A potential decline in ethanol production could impact the animal feed industry in 2013 in more ways than just freeing up an already tight corn supply.

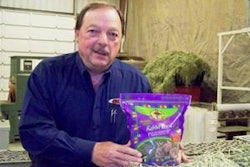

According to Tim Brusnahan, it could also affect the amount of Distillers Dried Grain and Solubles. Brusnahan, Brock Associates, shared his insights during the 2013 Feed Grains, Wheat and Oilseeds Commodity Outlook webinar, hosted by WATTAgNet.

“The U.S. consumer of gasoline has made an adjustment, going back to 2008 when gasoline touched $4 a gallon. Since that time, we’ve used less gas,” said Brusnahan. “The bottom line is gasoline use is less, thus decreasing the ethanol blend demand.”

He adds that since there is also a short supply of corn available, “economics will prevail,” and regardless of whether the government ethanol mandate is modified, less ethanol will be produced this year. He added there are 20 plants sitting idle, and others could possibly run under capacity or with an early season slowdown. That slowdown of ethanol production can signal a smaller supply of DDGS, which are a co-product of the ethanol-making process.

“This is an issue I suggest you take a pretty close look at. DDGS supplies will tighten up at some point,” he said. Brusnahan also discussed animal feed buying strategies. While he said that not all feed buying strategies fit everyone’s needs, he has a set of guidelines that could be considered regardless of the operation.

One thing that should be universal for animal feed buyers, he said, is having 60 days of ownership amid the tight supply market. When the supplies are as tight as they are now, the futures and options contract doesn’t always work effectively, he said, because of the tight supply and logistical challenges.

He also advises keeping an eye on wheat futures, as they will play a major role this year. When wheat futures move into a supply-driven rally, Brusnahan said corn will probably be not far behind. And if drought conditions extend into late April, it could ignite another supply driven rally for wheat that can influence the price of corn.

Brusnahan also touched on how the amount of available corn has prompted a shift in the commodities used for animal feed. While corn usage has dropped 2.2 percent in 2013, other grains gained part of the share. Wheat saw the biggest growth, going up 113.4 percent, while milo use went up 76.1 percent. Barley went up 57.9 percent, and even soybeans saw growth, as usage went up 9.8 percent.

Brusnahan said that the outlook for the animal feed industry is good, and livestock and poultry producers’ good management is a key factor in that. He notes that though cattle production is down, the pork industry has done well financially and the broiler industry has also admirably sustained itself amid tough times. Other minor livestock industries have also met the challenges well, he said.

“This is the reason why feed use is as strong as it is. Everyone has managed themselves well,” he said. Growers found the right time to purchase feed, which enabled them to keep producing and move their products to the consumers."

Other topics covered during the webinar included financial factors in the animal feed market for 2013, market fundamentals for the United States and South America, and a 2013 crop outlook.

Brock Associates and Brusnahan provide commodity price forecasting, research analysis, hedging and marketing strategies for farm producers and dairy producers and procurement and risk management strategies for feed manufacturers and corn processors.