2022 Poultry Nutrition & Feed Survey delves into the macro trends influencing feed production, inclusions

Poultry and poultry feed production has increasingly been influenced by shifting consumer preferences and an emphasis and adoption of sustainability principles by downstream partners which, in turn, have dictated how poultry is raised and how feed is formulated. WATT Global Media’s annual Poultry Nutrition & Feed Survey offers a firsthand look at the trends affecting the global poultry industry and provides a glimpse into the ways poultry producers, nutritionists and feed manufacturers are adapting to these changes and challenges.

The survey’s 2022 edition includes input from 359 respondents from around the world. More than half of survey participants are nutritionists, consultants and veterinarians; 16% work in live production management or own a poultry farm.

Despite the supply chain and labor challenges presented by the COVID-19 pandemic and commodity price volatility, survey respondents were optimistic about the year ahead — investing in their businesses and proactively evaluating their environmental footprint.

Emphasis on sustainability, climate change

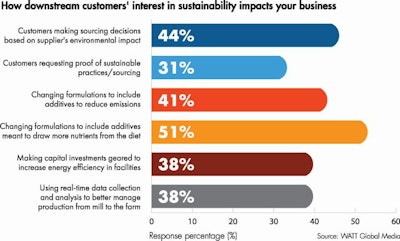

“Sustainability” in practice has evolved to become well-defined, actionable programs and pledges embraced by many large agrifood corporations. When asked how this emphasis on sustainability will influence their business in 2022, 51% of survey respondents say they have changed their formulations to include additives meant to draw more nutrients from rations. Forty-one percent have begun including emission-reducing feed additives to their feeding programs.

Citing the pressure of downstream customers, 44% are making sourcing decisions based on the perceived environmental impact of their suppliers; 31% report they have requested proof of sustainable practices and sourcing.

Companies are also investing in equipment to improve energy efficiency in their facilities (38%) and utilizing real-time data collection and analysis to better manage production (38%).

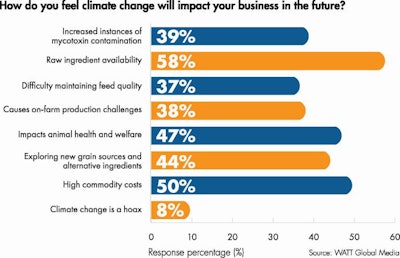

Survey respondents have also acknowledged the effects of climate change and how they think it will affect their business. In the future, survey respondents believe climate change will be responsible for reducing raw material availability (59%), contribute to high commodity costs (50%), increase instances of mycotoxin contamination (39%) and make it difficult to maintain feed quality (37%).

Poultry producers feel climate change will play a part in decreasing animal health and welfare (47%), as well as attributing to on-farm production challenges (38%).

2022 profitability outlook

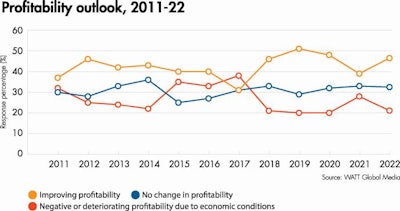

Compared with 2021’s survey results, 2022’s survey respondents seem to have a more optimistic business outlook. Forty-seven percent believe their company’s profitability will improve in 2022, 33% predict it will remain flat and 21% feel profitability will decrease.

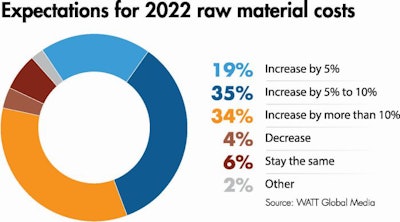

Poultry and poultry feed producers weathered commodity price volatility in 2021 — and most are bracing themselves for the trend to continue well into 2022. When asked to weigh in on the primary challenges facing their business, 88% cited the cost of grain as their No. 1 challenge. In fact, 34% fear grain costs will increase by more than 10% and 34% of survey respondents anticipate their grain costs increasing by between 5% to 10% in 2022. Only 6% are optimistic they will remain the same as in 2021.

High energy and transportation costs (66%) ranked among producers’ top concerns. Respondents also believe rising feed additive and micro-ingredient availability challenges (66%) and price hikes (64%) will continue to challenge their operation, a concern likely directly relating to their acknowledgment of looming supply chain risks (60%).

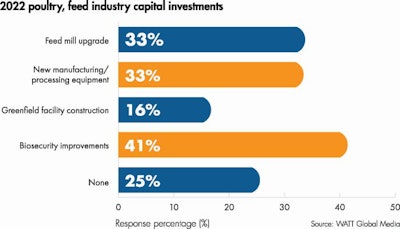

Not letting rising input costs and the general tinge of uncertainty impede their progress, poultry and feed companies are making capital investments in 2022. Forty percent of survey respondents report their company is making investments in improving their biosecurity measures; 33% plan to upgrade their feed mills and 33% will purchase new manufacturing or processing equipment.

Sixteen percent of respondents share that their company will be undertaking greenfield facility construction this year.

Viruses cause lingering trouble

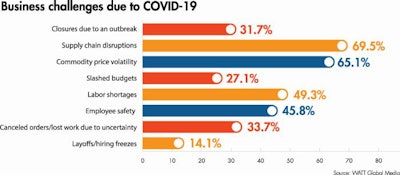

When asked about the main challenges their company continues to grapple with due to the COVID-19 pandemic, survey respondents cited supply chain disruptions (70%), commodity price volatility (65%), labor shortages (50%) and employee safety (46%) as their top four COVID-related stressors. In contrast with 2021’s report, concerns surrounding lost work or canceled orders due and slashed budgets ranked significantly lower.

Also, pointing to a bump in optimism, 45% of survey respondents believe their feed production will increase in 2022; 33% think it will stay the same as in 2021.

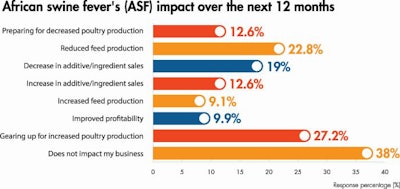

African swine fever (ASF) virus continues to challenge swine production in affected regions, primarily in Asia and Eastern Europe. This year, 27% of respondents believe the disease will spur an increase in poultry production. On the downside, however, 19% believe it will decrease their additive and ingredient sales and others (23%) believe it will lead to reduced feed production.

Challenges due to antibiotic reduction, elimination

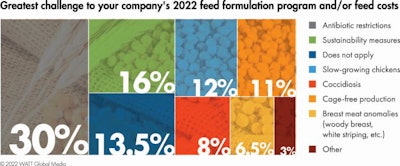

Asked to identify which poultry production trends will have the greatest impact on their feed costs and formulation programs, 30% of respondents cited antibiotic restrictions as their greatest production challenge in 2022, 15% noted sustainability and 12% said slow-growing chicken production.

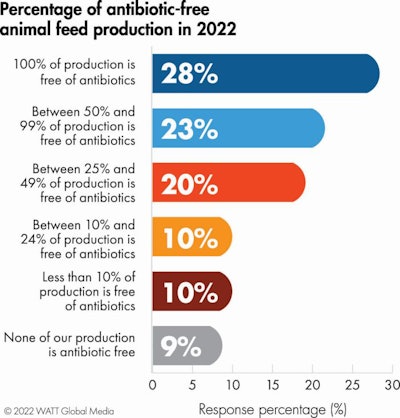

Ninety percent of 2022 survey participants report having some degree of antibiotic-free (ABF) production in their poultry operations — with 28% stating that 100% of their production is ABF.

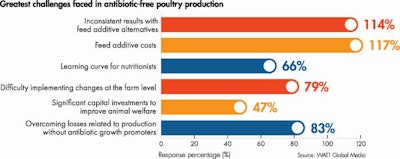

According to respondents, the greatest challenges in making the transition to ABF poultry production can be attributed to the cost of feed additives (38%), the inconsistent results they have experienced with feed additive alternatives (37%), the losses related to the elimination of antibiotic growth promoters (AGP) (27%) and the difficulty implementing changes on the farm level (26%).

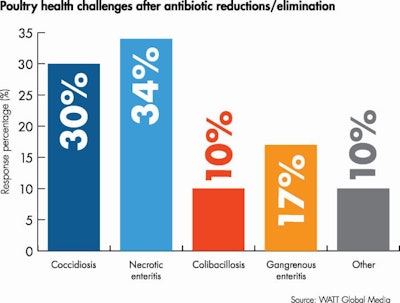

Since eliminating or reducing antibiotic usage in poultry feed production, respondents cite increased incidents of necrotic enteritis (34%), coccidiosis (30%), and colibacillosis (17%).

Experiences with AGP alternatives

Seventy-five percent of respondents report that their company is actively exploring, testing or using feed additives as antibiotic alternatives or replacements.

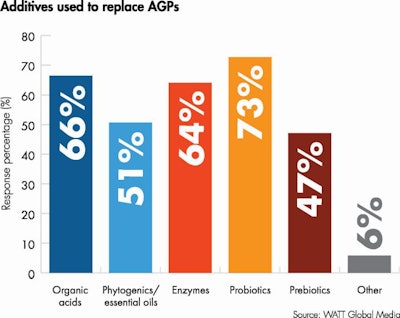

To simulate the production gains AGPs provided, survey respondents have incorporated different feed additives into their rations to bridge the gap. Probiotics (73%) and organic acids (66%) ranked as the most popular AGP alternatives; followed by enzymes (64%) and phytogenic feed additives (51%).

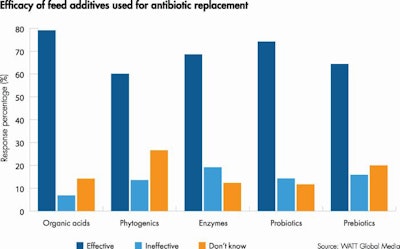

Survey respondents report finding organic acids (80%), probiotics (74%) and enzymes (69%) to be the most effective feed additive alternatives to antibiotics. Prebiotics (64%) and yeasts (55%) have also shown promise. Phytogenic feed additives and essential oils were deemed effective by 60% of respondents; however, 27% felt they could not comment on the efficacy of the category. Respondents felt they did not know how to leverage or have never used functional fibers (36%) and yeasts (27%) in ABF programs.

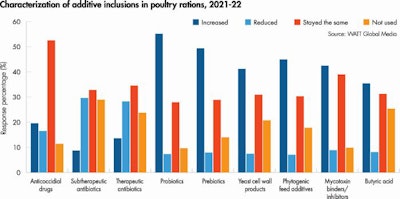

Comparing their outlook for 2022 inclusions against 2021, respondents will increase their use of probiotics (55%), prebiotics (50%) and essential oils (45%) this year. Thirty percent will decrease their use of subtherapeutic and therapeutic (28%) antibiotics in their poultry operations.

POULTRY NUTRITION & FEED SURVEY AT A GLANCE

The 2022 Poultry Nutrition & Feed Survey includes input from 359 poultry and feed industry stakeholders worldwide. This WATT Global Media special report seeks to identify the feeding and external trends shaping these sectors during the past 12 months; it was conducted in English and Spanish.

Participants included:

- Nutritionists: 29%

- Consultants: 18%

- Veterinarians: 12%

- Poultry farm owner/grower: 10%

- Marketing and sales: 9%

- Quality control, purchasing agent, other: 8%

- Live production management: 6%

- General administration: 4%

- Feed mill/plant operations: 4%

Responses from:

- United States/Canada: 35%

- Latin America: 20%

- Asia/Pacific: 18%

- Europe: 13%

- Africa: 10%

- Middle East: 4%

Sectors:

- Consultant/veterinarian/nutritionist: 40%

- Manufacturing/distributing feed additives: 14%

- Feed manufacturing: 12%

- Broiler production: 9%

- Egg production: 8%

- Turkey/duck production: 4%

- Poultry processing: 4%

- Premix manufacturing: 3%

- Breeder farm/hatchery: 1%

- Other: 5%