“Agriculture is an increasingly global business,” observed one of the principals in a recent takeover deal designed to unite grain handling enterprises from two continents. This comment applies especially well to the flow of cereals and oilseeds into feed manufacturing. In fact, almost every country’s farm feed composition depends on how these grains are grown and traded internationally.

The consequence of globalization is that developments in the grain trade have a direct and significant impact on the feed sector anywhere livestock, poultry and fish are commercially farmed. This synergy extends not only to the identity of the main players, but also to their respective policies and strategies.

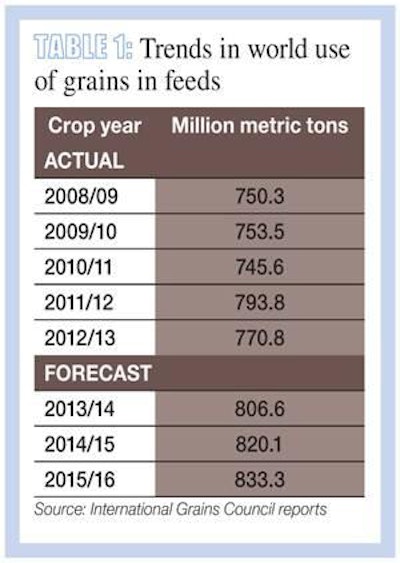

The International Grains Council’s (IGC) 2013 Grains Conference, a gathering of the largest trading organizations in the world, provided an opportunity to gain expert views on the global market outlook for feed’s primary ingredients. The following is a list of highlights of recent developments in the global grain trade.

Japanese company expands reach

Mitsui, one of Japan’s biggest trading companies which operates in 67 countries, reports revenues of US$64 billion from a wide range of activities, but grain is seen as a core business, explained Hiroyuki Hidaka, general manager of the corporation’s grain business division, at the IGC meeting. Mitsui hopes to achieve a stable and sustainable supply of grains from the United States, Brazil, Australia and Russia to deliver to Asia and the emerging markets of the Middle East and Africa.

In his remarks, Hidaka noted the strategic alliance newly formed between Mitsui and Russian grain enterprise, Sodrugestvo; the Japanese corporation holds a 10 percent stake. Sodrugestvo is Russia’s biggest supplier of soybean meal, having a market share of about 60 percent. It handles grain from growers in Russia and surrounding countries, as well as operating a private export shipping terminal at Kaliningrad. In addition to Mitsui becoming involved in marketing grain from the terminal, the new alliance will see the companies working together on feed and livestock business development inside Russia.

Mitsui’s American arm, UGC, and Australian subsidiary, Plum Grove, operate in the conventional trade areas of grain procurement and export; however, the trend for grain traders to expand into crop production is illustrated by the corporation’s Brazilian offshoot, Multigrain. It now farms almost 117,000 hectares of land in Brazil with corn and soybeans among its crops, Hidaka reported, exporting grain through the port of Tubarão.

There are close echoes of this Japanese-Brazilian grain connection in the recently announced move by Mitsubishi Corporation to acquire extra shares in Brazil-based grain producer, Ceagro, making it a subsidiary. Ceagro’s specialty is in corn and soybean supplies from the center and north of Brazil, where harvests are increasing and exports can go through relatively underutilized northern ports.

Brazilian infrastructure concerns

Brazil’s line of ports along its Atlantic coast provided a frequent topic of discussion at IGC’s conference. Although Multigrain uses Tubarão (in the southeastern state of Espirito Santo), it is not a major outlet for grain exports at present despite being the biggest port in the country for total tonnage of all materials handled and the largest terminal in the world for iron ore. Over 70 percent of Brazilian corn shipments and more than half of the soybean exports originate from the southerly ports of Santos and Paranaguá.

The internal problem this has created is one of logistics and specifically of high transport costs, because these ports involve trucking the grain for distances of 2,000 kilometers or more from the main inland production zones.

Thomé Luiz Freire Guth, director of commodity analysis for grains and meat products at the Brazilian government’s national food supply agency Conab, highlighted how extra freight costs impact heavily on grower incomes in Brazil during his presentation. For example, it can cost US$137.50/metric ton to move soybeans from farm to port, compared with less than US$33 in Argentina and only US$18 where U.S. beans travel down the Mississippi.

A typical cost of US$30/ton to carry American Midwestern corn to the coast was quoted by Kona Haque, agricultural commodities director of research at Macquarie Capital (Europe) Ltd. She indicated an equivalent transportation costing around US$75/ton for Brazilian corn from the state of Rio Grande do Sul and up to US$140 where the journey started in Mato Grosso. The difference, according to Macquarie Research with Aprosoja, is that the United States moves over 60 percent of its grain by water and just 16 percent by road whereas the proportions in Brazil are reversed – trucking accounts for 60 percent and waterborne transport only 7 percent.

At present, almost all the Brazilian transport of export grains by truck involves journeys to the east coast of the country. However, new routes are opening, such as the Southern InterOceanic Highway that has been built to link Porto Velho in Brazil to the ports on Peru’s Pacific coast. Intended principally to carry Brazilian grains to west side destinations and ports, the highway in theory should feed production in Peru, Bolivia and neighboring countries by improving the supply of grain at affordable prices. It should also provide a corridor for Brazilian grain shipments to customers outside South America, but local sources express the practical concern that the shipping cost is still too high, as the grain trucks rarely find return loads, and so, drive back empty.

While the prospect of sending more corn from central states is also being examined, such as Mato Grosso to a northern port, the Brazilian authorities recognize the need for considerable additional investment in infrastructure – including more rail links. The option of transporting more along the country’s rivers looks less attractive currently, according to IGC delegates. The shipping cost would be relatively low when compared with road transport, but Brazil’s highly influential environmentalists oppose the idea of a greater commercialization of its waterways.

Whatever the new Brazilian infrastructure may be, the source of funding will remain a key question. Conference sources indicated the authorities favor the idea of a public-private partnership for rail cargo lines by drawing in money from corporations such as grain traders who would be the biggest users of the facilities. The problem with this is likely to be that the traders themselves have already committed their next round of investments to gaining more assets in grain storage and port terminals.

Logistics and competition

While the ownership and operation of supply chain facilities has long been a feature of Bunge, ADM, Cargill and the other global giants of the agricultural commodity trade, their rivals are clearly making the acquisition of similar physical resources a major part of their forward strategy. Analysts say it is a way to secure better margins than from trading alone while also developing a more competitive business structure.

Japanese trading houses have been prominent among the investors, attendees at the world grain conference pointed out. In addition to Mitsui and Mitsubishi, moves over the past year involving traders from Japan have included Marubeni Corporation’s acquisition of U.S. grain giant Gavilon with its extensive storage network and the establishment of a Vietnamese feed factory by Sojitz Corporation after its purchase of Vietnam’s largest grain terminal.

Competition is the greatest challenge facing grain traders. In Australia, for example, when single-desk marketing of its wheat exports ended in 2008, the monopoly role of the former Australian Wheat Board was replaced by the emergence of more than 20 private companies in the export wheat market. In western Canada, deregulation since August 2012 has similarly changed the face of wheat export marketing as the former wheat board (now named CWB) needed to convert itself from single seller to a competitive grain company. As CWB CEO Ian White’s presentation made clear, the competitiveness of CWB at present is hampered by its lack of grain-handling assets, whereas its more fully equipped rivals gain from operating their own pipeline for procurement and logistics.

The themes of competition and asset ownership are starting to converge. Several trading companies with a background in oil and energy have taken the first steps to a diversification into grain and other agricultural commodities. It will mean more competitors entering the grain trading environment, say industry observers, but it also will bring more prospective buyers for the silo elevators and port loaders – assets that these energy-based newcomers will need to add to their existing logistics.

For more information about the International Grains Council, please visit www.igc.int.