Insects are known for their protein content, but they are also rich in lipids and other useful components.

More than 2,100 insect species are consumed as food or feed all over the world — and 25 have been scientifically investigated as a feed ingredient. European regulations accept seven species, but two represent more than 80% of scientific literature: the mealworm (Tenebrio molitor) and the black soldier fly (Hermetia illucens).

More than proteins, insects also contain oils, quite similar physically to copra oil, and they may interest feed manufacturers as they contain active components, such as lauric acid.

Insect product producers see them as a very real solution to raw materials shortages and a means to address the social pressure regarding forest degradation and/or genetically modified organism (GMO) raw material.

Insect byproducts in animal feed

In feed, insect byproducts are also positioned as sustainable ingredients with several added benefits.

“With insects, feed manufacturers may move away from feed ingredients, which compete with food, find local available alternative to soy and find high-quality ingredients — GMO-free and organic,” says Maye Walraven, head of business development of French insect producer Innovafeed.

As she explained, insects are not only proteins but also lipids and frass, as was emphasized at the International Platform of Insects for Feed and Food (IPIFF), a workshop held in Brussels in late 2019.

“In feed, insects are more than a feed ingredient,” explained Lars Herink Lau Heckman with the Danish technological institute, an IPIFF member in charge of research. “The presence of immune boosting agents, such as antimicrobial peptides, chitin and lauric acid, contributes to a reduction in the use of agro pharmaceuticals.”

Due to lingering bovine spongiform encephalopathy (BSE) fears from a quarter of a century ago, European regulations do not accept insect proteins in poultry and swine because they consider them animal proteins. Producers hope that regulations will soon allow feed plants to use insect proteins and control official methods to discriminate insect proteins from the other animal proteins that are now available.

However, European feed plants can already use insect oils, which are authorized for poultry and pigs, aquafeed, pet food and young animals. In this case, they are added to whey up to 15-30% as local replacement of copra oil.

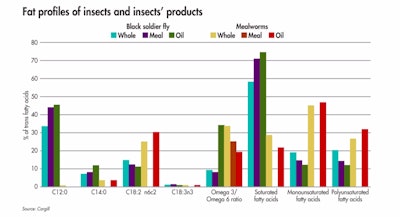

“Insect fat is a natural part of monogastric diets when meeting farmed animals’ and pets’ nutritional requirements,” says Walraven. It contains approximately 70% of saturated fatty acids (40% of C12, 8% of C14, 12% of C16, 27% of C18) and 30% of unsaturated fatty acids (11% C18:1 and 14% C18:2).

Fat content and profiles vary depending on the species and the material — i.e., black soldier fly is much richer in saturated fatty acid than mealworms. (Courtesy Cargill)

Fat content and profiles vary depending on the species and the material — i.e., black soldier fly is much richer in saturated fatty acid than mealworms. (Courtesy Cargill)Insect byproduct research

The feed industry isn’t waiting for regulations to change before there’s an in-depth investigation into the virtues of insect proteins and oils.

For example, Gilles Caby from Cargill France notes research has shown that the fat is the main variable component of black soldier fly. The level depends on the larvae feeding substrate, which can range from 7-43% in insects, and then may vary depending on the extraction process.

Mealworm is less variable due to its stricter feeding requirements, even if those data must be confirmed to include variability between each production plant.

“We’re quite sure that insect products may take place of other raw material for aquafeed and we use them already,” Caby reports. “But we must be sure about the quality in regards, mainly, to rancidity rate and amine biogens contents that we need to be as low as possible. And even if we’ve got data for formulation matrix, we keep it secure with [the] incorporation of no more than 0.5% oil and 5-10% protein meal for the moment, waiting for more trials.”

Antimicrobial properties of insect oil

Insect oils are not only lipids, but they also contain lauric acid, which is known to be a natural antimicrobial and has attracted the interest of nutritionists.

Walraven explains that insect fat might be used to improve health and organic properties up to 2% in sow feed and between 1-4% in piglets feed, with possible inclusion in fattening pigs feed. In poultry, she spoke of 0.2-0.5% inclusion in the starter stage, 0.2-1% in grower rations and up to 2% in the finishing phase.

“This high-quality source of fatty acid is highly digestible thanks to medium-chain triglycerides. Its saturated profile confers a low oxidation of the oil and contributes to better quality preservation of the final meat,” Walraven says. “Insect oil is naturally highly concentrated in lauric acid (>40%) known for its antimicrobial properties, which have an effect on gut microbiota and is active on gram-positive bacteria and keep gram-negative bacteria under control.”

Mainly known as an alternative to copra oil due to its fusion point, it has been tested on antibiotic-free farms.

“Zootechnical advantages have been demonstrated through multiple trials,” insists Walraven. “In swine, we’ve partially replaced soy oil with an inclusion rate of 0.5%, 1% and 2% in post-weaning diets and we’ve obtained similar performances on growth. In another trial, we’ve partially replaced rapeseed oil and we even obtain a decreased Feed Conversion Rate (+2%). In fast-growing chickens, we totally replaced soy oil with an inclusion rate of 2.5% and 5%, and we obtained a -0.6% of FCR, a reduction of 3.5% of water consumption and a positive trend on feces quality.”

State of insect ingredient production

The production of insect ingredients is still at a low level, e.g., the next Innovafeed plant is planned to produce 5,000 tons of oil/year, but some niche markets might even appear this year.

Based on the French retailer’s success with insect-fed trout, which saw consumer approval, InnovaFeed wants to expand this insect-fed value proposition for poultry, swine, salmon and shrimps. It works on a “poultry feed with insect oil,” to be launched in France in the next few months.

Poultry trials began in 2019 with feed manufacturer Nealia, who also supplies of the insect feed, to confirm nutritional interest and efficacy.

At the other part of the food chain, consumers accept this new proposal.

Even if insect oil is authorized, a psychological barrier may exist with European consumers preventing them from incorporating it as a feed ingredient in poultry or pig feed.

Meanwhile, in a study conducted on behalf of InnovaFeed, one-third of French consumers knows poultry naturally eats insects and the large majority understands the role insect oil could play in avoiding the importation of soy from deforested tropical areas. More than half (55%) agree with the idea to buy poultry that has consumed this ingredient and nearly half of the respondents to this survey (48%) are ready to buy pork coming from pig feed with insect oil.