Cautious optimism is the watchword for the pig industry across North America as it launches itself into 2012 and beyond. A particular focus is being put on driving the export trade forward and improving pig welfare to guard against attacks from animal rights groups.

Two of the industry’s leading economists, Dr Steve Meyer and Dr Karl Skold, both agreed that the region’s pig producers have reason to look forward to a positive future, especially with regard to prices and cost of production.

And, as we report in this issue, one British-based pig breeding company is branching out into North America.

US, Canadian pig production Speaking at the Banff Pork Seminar in January, Dr Skold, president of Westside Economics, said: “Overall, the fundamentals are promising and looking more solid than they have in recent years. We are seeing transitions in markets that should benefit the United States pig sector and Canadian pork production.”

In addition to what Dr Skold called “the good news” on the outlook for animal feed costs, he said there were signals of a continued strong and rising demand for pork, both domestically and internationally. Overall, there wasn’t much to complain about, particularly for the Canadian pig industry that had struggled through four years of extremely challenging conditions. Although he did point out that caution was called for in equal measure in a world that is currently facing a season of instability in the wake of a global economic downturn.

Meanwhile, Dr Steve Meyer, a former director of economics for the National Pork Producers Council and the Pork Board, who founded Paragon Economics in 2002 to provide expert economic analysis of agricultural markets and business decisions, told Pig International that he thought the current state of the US pork industry was good.

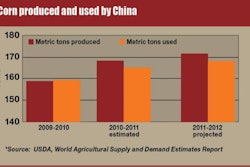

“While profits for 2011 were not great, according to my data they amounted to $4.92 per head in spite of record-high feed costs,” says Dr Meyer. “Break-even costs in 2012 are forecast to be about $3/cwt carcass lower based on current futures prices for corn and soybean meal. A 1-2% increase in supplies will push prices somewhat lower, but futures suggest profits of more than $10/head for 2012.”

“Supplies are reasonably in line with slaughter capacity at the moment, but I think the US will need more slaughter space by the end of 2013 or, for sure, 2014,” he said. “Domestic pork demand was just over 1% higher in 2011 and exports were excellent. I believe they will exceed 5 billion pounds carcase weight when the final data for December are in next month (after Pig International went to press).”

Pork exports increase Asked about the opportunities ahead, Dr Meyer said that he hoped pork would be able to increase its market share in the US, as beef production and chicken output fell and he added that he expected more activity on the export market with the signing of the Korean Free Trade Agreement and rising demand in China and Hong Kong.

The main challenges to this optimistic outlook are the general economic conditions and their impacts on demand at home and abroad. Pig producers should also be aware of moves to limit certain technologies in the US, gestation stalls being the most noteworthy, as well as continued efforts to limit the use of key antibiotics in animal production and the entire animal welfare culture and its impacts.

USDA supports this cautious optimism about the pig industry’s growth in the US, with new estimates pointing to “small increases in hog production in 2012”.

In a report in January, it stated: “Prices of hogs and pork in 2012 are expected to reflect slightly larger hog supplies in the face of expected small production increases and stable exports. However, significantly higher prices for substitute animal proteins – beef, in particular – are expected to provide some support for US pork sector prices in 2012.” It forecasts that the total US pork exports this year to be about 5.1 billion pounds, which is about the same as in 2011.

North American pork outlook The outlook for North America is neatly summed up in the International Meat Market Review, published regularly by the UK’s Agriculture and Horticulture Development Board which stated: “With further improvements in productivity, the (US) pig crop is expected to rise, which will feed through to a 2% increase in slaughtering in 2012.”

It adds: “With high pig prices continuing to be available to producers and feed costs remaining relatively high, there is unlikely to be any further increase in average carcase weights. This means that the amount of pig meat produced will also increase by about 2%.”

As far as Canada is concerned, the Review published that while the country’s pork production in 2012 is expected to increase by about 1% on 2011 levels, the cost of feed, as well as some uncertainties in both pork prices and foreign demand is likely to temper production growth during the next 12 months.