Aquaculture’s growth in recent years has provided one of the brightest stars in the compound feeds firmament, but its record in 2013 was rather less impressive. Asia had problems with shrimp disease as well as with reducing fish volumes of both pangasius and tilapia. Declining markets for salmonid feeds were seen in the key sectors of Norway, Chile and Canada. Smaller aquafeed sectors, such as in Australia, similarly reported reduced volumes.

World market data compiled by the Skretting aquafeeds company of the Nutreco Group show a total of 3.4 million metric tons of feeds for salmon and trout were produced globally last year — only marginally down from 2012 — while feeds for the “white fishes” segment were up slightly at 13 million tons. The big difference between the years was a drop in shrimp feeds from 3.9 million tons in 2012 to 3.1 million tons in 2013.

Disease hurts shrimp, salmonids

The explanation lies in a viral disease of shrimp, called Early Mortality Syndrome (EMS), which ravaged Asian shrimp farms in 2013. In Thailand, for example, EMS was blamed for cutting national shrimp production by almost half. Other places with aquaculture disease issues included Mexico, Chile and Canada.

Western Canadian salmon production is trending lower under disease pressures. But, the forecast for Norway is that there will be a rapid recovery of salmonid volumes, after unusual patterns for seasonal water temperatures caused the Norwegian business in 2013 to register its first decrease for several years. Norway’s fish feed volumes fell by about 2 percent in 2013.

Aquafeed up in some markets

However, there were also aquafeed winners last year. Production rose in places such as Bangladesh, India, Indonesia and Turkey. Bangladesh now claims to be producing in excess of 1 million metric tons of fish feeds annually. India has been forecast to register a 20 percent volume increase by 2015. Indonesia has echoed China in the fact that more than 10 percent of all complete feeds now are for aquaculture.

The member states of the European Union produce about 1.3 million metric tons of fish feeds annually and the non-salmonid feed market in Europe expanded by an estimated 1.2 percent in 2013.

Generally, world output from aquaculture grew by 5 percent in 2013 and around 90 percent of the tonnage emanates from Asia-Pacific territories. By volume, salmon and trout production is the third largest in the sector globally after carp and tilapia. When on-farm feed mixing is excluded, according to Nutreco/Skretting, the market for commercial aquafeeds, excluding carp, reached nearly 19.5 million metric tons in 2013 and some 3.4 million tons of this was for salmonid species.

Mixed outlook on production rebounds

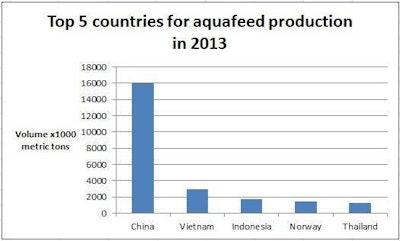

While salmonid feeds are made mainly in Europe/Scandinavia and parts of Latin America, feeds for other fish and also shrimp are produced predominantly in the countries of China, Ecuador, India, Indonesia, Thailand and Vietnam. The fall of almost 20 percent in total world shrimp feed volumes in 2013 is expected to be followed by the start of a strong recovery in 2014 as disease issues are overcome.

There could also be more production of pangasius in the main producing regions of the world in 2014, defying a downward trend for the species since 2008.

Aqua-sector specialists Kontali Analyse have predicted that the 3 percent worldwide decrease in salmonid feed usage in 2013 will be followed by a 2 percent increase in 2014, boosted particularly by a 7 percent rise for Norway. Chile is forecast to suffer another 8 percent production drop due to health/hygiene issues after losing 5 percent last year.

A long-term projection quoted by Nutreco is that the commercial segment of the complete aquafeeds market can be expected to grow at a rate of 3 percent per year. Even at current world aquaculture production and feed conversion ratios, the calculated requirement for aquatic feeds from all sources already exceeds 150 million metric tons per year.