The carbon market is a relatively new industry that may seem confusing and complicated to some who could benefit from it.

Carbon markets can help companies reduce greenhouse gas (GHG) emissions and earn money doing so by buying and selling carbon credits.

Feed Mill of the Future asked Matt Sutton-Vermeulen and Garth Boyd, Ph.D., partners at The Context Network, to clarify some details of ag carbon and how it works. Context is a strategic consulting firm that helps its clients in the agribusiness space advance responsible agriculture.

Responses have been edited for clarity.

Can you provide a brief overview of carbon trading and how it works?

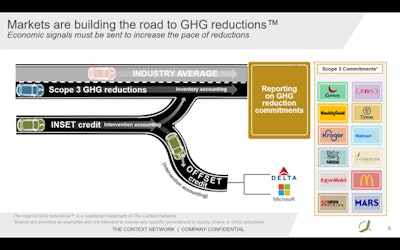

Ag carbon can be monetized through three distinct pathways. The first three are shown on this graphic:

This graphic shows the pathways to monetize Scope 3 greenhouse gas (GHG) reductions, inset credits and offset credits.Courtesy The Context Network

This graphic shows the pathways to monetize Scope 3 greenhouse gas (GHG) reductions, inset credits and offset credits.Courtesy The Context Network

- Scope 3 GHG reductions: GHG emission reductions in the supply chain calculated through inventory accounting for organization reporting toward reduction commitments

- Inset credits: GHG emission reductions in the supply chain calculated through intervention accounting and certified by a carbon registry/program and then adapted into inventory accounting for reporting purposes

- Offset credits: GHG emission reductions that occurred outside of an organization’s supply chain calculated through intervention accounting and certified by a carbon registry/program and then adapted into their organizations GHG report

- Regulated markets: The national Renewable Fuels Standard (RFS) and the California Low Carbon Fuels Standard (LCFS). These two policies create opportunities for complimentary income through the creation of credits in the forms of renewable identification numbers (RINs) for RFS and Low Carbon Fuel Credits (LCFS) for the California program.

What are the main goals and objectives of carbon trading schemes?

The high-level goals of carbon trading schemes are to incentivize project developers and supply chains to take actions voluntarily to reduce GHG emissions or sequester carbon. Downstream companies send a monetary demand signal for reducing their GHG footprint (Scope 1 and 2) or in their supply chain, both in non-regulated sectors of the economy.

How do these policies impact businesses and industries?

No direct impact for those that choose not to participate. For those that do, purchasing offsets usually provides a cheaper alternative for a business to reduce its GHG emissions (Scope 1 and 2) than if it implemented technology or reduced production themselves. Or, for businesses that don’t have viable options for decreasing emissions, it provides a solution.

How is the carbon market structured, and what are the main participants?

There is no overall, regulated carbon market. In its current state, it is immature and lacks structure and function characteristics of more mature markets such as universal product standards, price discovery, liquidity of supply and demand, and a data clearinghouse to ensure integrity. Instead, there are numerous, unregulated carbon programs, each with their own governance rules. The International Financial Reporting Standards (IFRS) established global financial reporting standards decades ago. It is in the process of aligning and adapting processes for a more robust systems approach through alignment of International Sustainability Standards Board, GHG Protocol, the Task Force on Climate-Related Financial Disclosures (TCFD), Science Based Targets initiative (SBTi), The Integrity Council for Voluntary Carbon Markets (ICVCM), Voluntary Carbon Markets Integrity Initiative (VCMI), Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) and CDP. Time will tell if this approach is successful.

What factors influence the price of carbon credits or allowances?

Supply and demand associated with quality traits built into the carbon development process:

- Data quality and quantity that provides confidence and certainty if there is more data rather than less

- Permanence to ensure the carbon cannot be lost such as the case of a forest fire

- Leakage

- Causality in the case of scope 3 GHG emissions and inset credits created within a supply chain

- Additionality in the case of offset credits created outside of a supply chain

- Assurance of the quality itself

- Type of reduction: Absolute vs. intensity

What are the steps involved in participating in a carbon trading scheme?

- For a project developer: Choosing the program and registry that provides the most benefits like highest price, reputation and confidence

- For a buyer of credits (offset or inset): Identify the program that provides credits with the traits important to your organization's commitments

- For a company seeking scope 3 GHG reductions: It can either engage a developer and set clear expectations for its needs within its supply chain or it can directly engage its supply chain and collaboratively perform inventory accounting associated with potential reductions

What are the economic implications of carbon trading for businesses?

Cost of project development or purchase and risk of criticism or lawsuits related to greenwashing if claims associated with the reductions aren’t perceived as being real.

Can you provide examples of successful carbon trading strategies or initiatives?

Yes, the most successful that involves agriculture is the Alberta Offset System. The largest voluntary carbon registry in the world is Verra.

Are there any potential drawbacks or limitations to carbon trading in terms of environmental outcomes?

Yes, the potential for reversal like when a no-till field is plowed. Sequestered carbon in the soil is released to the atmosphere with this soil disturbance. This risk can be mitigated by establishing a reserve pool that can serve as an insurance mechanism. There are many other potential risks associated with carbon quality and measurement, monitoring, reporting and verification.

What role do carbon offsets play in encouraging emission reductions?

Companies sending a demand signal to purchase offset credits outside of their supply chain provide a unique opportunity for increased demand liquidity for ag carbon. The supply and demand determines the price, and the price determines the number of projects and overall tonnage generated.

How do you see the future of carbon trading evolving, particularly in response to emerging challenges like climate change?

Offset projects are likely to decline because pressure from investors is on big emitters to take action within their control, and Scope 3 GHG reductions in supply chains will increase. This is mostly due to requirements of Science Based Targets initiative (SBTi), a GHG governance program that is the most widely used globally and now has over 7,000 firms engaged in the process.

What are the main challenges faced by companies or governments in implementing carbon trading schemes?

- Immaturity: The immaturity of the market, which lacks standardization, oversight, practices and systems

- People: The significant gap between the supply and demand for trained, competent professionals that understand the interface between the science, business, economics and social implications of how these systems need to work to reduce GHG emissions with certainty

What opportunities exist for companies to leverage carbon trading for competitive advantage or sustainability goals?

There are significant opportunities for companies to play roles in the measurement, monitoring, reporting and verification of Scope 3 GHG reductions in agriculture.

Are there any best practices or lessons learned from past experiences with carbon trading that you would highlight?

- Listen and lead: Listen to trusted professionals who have failed and succeeded and then lead according to your values.

- Build community: Create a diverse network of trusted professionals who can provide you with candid insights.

- Progress over perfection: Don’t suffer paralysis while seeking perfection. You will never get anything done.

- Integrity matters: Be prepared to transparently describe what you did, why you did it and how you did it.