Feed industry stakeholders offer their perspective on issues shaping, growing feed production in the region.

Over the last decade, Latin America has been heralded as one of the fastest growing regions for animal protein production.

According to Alltech’s 2020 Global Feed Survey, Latin American feed production grew by 2.2% in 2019, a total of nearly 168 million metric tons. The largest feed manufacturing countries — Brazil, Mexico and Argentina — account for 76% of the region’s production.

Several regional and international animal protein production trends have begun to and will continue to shape feed demand and influence formulations. Here’s a look at the six macro trends influencing Latin American feed production:

1. Growing demand for animal protein

The demand for meat in Latin America has been on an upward trajectory for more than a decade.

“Between 2000 and 2018, this region has seen significant increases in all meat categories,” explains Ben Towns, global business director, Arm & Hammer Animal and Food Production. “Poultry production in the region increased 112%, pork production increased 64% and beef production increased 29%. The dairy industry is also seeing increases, with milk production up 35% over the past two decades. This steady increase in animal production translates into greater feed demand — creating opportunities for feed suppliers.”

The poultry and egg sectors have seen the most growth — upwards of 2% in all but one Latin American country — and, in Rabobank senior analyst Nan-Dirk Mulder’s opinion, yield the most potential.

“From a trade perspective, Latin America absolutely has many opportunities to grow exports, but also locally there is a good investment story,” Mulder says. “If you look at the future, in 2050, there will be 120 million more people in the region. Some economies are volatile, but some countries, in this perspective, do quite well. If you look at the consumption of meat, there are large meat-loving countries with high consumption levels — Argentina, Uruguay and Brazil — but there are also other countries — Peru, Colombia, parts of Central America — with the potential to increase consumption.”

Currently, Latin American consumers have been slow to embrace the plant-based meat alternative trend. However, as Alessandro Lima, Biorigin feed business manager, points out, increasing sustainability and animal welfare concerns have made consumers more willing to change their center-plate protein options.

2. Technology boom

As innovative technologies are adopted, infrastructure is improved and new trade opportunities arise, Latin American protein and feed production will become more profitable.

However, the sector has been slow to adopt new ag tech innovations.

“The continued growth of the Latin America livestock industry may be hampered in some areas by lagging production efficiency and the availability of new technologies, practices and genetics to enhance profitability,” Towns says. “Looking to the future, we expect Latin American livestock producers to achieve greater production efficiency by adopting new feed technologies and practices.”

“Production efficiency is linked to profitability,” says Alexandra Naranjo, technical director, Trouw Nutrition Latin America. “Feed is a large part of the production process and, therefore, has a significant impact on the costs of production of protein for human consumption. The largest challenges in our market are aligned with the concept of digitization and the implementation of data management for decision making, as well as for making the production process more efficient and precise.”

3. Volatility & competition

Market volatility, inflation and negative economic conditions challenge the Latin American livestock, poultry and feed industries to maintain production rates and to be competitive in a global market scenario, Lima says.

In Feed Strategy’s 2020 Poultry Nutrition & Feed Survey (March 2020), for example, 92% of respondents from Latin America cited commodity costs as one of the greatest challenges to their business; 64% cited exchange rate fluctuations.

“Many countries in the region face currency devaluation, and the high cost of imported raw materials adds to overall economic challenges,” Towns adds. “Feed suppliers face the same economic challenges as our customers, so we must work to gain efficiencies.”

4. Antibiotic elimination & reductions

While the importance of combating antimicrobial resistance to antibiotics is well accepted, the adoption of antibiotic reduction and elimination strategies vary across Latin America.

Local regulations have been established to minimize the use of antibiotics in livestock and poultry production, but the requirements vary from country to country, with several banning or moving away from antibiotics growth promoters (AGPs). With AGPs out of the equation, feed producers look to feed additive solutions to maintain productivity.

“Many feed companies look for alternatives, mainly natural alternatives, to improve animal health and welfare to guarantee the production levels without sacrificing the animal protein supply, opening space for feed ingredients companies to innovate and deliver solutions for gut health and immune support,” Lima says.

Latin American feed producers are increasingly exploring AGP alternative products, such as organic acids, medium- and short-chain fatty acids, phytobiotics, yeast derivatives, prebiotics, probiotics, essential oils, tannins and enzymes directed to different substrates in the diet.

“The addition of these products not only holds true for feed, but these concepts are also being utilized to improve drinking water quality used in production and, therefore, positively impacting the gut health of the animal and its microbiota modulation,” says Naranjo.

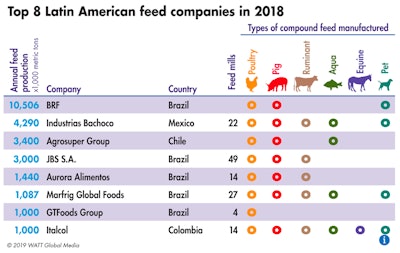

According to WATT Global Media’s Top Feed Companies database, eight Latin American companies produced more than 1 million metric tons of compound feed in 2018. For more Top Companies insights, read Feed Strategy’s 2019 Top Feed Companies report.

According to WATT Global Media’s Top Feed Companies database, eight Latin American companies produced more than 1 million metric tons of compound feed in 2018. For more Top Companies insights, read Feed Strategy’s 2019 Top Feed Companies report.5. Food safety & biosecurity

Food safety is a high priority in Latin American protein production — ensuring consumer health and trust in the animal protein supply chain, but also to maintain export relationships. While the list of measures is extensive and varies from country to country, Brazil is leading the way in advancing food safety.

“What I can say is that this issue is taken extremely seriously in Brazil by all poultry producers and throughout Latin America by all producers involved in international trade, i.e., exporting poultry to EU, Japan, China, and other major importing countries,” explains Marcelo Lang, global marketing director – animal health & nutrition, Chr. Hansen, Inc.

To this end, strict and costly biosecurity measures have been implemented.

“In Brazil, for example, food safety and the reduction of Salmonella contamination in poultry products is priority number one,” says Lang. “It’s being addressed with a great deal of professionalism and meticulous execution of biosecurity protocols at all links of the production chain, from procurement of feed ingredients to animal care, to processing, training of all staff handling live animals or in the processing plants, testing of all flocks prior to sending them to slaughter and much more.”

Companies have also adopted a variety of animal health interventions such as vaccines, organic acids, probiotics and other product categories for reducing the pathogen load and shedding in live animals.

6. Emphasis on animal welfare

As consumers locally and in export markets increasingly demand improved animal welfare standards, it is shaping the ways poultry and livestock are fed, raised and brought to market.

“Most [Latin American] companies follow specific welfare protocols approved by their customers — importing companies, mainly — or alternatively they agree to abide by protocols created by NGO (non-governmental organization) or industry associations and accept to be inspected by those institutions to ensure they’re following the guidelines,” Lang says.

For feed producers and nutritionists, the emphasis is focused on quality, safe and nutritious feeds to ensure production and animal health.

“Protecting animals for the stress they experience throughout the life cycle in a high-performance production chain is fundamental,” Lima says. “Investing in quality nutrition is one of the solution producers could harness to improve animal welfare.”

Reference available upon request.

Brazil, Mexico and Argentina account for 76% of the region’s 2019 feed production. (Anson_iStock | iStock.com)

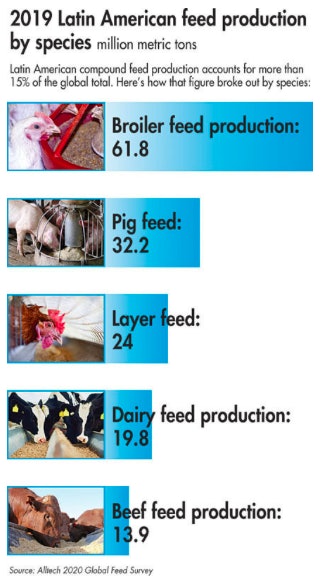

Brazil, Mexico and Argentina account for 76% of the region’s 2019 feed production. (Anson_iStock | iStock.com)2019 Latin American feed production by species

Latin American compound feed production accounts for more than 15% of the global total. Here’s how that figure broke out by species:

- Broiler feed production: 61.8 million metric tons

- Layer feed: 24 million metric tons

- Pig feed: 32.2 million metric tons

- Beef feed production: 13.9 million metric tons

- Dairy feed production: 19.8 million metric tons

Source: Alltech 2020 Global Feed Survey