fish and shrimp ) and the swine segment expect similar growth rates to that of the whole industry, of 3.36% and 3.63%, respectively. The only segments that will grow at rates below the national total level are those of beef and dairy cattle, with 2.43% and 2.28%, respectively.

3) Argentina

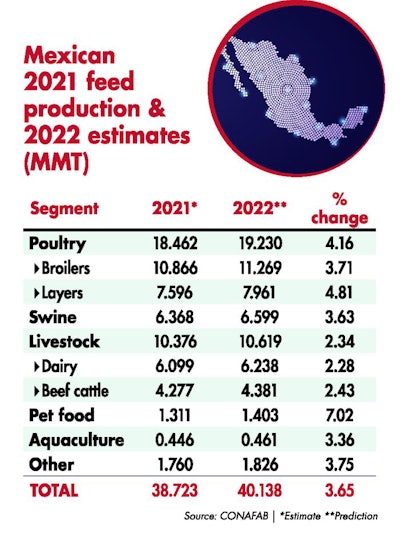

The southernmost country in the continent accounts for 10.88% of the Latin American feed market. The Argentine Chamber of Animal Nutrition Companies (CAENA) is the entity that represents Argentine feed producers, which reported that at the end of 2021 they produced 19.42 mmt, including pet food production, with a growth rate of 1.03% compared with 2020. This figure includes the production of compound feeds and not of premixes or other types of feeds.

It should be mentioned that at the time of drafting this article, unlike Sindirações (Brazil) and CONAFAB (Mexico), CAENA did not have a forecast for 2022.

The poultry feed segment has a share of 39.6%, similar to that of cattle feed (beef and dairy) at 40.5%, a differentiating characteristic from that of Brazil and Mexico. Pet food production is of 750,000 MT, or 3.86%, while aquafeed is only 3,629 metric tons or 0.02%.\